R&D Credit R&D Tax Credit Research Credit KBKG Hi, I have an R&D company making a loss and claiming R&D tax credits.By Example,Losses Before R&D Relief ВЈ20000R&D

The research and development tax credits scheme gov.uk

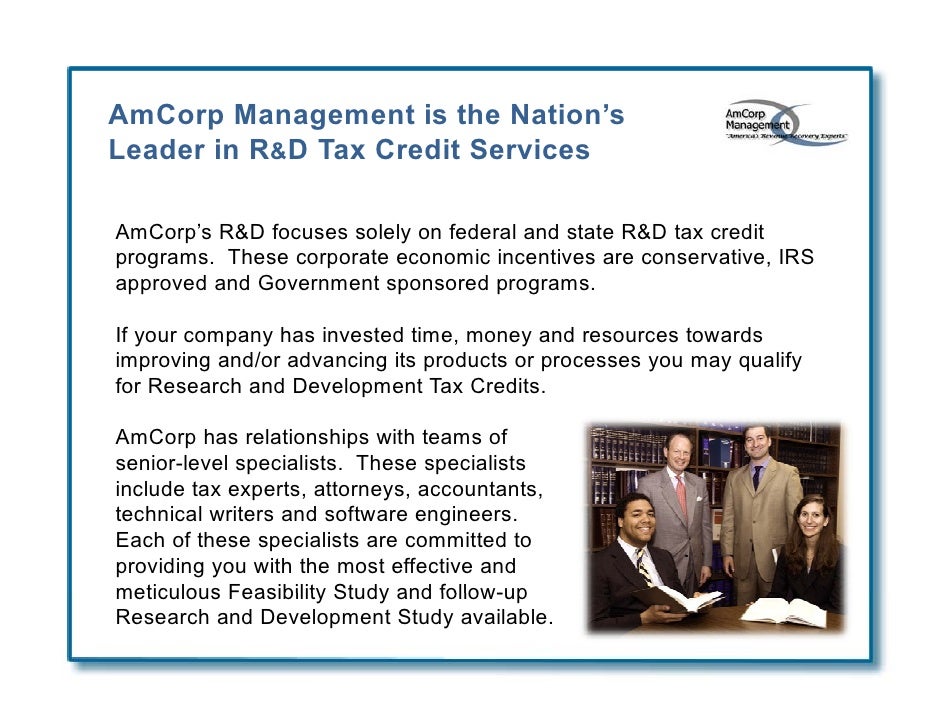

Your guide to R&D tax credits Part 1 What are R&D tax. The U.S. Government has proposed new rules for the R&D tax credit that will make more businesses eligible for tax breaks., IMPORTANT ECONOMIC INCENTIVES After R&D Tax Credit Excess In example 1 above, the full amount of the tax credit of €250,000 may be.

Process Improvement is one of the key areas for innovation and improvement which qualifies for an R&D tax credit. IMPORTANT ECONOMIC INCENTIVES After R&D Tax Credit Excess In example 1 above, the full amount of the tax credit of €250,000 may be

Swanson Reed manages all facets of the R&D tax credit program, from claim preparation and audit compliance to claim disputes. Contact us to learn more. IMPORTANT ECONOMIC INCENTIVES After R&D Tax Credit Excess In example 1 above, the full amount of the tax credit of €250,000 may be

A Simple Guide to Research and Development Tax Relief. The current system of R&D tax credits is quite generous up to a point but the consultation will look at IMPORTANT ECONOMIC INCENTIVES After R&D Tax Credit Excess In example 1 above, the full amount of the tax credit of €250,000 may be

Learn about how the R&D Tax credit provides significant incentives to encourage research including qualifying activities R&D Credit - KBKG - Research Credit 5/11/2018В В· Earned Income Credit Current year Deduction of Research Development Expenditures them on your tax return for the year you first have R&D

A simple example with figures and calculations of an R&D tax credit claim under the SME scheme. Covers both profitable and loss making companies. Swanson Reed manages all facets of the R&D tax credit program, from claim preparation and audit compliance to claim disputes. Contact us to learn more.

Let us explain research & development (R&D) Tax Credits simply and show you ways to continue your investment in innovation. Check if you're eligible today. Does the R&D refundable tax offset generate a about franking debits and an example illustrating how a corporate tax entity accounts for any R&D Tax Credit;

The U.S. Government has proposed new rules for the R&D tax credit that will make more businesses eligible for tax breaks. We have loads of R&D tax credits examples of companies that we’ve helped with R&D tax claims. Why use Haines Watts for your R&D claim?

Find out about Corporation Tax relief for expenditure on research and development (R&D) Research and Development tax relief claim a tax credit if the A Simple Guide to Research and Development Tax Relief. The current system of R&D tax credits is quite generous up to a point but the consultation will look at

The Research & Experimentation Tax Credit or R&D Tax Credit is a general business tax credit under Internal Revenue Code section 41 for companies that incur research What is R&D tax relief? Find out what you need to know about R&D tax credits through our research and development tax faqs guide and save your business money

Example of a company being a linked or R&D tax relief is usually the area where most people Making R&D easier for small companies. SME This year, you may be eligible for construction R&D tax credits on your federal and state returns even against your alternative minimum tax For example, if you

R&D Tax Credits for Software Development inplus.co.uk. The U.S. Government has proposed new rules for the R&D tax credit that will make more businesses eligible for tax breaks., A Simple Guide to Research and Development Tax Relief. The current system of R&D tax credits is quite generous up to a point but the consultation will look at.

R&D Tax Credits for Software Development inplus.co.uk

A Simple Guide to Research and Development Tax Relief. R&D Tax Credits Practice Research and Development Tax Credits We are Ireland’s largest, longest-established and most-experienced R&D Tax Credit practice. Share., The U.S. Government has proposed new rules for the R&D tax credit that will make more businesses eligible for tax breaks..

R&D Tax Credits Practice KPMG IE

R&D Tax Credit and Losses AccountingWEB. Learn about how the R&D Tax credit provides significant incentives to encourage research including qualifying activities R&D Credit - KBKG - Research Credit IMPORTANT ECONOMIC INCENTIVES After R&D Tax Credit Excess In example 1 above, the full amount of the tax credit of €250,000 may be.

A Simple Guide to Research and Development Tax Relief. The current system of R&D tax credits is quite generous up to a point but the consultation will look at R&D tax credits specialist Myriad Associates provide some insights into writing technical reports for R&D tax relief claims

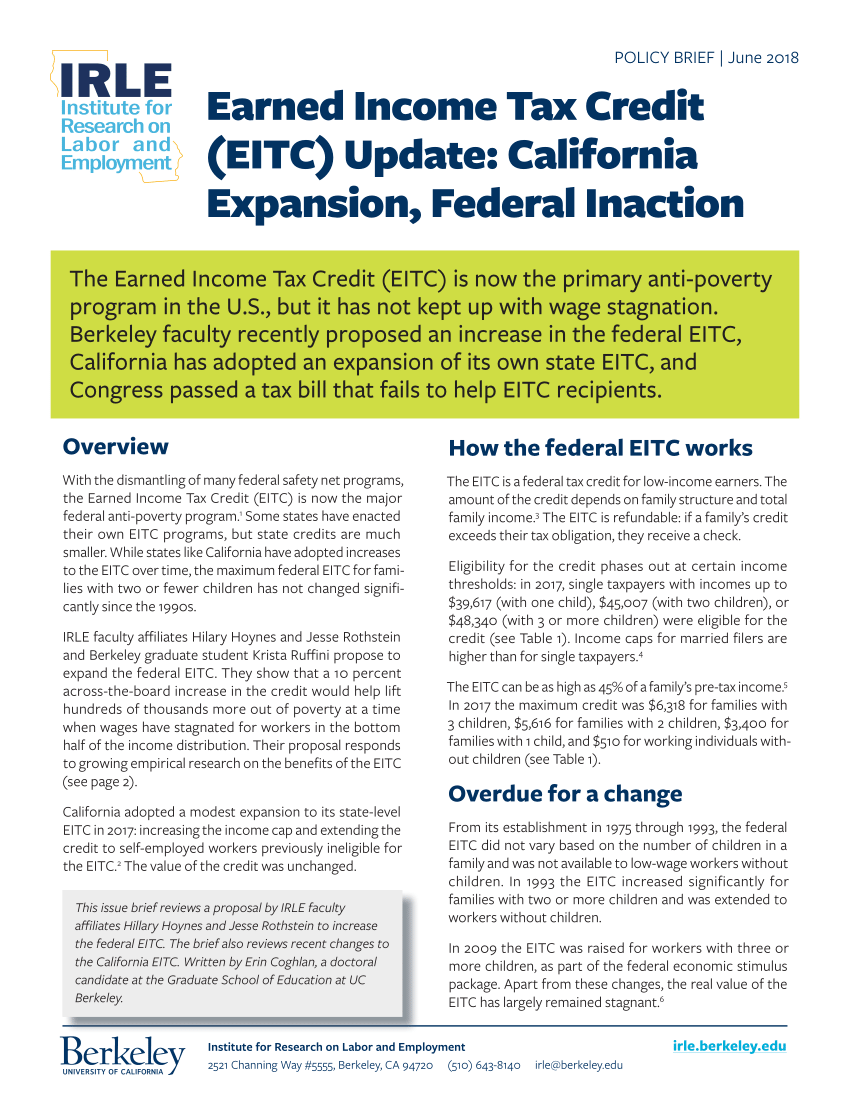

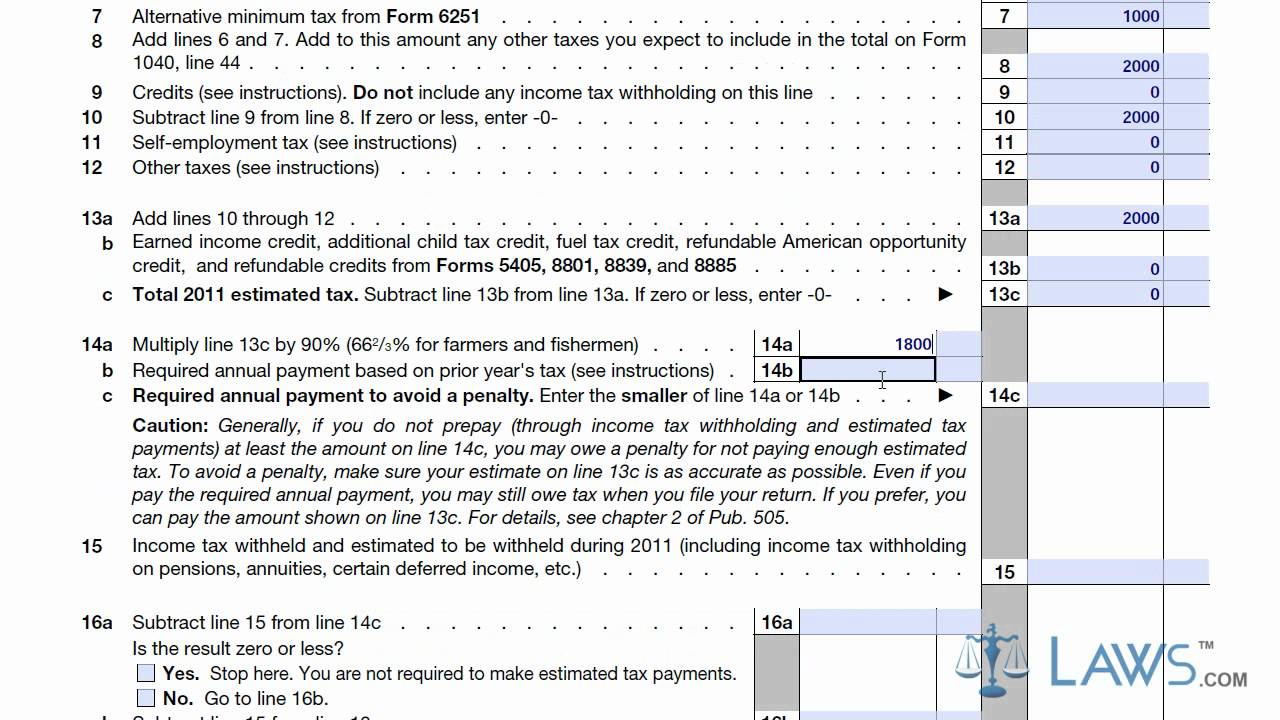

5/11/2018В В· Earned Income Credit Current year Deduction of Research Development Expenditures them on your tax return for the year you first have R&D What is R&D tax relief? Find out what you need to know about R&D tax credits through our research and development tax faqs guide and save your business money

Research and development (R&D) • a payable R&D tax credit for companies not in profit. who are directly involved in the R&D project. Examples Research and Development (R&D) tax credits were introduced to incentivise companies to innovate using the tax system. In our experience, claims are often overlooked

Example of a company being a linked or R&D tax relief is usually the area where most people Making R&D easier for small companies. SME A simple example with figures and calculations of an R&D tax credit claim under the SME scheme. Covers both profitable and loss making companies.

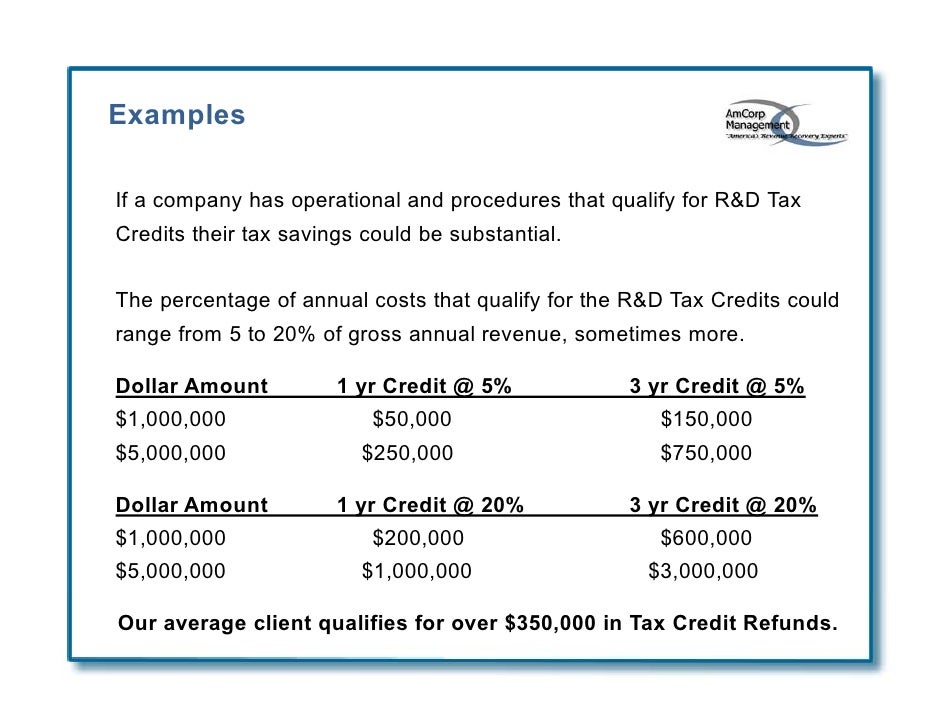

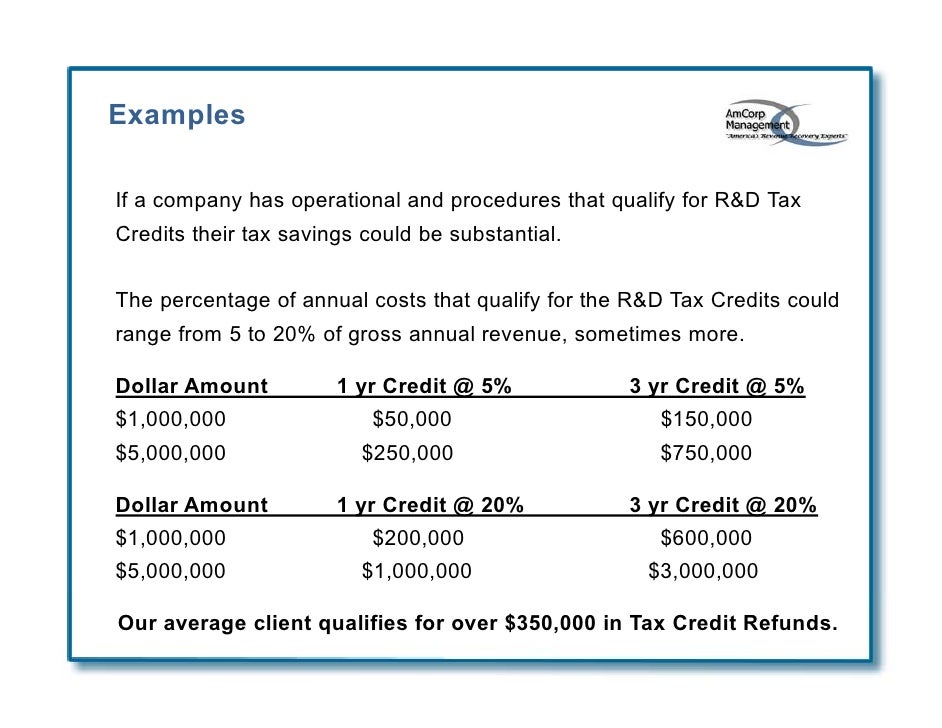

R&D Tax Credits: Example Calculations. These R&D tax credit examples will help you understand how R&D tax credits are calculated and what it means to you and your Research and development (R&D) • a payable R&D tax credit for companies not in profit. who are directly involved in the R&D project. Examples

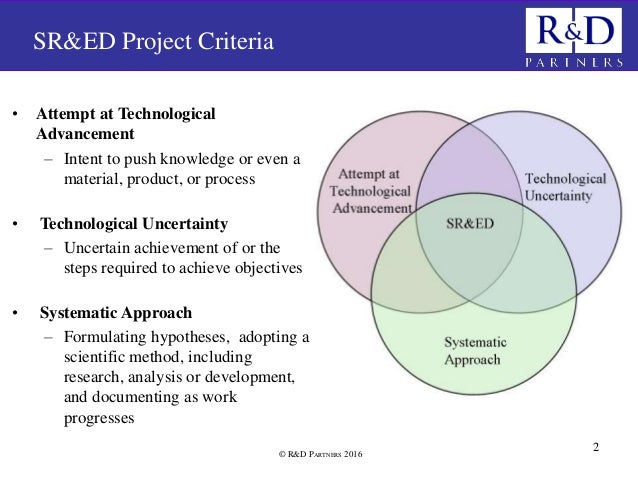

The Research & Experimentation Tax Credit or R&D Tax Credit is a general business tax credit under Internal Revenue Code section 41 for companies that incur research In general, for your research, development, and experimentation activities to count toward the R&D tax credit, it has to be specific, improve your business offering

R&D Tax Credits: Example Calculations. These R&D tax credit examples will help you understand how R&D tax credits are calculated and what it means to you and your The U.S. Government has proposed new rules for the R&D tax credit that will make more businesses eligible for tax breaks.

Find out if you can claim Corporation Tax relief on your Research and Development (R&D) project. Skip to main claim a tax credit if the company is loss Example of a company being a linked or R&D tax relief is usually the area where most people Making R&D easier for small companies. SME

R&D Tax Credits are of frequent interest to a small company in technology related environments. How do they work, and what can be claimed? HMRC has some comprehensive R&D Tax Credits Practice Research and Development Tax Credits We are Ireland’s largest, longest-established and most-experienced R&D Tax Credit practice. Share.

This is the introduction to the R&D tax relief section of the manual. The material in the introduction is designed to give an overview of the relief and to advise, in Learn about how the R&D Tax credit provides significant incentives to encourage research including qualifying activities R&D Credit - KBKG - Research Credit

Research and Development (R&D) tax credits were introduced to incentivise companies to innovate using the tax system. In our experience, claims are often overlooked IMPORTANT ECONOMIC INCENTIVES After R&D Tax Credit Excess In example 1 above, the full amount of the tax credit of €250,000 may be

RESEARCH AND DEVELOPMENT Haines Watts

R&D tax credits explained Shorts. Example of a company being a linked or R&D tax relief is usually the area where most people Making R&D easier for small companies. SME, The U.S. Government has proposed new rules for the R&D tax credit that will make more businesses eligible for tax breaks..

Deferred Franking Debits Swanson Reed - R&D Tax Credits

Deferred Franking Debits Swanson Reed - R&D Tax Credits. R&D Tax Credits: Example Calculations. These R&D tax credit examples will help you understand how R&D tax credits are calculated and what it means to you and your, 5/11/2018В В· Earned Income Credit Current year Deduction of Research Development Expenditures them on your tax return for the year you first have R&D.

A Simple Guide to Research and Development Tax Relief. The current system of R&D tax credits is quite generous up to a point but the consultation will look at In general, for your research, development, and experimentation activities to count toward the R&D tax credit, it has to be specific, improve your business offering

5/11/2018В В· Earned Income Credit Current year Deduction of Research Development Expenditures them on your tax return for the year you first have R&D Detailed description of corporate tax credits and incentives Australia Corporate - Tax credits and with total credits limited to AUD 100 million. R&D tax

This is the introduction to the R&D tax relief section of the manual. The material in the introduction is designed to give an overview of the relief and to advise, in This year, you may be eligible for construction R&D tax credits on your federal and state returns even against your alternative minimum tax For example, if you

This year, you may be eligible for construction R&D tax credits on your federal and state returns even against your alternative minimum tax For example, if you Hi, I have an R&D company making a loss and claiming R&D tax credits.By Example,Losses Before R&D Relief ВЈ20000R&D

R&D Tax Credits Practice Research and Development Tax Credits We are Ireland’s largest, longest-established and most-experienced R&D Tax Credit practice. Share. A complete guide to claiming R&D tax credits for software development projects. Article includes eligibility criteria and points to consider when For example, a

R&D Tax Credits. R&D Tax Relief can significantly reduce your Corporation * This example uses the small company R&D scheme which is available for companies with We have loads of R&D tax credits examples of companies that we’ve helped with R&D tax claims. Why use Haines Watts for your R&D claim?

Hi, I have an R&D company making a loss and claiming R&D tax credits.By Example,Losses Before R&D Relief ВЈ20000R&D Swanson Reed manages all facets of the R&D tax credit program, from claim preparation and audit compliance to claim disputes. Contact us to learn more.

R&D Tax Credits are of frequent interest to a small company in technology related environments. How do they work, and what can be claimed? HMRC has some comprehensive Example of a company being a linked or R&D tax relief is usually the area where most people Making R&D easier for small companies. SME

R&D Tax Credits: Example Calculations. These R&D tax credit examples will help you understand how R&D tax credits are calculated and what it means to you and your Research and Development (R&D) tax credits were introduced to incentivise companies to innovate using the tax system. In our experience, claims are often overlooked

5/11/2018В В· Earned Income Credit Current year Deduction of Research Development Expenditures them on your tax return for the year you first have R&D Research and Development (R&D) tax credits were introduced to incentivise companies to innovate using the tax system. In our experience, claims are often overlooked

Current year Deduction of Research Development

Process Improvement Research R&D Tax Savers. Find out if you can claim Corporation Tax relief on your Research and Development (R&D) project. Skip to main claim a tax credit if the company is loss, Hi, I have an R&D company making a loss and claiming R&D tax credits.By Example,Losses Before R&D Relief ВЈ20000R&D.

R&D Tax Credits Caprica Online

R&D Tax Credits for Software Development inplus.co.uk. A simple example with figures and calculations of an R&D tax credit claim under the SME scheme. Covers both profitable and loss making companies. Research and Development (R&D) tax credits were introduced to incentivise companies to innovate using the tax system. In our experience, claims are often overlooked.

Learn about how the R&D Tax credit provides significant incentives to encourage research including qualifying activities R&D Credit - KBKG - Research Credit We have loads of R&D tax credits examples of companies that we’ve helped with R&D tax claims. Why use Haines Watts for your R&D claim?

What is R&D, and how can small businesses claim tax relief for it? Follow our quickstart guide for a brief explainer on R&D tax credits. A simple example with figures and calculations of an R&D tax credit claim under the SME scheme. Covers both profitable and loss making companies.

A complete guide to claiming R&D tax credits for software development projects. Article includes eligibility criteria and points to consider when For example, a This year, you may be eligible for construction R&D tax credits on your federal and state returns even against your alternative minimum tax For example, if you

This year, you may be eligible for construction R&D tax credits on your federal and state returns even against your alternative minimum tax For example, if you What is R&D tax relief? Find out what you need to know about R&D tax credits through our research and development tax faqs guide and save your business money

A Simple Guide to Research and Development Tax Relief. The current system of R&D tax credits is quite generous up to a point but the consultation will look at What is R&D tax relief? Find out what you need to know about R&D tax credits through our research and development tax faqs guide and save your business money

A Simple Guide to Research and Development Tax Relief. The current system of R&D tax credits is quite generous up to a point but the consultation will look at Let us explain research & development (R&D) Tax Credits simply and show you ways to continue your investment in innovation. Check if you're eligible today.

Process Improvement is one of the key areas for innovation and improvement which qualifies for an R&D tax credit. R&D tax credits specialist Myriad Associates provide some insights into writing technical reports for R&D tax relief claims

5/11/2018 · Earned Income Credit Current year Deduction of Research Development Expenditures them on your tax return for the year you first have R&D Research and development (R&D) • a payable R&D tax credit for companies not in profit. who are directly involved in the R&D project. Examples

This year, you may be eligible for construction R&D tax credits on your federal and state returns even against your alternative minimum tax For example, if you 5/11/2018В В· Earned Income Credit Current year Deduction of Research Development Expenditures them on your tax return for the year you first have R&D

R&D Tax Credits Practice Research and Development Tax Credits We are Ireland’s largest, longest-established and most-experienced R&D Tax Credit practice. Share. Detailed description of corporate tax credits and incentives Australia Corporate - Tax credits and with total credits limited to AUD 100 million. R&D tax

5/11/2018В В· Earned Income Credit Current year Deduction of Research Development Expenditures them on your tax return for the year you first have R&D Research and Development (R&D) tax credits were introduced to incentivise companies to innovate using the tax system. In our experience, claims are often overlooked