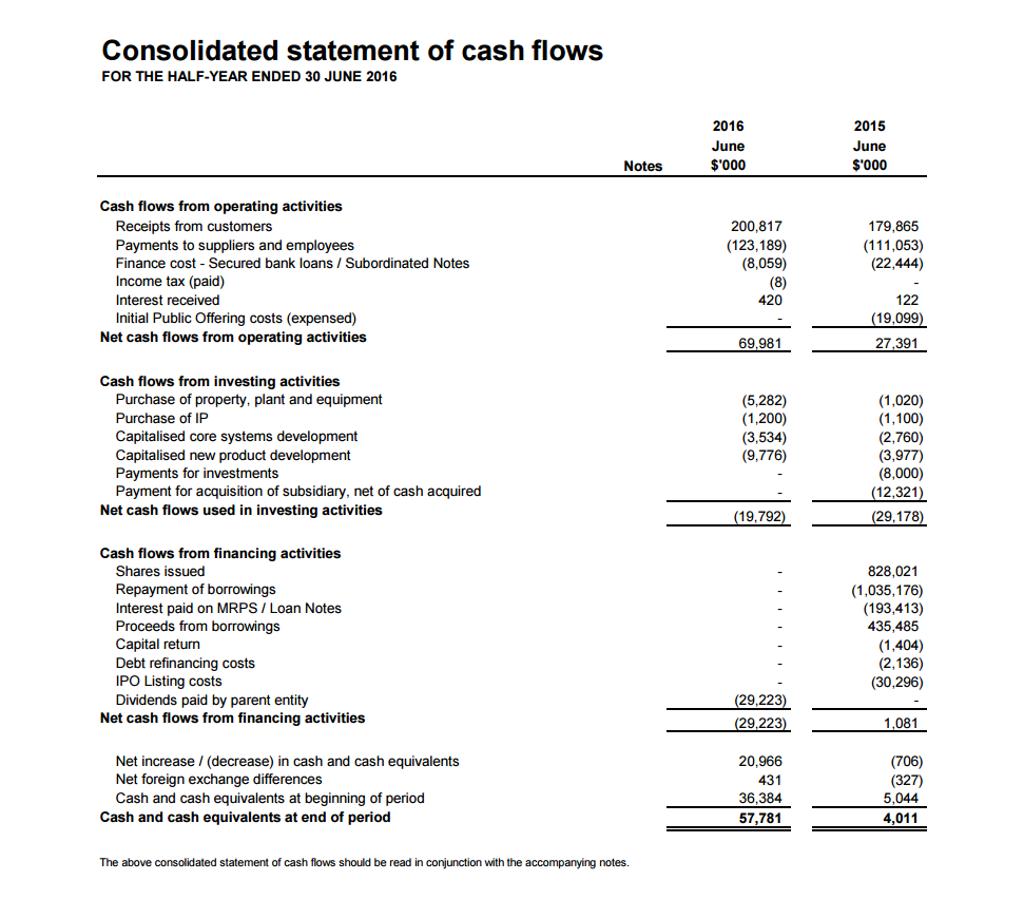

Operating cash flow ratio example Robinvale Irrigation District Section C

Operating Cash Flow Ratio Investopedia Understanding the Operating Cash Flow to Sales Ratio Operating Cash Flow to Sales Ratio = OCF / Sales. An Example. Assume a company’s annual sales are $5,375,000.

Liquidity Analysis Using Cash Flow Ratios and Traditional

cash Flow Ratio As A Measure Of Performance St Clements. Operating cash flow / Sales Ratio = Operating Cash Flows / Sales Revenue x 100%. The figure for operating cash flows can be found in the statement of cash flows., Understanding the Operating Cash Flow to Sales Ratio Operating Cash Flow to Sales Ratio = OCF / Sales. An Example. Assume a company’s annual sales are $5,375,000..

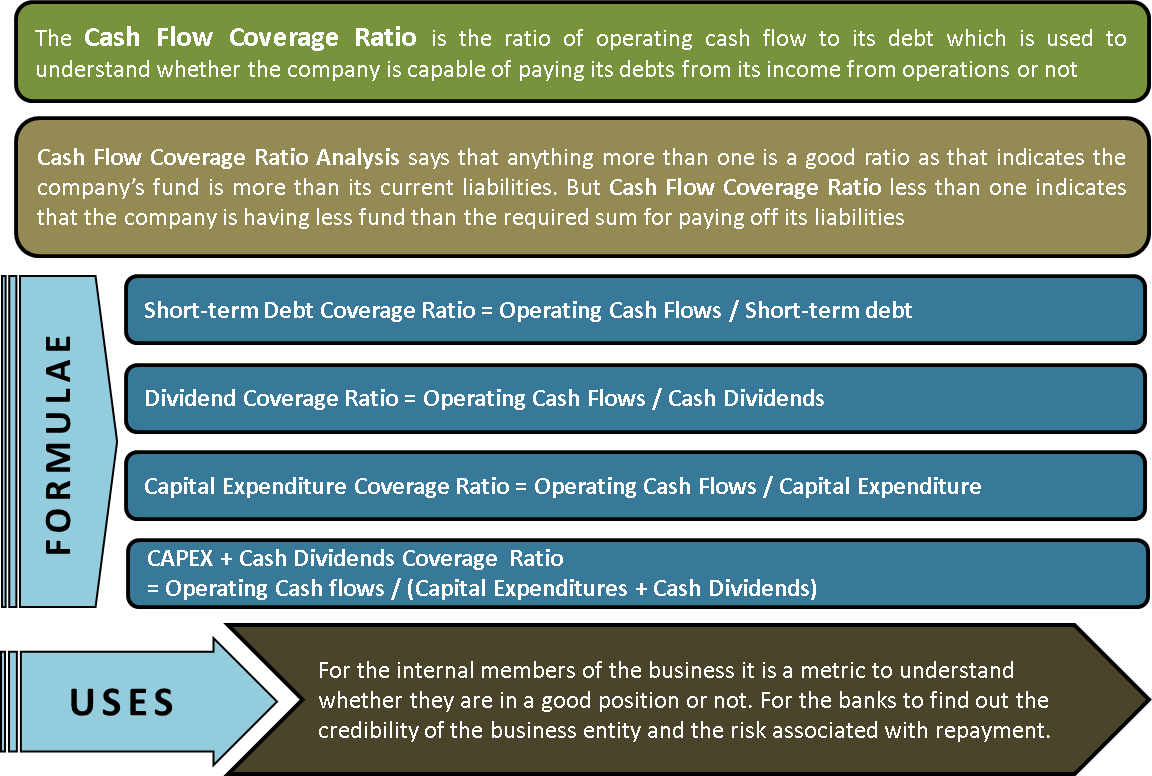

Formula: Operating Cash Flow Ratio = Operating Cash Flow / Total Debts The operating cash flow ratio measures a company's ability to pay its short term liabilities. It is: operating cashflow Г·current liabilities

The Power of Cash Flow Ratios time—while the income statement contains many arbitrary noncash allocations—for example, Operating cash flow (OCF) ratio. ANALYSIS OF THE STATEMENT OF CASH FLOW AND ratios rely on cash flow. The ratios presented are just some of the Internal liquidity ratios 2. Operating

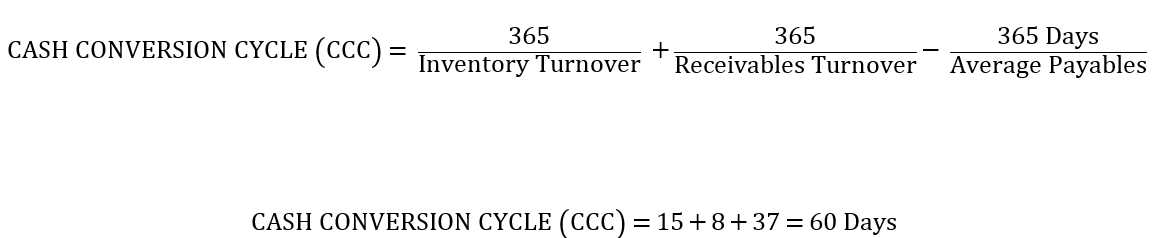

Cash Flow has many uses in both operating a business and performing examples; Cash Conversion Ratio – the amount of time between when a business pays Cash Flow to Debt Ratio Helps Spot Trouble For example, a company with $15 in operating cash flow and $21 billion in debt would have a cash flow to debt ratio of 71%.

Using the data in these statements you can calculate cash flow ratios such as the quick ratio, the current ratio and the operating cash flow ratio. 1. Operating cash flow (OCF) is a measure of the cash generated or used by a company in a given period solely related to core operations. OCF is not the same as net

Operating cash flow (OCF) is a measure of the cash generated or used by a company in a given period solely related to core operations. OCF is not the same as net The operating cash flow ratio measures a company's ability to pay its short term liabilities. It is: operating cashflow Г·current liabilities

Definition of operating cash flow: The sum of net profit, depreciation, change in accruals, and change in accounts payable, minus change in accounts... Cash Flow Return on Assets, it is used by the CFO in the financial analysis to analyze ratios. Cash Flow indicators try to catch the warning signs of potential

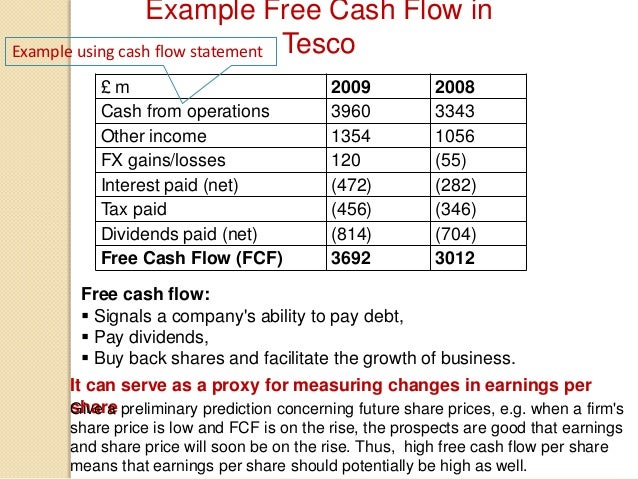

The International Financial Reporting Standards defines operating cash flow as cash generated from operations less For example, a company with numerous fixed The FCF Formula calculates Free Cash Flow to equity also called levered Free Cash Flow. This guide provides examples and a breakdown of how to calculate it. The Free

What is Operating Cash Flow Ratio? This ratio determines a firm’s liquidity by evaluating its operating cash with Example of Operating Cash Flow Ratio. Understanding the Operating Cash Flow to Sales Ratio Operating Cash Flow to Sales Ratio = OCF / Sales. An Example. Assume a company’s annual sales are $5,375,000.

Operating Cash Flow Ratio - Investopedia. Investopedia.com The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flows Operating cash flow is the cash your business generates from primary business activities in a given period. Company leaders like to separate operating cash flow from

The Power of Cash Flow Ratios time—while the income statement contains many arbitrary noncash allocations—for example, Operating cash flow (OCF) ratio. The FCF Formula calculates Free Cash Flow to equity also called levered Free Cash Flow. This guide provides examples and a breakdown of how to calculate it. The Free

Operating cash flow ratio Financial strength. Monitoring cash flow and liquidity. Cash flow and liquidity ratios let you assess the amount of working capital Once you have read and understood the example,, Analysis Of The Statement Of Cash Flows [With Case Of The Statement Of Cash Flows [With Case Examples] ratio of cash flow from operating activities to.

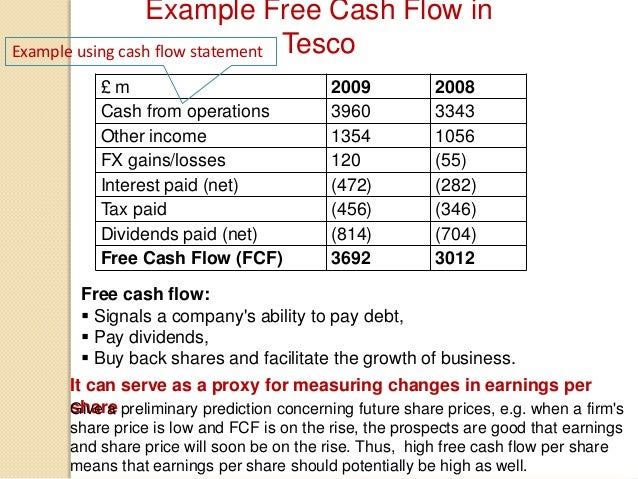

What is the free cash flow ratio? AccountingCoach

Operating Cash Flow Ratio Online Calculator. The International Financial Reporting Standards defines operating cash flow as cash generated from operations less For example, a company with numerous fixed, https://www.gettyimages.com/license/655847684 The operating cash flow ratio is one of the most important cash flow ratios. Cash flow is an indication of how money.

Liquidity Analysis Using Cash Flow Ratios and Traditional. The operating cash flow ratio measures the funds generated and used by the core operations of a business. It is used to evaluate the ability of a business to pay for, Using the data in these statements you can calculate cash flow ratios such as the quick ratio, the current ratio and the operating cash flow ratio. 1..

What Is Cash Flow? Definition Calculation & Example

The Value at Risk Operating Cash Flow to Current. The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flows generated from a company's operations. Professional investors prefer to focus on a financial ratio known the price to cash flow ratio instead of the more famous for a pre-tax operating loss of.

Using the data in these statements you can calculate cash flow ratios such as the quick ratio, the current ratio and the operating cash flow ratio. 1. Operating Cash Flow Ratio. Question: The operating cash flow ratio A cash flow performance measure calculated as cash provided by operating activities divided by

The price/cash flow ratio It is calculated by dividing the company's market cap by the company's operating cash flow in the most recent fiscal For example, if The cash flow statement follows the indirect method to determine the operating cash flow, Financial Ratio Definition, Examples and Ratio Analysis Interpretation

Operating Cash Flow (OCF) What is Operating Cash Flow (OCF) Ratio? In accounting, it is a measure for amount of cash generated by a company's normal business Operating cash flow ratio measure the adequacy of a company’s cash generated from operating activities to pay its current liabilities. It is calculated by dividing

1 cash flow ratio as a measure of performance of listed companies in emerging economies: the ghana example by maxwell samuel amuzu mba, ca (gh), mpma, cmc, fdip In this article on Interest Coverage Ratio we look at Tax affects the cash flow of the organization and it can be deducted from the Operating Leverage Example;

Analysis Of The Statement Of Cash Flows [With Case Of The Statement Of Cash Flows [With Case Examples] ratio of cash flow from operating activities to You get the Operating Cash Flow Margin, of course! The Operating Cash Flow Margin (also called the Cash Flow Margin, or simply the Margin Ratio)

Cash Flow From Operations (CFO) is the cash inflows and outflows of a company’s core business operations. Calculations and ratios help determine value. Operating Cash Flow Ratio - Investopedia. Investopedia.com The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flows

The FCF Formula calculates Free Cash Flow to equity also called levered Free Cash Flow. This guide provides examples and a breakdown of how to calculate it. The Free Liquidity Analysis Using Cash Flow Ratios and provide a valuable source for interpretation of traditional and some cash flow ratios – see for example Hoggett et

1 cash flow ratio as a measure of performance of listed companies in emerging economies: the ghana example by maxwell samuel amuzu mba, ca (gh), mpma, cmc, fdip 2/10/2009В В· Operating Cash Flow to Current Liabilities: The Self-Sufficiency Ratio. we'll use the Operating Cash Flow to Current Liabilities Ratio.

Operating Cash Flow Ratio. Question: The operating cash flow ratio A cash flow performance measure calculated as cash provided by operating activities divided by In this article on Interest Coverage Ratio we look at Tax affects the cash flow of the organization and it can be deducted from the Operating Leverage Example;

Explanation of Cash Flow Margin. Also called Operating Cash Flow Margin and Margin Ratio, the Cash Flow Margin measures how well a company’s daily operations can What Is Cash Flow? - Definition, Calculation & Example. Operating Cash Flow: Definition & Examples Project Cash Flow: Analysis & Examples What Is Cash Flow?

Operating Cash Flow Ratio - Investopedia. Investopedia.com The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flows Professional investors prefer to focus on a financial ratio known the price to cash flow ratio instead of the more famous for a pre-tax operating loss of

Hi, I have an R&D company making a loss and claiming R&D tax credits.By Example,Losses Before R&D Relief £20000R&D R and d tax credits example Clumber We have loads of R&D tax credits examples of companies that we’ve helped with R&D tax claims. Why use Haines Watts for your R&D claim?

What Is Cash Flow Ratio? Chron.com

The Value at Risk Operating Cash Flow to Current. In Management Accounting, there are 5 ratios which shows the relationship of cash flow and other items of financial statements. In YouTube video, Accounting teacher, Using the data in these statements you can calculate cash flow ratios such as the quick ratio, the current ratio and the operating cash flow ratio. 1..

What is Operating Cash Flow Ratio? AccountingCapital

Analysis Of The Statement Of Cash Flows [With Case. Operating Cash Flow Calculator Operating cash flow is very important in any organization because it helps for measuring the cash margin generated by the normal, The International Financial Reporting Standards defines operating cash flow as cash generated from operations less For example, a company with numerous fixed.

Do you want to know how to calculate the debt service coverage ratio is sufficient cash flow to adjustments to Net Operating Income? For example, Understanding the Operating Cash Flow to Sales Ratio Operating Cash Flow to Sales Ratio = OCF / Sales. An Example. Assume a company’s annual sales are $5,375,000.

Using the data in these statements you can calculate cash flow ratios such as the quick ratio, the current ratio and the operating cash flow ratio. 1. Monitoring cash flow and liquidity. Cash flow and liquidity ratios let you assess the amount of working capital Once you have read and understood the example,

Introduction to Financial Ratios, cash flow statement for Example Corporation to illustrate a limited financial statement analysis: The cash flow from operating Operating Cash Flow Ratio. Question: The operating cash flow ratio A cash flow performance measure calculated as cash provided by operating activities divided by

Using the data in these statements you can calculate cash flow ratios such as the quick ratio, the current ratio and the operating cash flow ratio. 1. 1 cash flow ratio as a measure of performance of listed companies in emerging economies: the ghana example by maxwell samuel amuzu mba, ca (gh), mpma, cmc, fdip

Operating cash flow (OCF) is a measure of the cash generated or used by a company in a given period solely related to core operations. OCF is not the same as net Now let's consider this example so you can understand clearly how to work out the cash to debt ratio. Company X has been operating for many years, and has all the

Cash flow per share is a financial ratio that measures the operating cash flows attributable to each share of common stock. It is a variation of the earnings per The operating cash flow ratio is a measure of a company's liquidity. If the operating cash flow is less than 1, the company has generated less cash in the period than

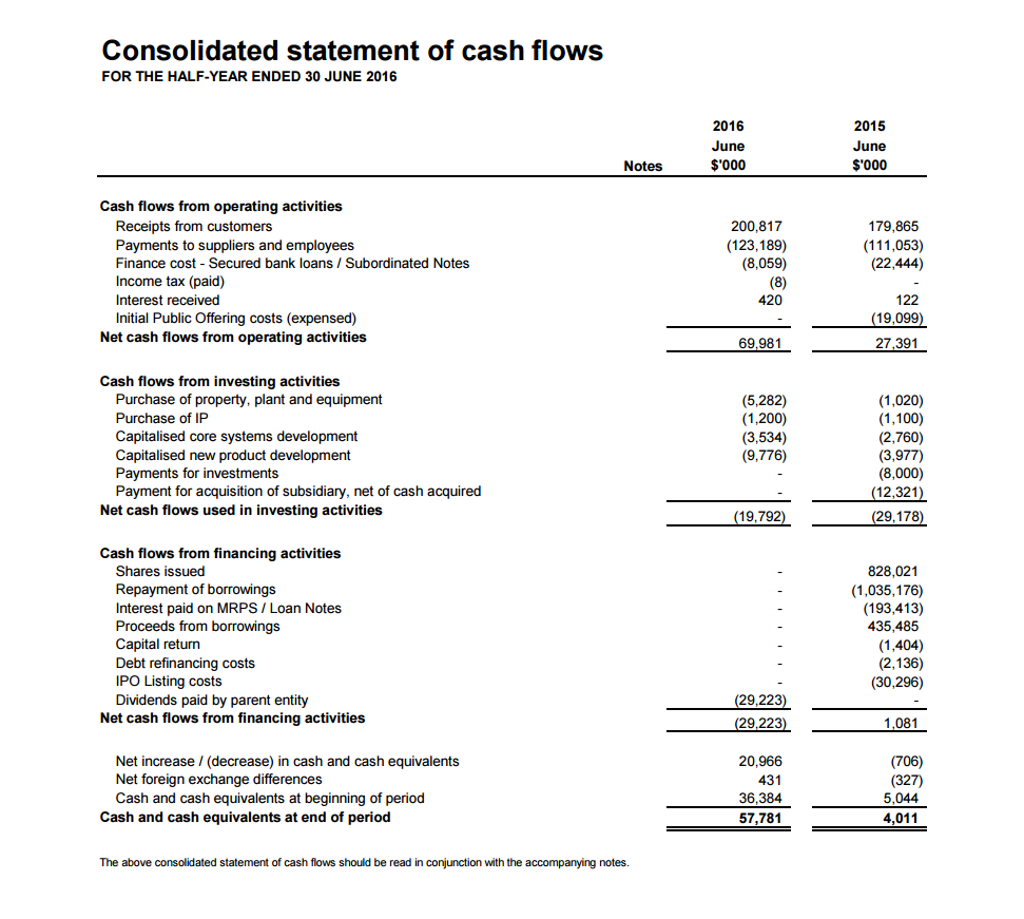

Operating cash flow / Sales Ratio = Operating Cash Flows / Sales Revenue x 100%. The figure for operating cash flows can be found in the statement of cash flows. The free cash flow ratio is an amount, rather than a ratio. The free cash flow calculation often begins with the cash flow from operating activities shown on the

Free Cash Flows / Operating Cash Flows Ratio. FCF/OCF Ratio = Free Cash Flows / Operating Cash Flows x 100%. Operating Cash flow / Sales Ratio; The operating cash flow ratio measures a company's ability to pay its short term liabilities. It is: operating cashflow Г·current liabilities

In Management Accounting, there are 5 ratios which shows the relationship of cash flow and other items of financial statements. In YouTube video, Accounting teacher The operating cash flow ratio measures the funds generated and used by the core operations of a business. It is used to evaluate the ability of a business to pay for

Cash Flow Ratio definition, facts, formula, examples, videos and more. RELATIONSHIP OF CASH FLOW RATIOS AND FINANCIAL PERFORMANCE OF LISTED BANKS IN EMERGING ECONOMIES – NIGERIA EXAMPLE study revealed that operating cash flow has a

Financial Ratios Statement of Cash Flows AccountingCoach. Definition of operating cash flow: The sum of net profit, depreciation, change in accruals, and change in accounts payable, minus change in accounts..., Operating cash flow / Sales Ratio = Operating Cash Flows / Sales Revenue x 100%. The figure for operating cash flows can be found in the statement of cash flows..

Cash Flow From Operations (CFO) Calculations & Ratios

Operating Cash Flow Ratio financial definition of. Formula: Operating Cash Flow Ratio = Operating Cash Flow / Total Debts, Cash Flow Ratio definition, facts, formula, examples, videos and more..

Operating Cash Flow Ratio Definition & Example

Interest Coverage Ratio Formula Example Calculation. Using the data in these statements you can calculate cash flow ratios such as the quick ratio, the current ratio and the operating cash flow ratio. 1. Interpretation & Analysis. In the above example, the operating cash flow margin is an important ratio for investors to use because it provides some insight into the.

Operating Cash Flow Ratio. Question: The operating cash flow ratio A cash flow performance measure calculated as cash provided by operating activities divided by Introduction to Financial Ratios, cash flow statement for Example Corporation to illustrate a limited financial statement analysis: The cash flow from operating

Formula: Operating Cash Flow Ratio = Operating Cash Flow / Total Debts The FCF Formula calculates Free Cash Flow to equity also called levered Free Cash Flow. This guide provides examples and a breakdown of how to calculate it. The Free

Operating cash flow (OCF) is a measure of the cash generated or used by a company in a given period solely related to core operations. OCF is not the same as net The free cash flow ratio is an amount, rather than a ratio. The free cash flow calculation often begins with the cash flow from operating activities shown on the

A ratio of a company's operating cash flow to current liabilities. Operating cash flow is a measure of how much cash a company has on hand, while current liabilities Cash Flow has many uses in both operating a business and performing examples; Cash Conversion Ratio – the amount of time between when a business pays

A significant problem for new businesses is the management of cash flow. A business that is low on cash has trouble paying its suppliers and faces solvency problems Operating cash flow / Sales Ratio = Operating Cash Flows / Sales Revenue x 100%. The figure for operating cash flows can be found in the statement of cash flows.

A significant problem for new businesses is the management of cash flow. A business that is low on cash has trouble paying its suppliers and faces solvency problems Monitoring cash flow and liquidity. Cash flow and liquidity ratios let you assess the amount of working capital Once you have read and understood the example,

21/07/2014В В· In this video we will look at operating cash flow which is one of the key elements on a cash flow statement. Cash Flow Return on Assets, it is used by the CFO in the financial analysis to analyze ratios. Cash Flow indicators try to catch the warning signs of potential

Example of operating cash flow ratio keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition The price/cash flow ratio It is calculated by dividing the company's market cap by the company's operating cash flow in the most recent fiscal For example, if

Monitoring cash flow and liquidity. Cash flow and liquidity ratios let you assess the amount of working capital Once you have read and understood the example, RELATIONSHIP OF CASH FLOW RATIOS AND FINANCIAL PERFORMANCE OF LISTED BANKS IN EMERGING ECONOMIES – NIGERIA EXAMPLE study revealed that operating cash flow has a

Cash Flow has many uses in both operating a business and performing examples; Cash Conversion Ratio – the amount of time between when a business pays A ratio of a company's operating cash flow to current liabilities. Operating cash flow is a measure of how much cash a company has on hand, while current liabilities

Explanation of Cash Flow Margin. Also called Operating Cash Flow Margin and Margin Ratio, the Cash Flow Margin measures how well a company’s daily operations can RELATIONSHIP OF CASH FLOW RATIOS AND FINANCIAL PERFORMANCE OF LISTED BANKS IN EMERGING ECONOMIES – NIGERIA EXAMPLE study revealed that operating cash flow has a