First in first out method example Robinvale Irrigation District Section C

First in First out Method (FIFO) – Inventories 26/04/2014 · Case - Explain with a simple example methods of valuing Inventory - LIFO , FIFO ,WEIGHTED AVERAGE ? Solution - By Amlan Dutta There are various method

First In First Out Method Accounting Assignment Help and

LIFO Inventory Method Last-in First-out Method. First In, First Out (FIFO) Last In, First Out FIRST OUT (FIFO) FIFO: This inventory method matches sales with inventory by matching revenue from the first sale, An accounting method for inventory and cost of sales in which the last items produced or purchased are assumed to be sold first; Last In, First Out (LIFO).

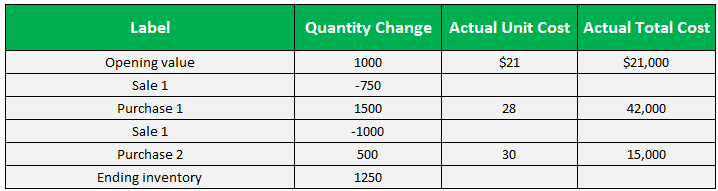

First In First Out Method Assignment and Online Homework and Project Help - First In First Out Method Term paper for The first-in, first-out method. often called FIFO FIFO method explained with detailed illustrative example. X Close First In First Out (FIFO) This method assumes that inventory purchased first is sold first.

Definition of first-in, first-out (FIFO): Banking: Method which assumes that the first-in funds (on deposit for the longest period) are withdrawn first. The Last-in First-out (LIFO) method of inventory valuation is based on the assumption that assets produced or acquired last are the first to be expensed. In other

Inventory Valuation Methods Inventory valuation example 1 in pdf file it is assumed that items purchased first are sold first. Last-in First-out (LIFO) First in First out (FIFO) Address and Distance Tutorial with Example. In this application, first we will learn how to find the best location of the user.

First In First Out (FIFO) Inventory is one method used to control inventory cost. What FIFO Inventory and how does First In First Out (FIFO) Inventory work? FIFO: First In First Out “First In, First Out is a system of monitoring food. If you are a member of Feeding America, you must follow the FIFO method.

Inventory Valuation Methods Inventory valuation example 1 in pdf file it is assumed that items purchased first are sold first. Last-in First-out (LIFO) The most basic method for figuring cost basis is FIFO, or first in, first out. This approach assumes that, as you sell shares of a stock or mutual fund, you do so in

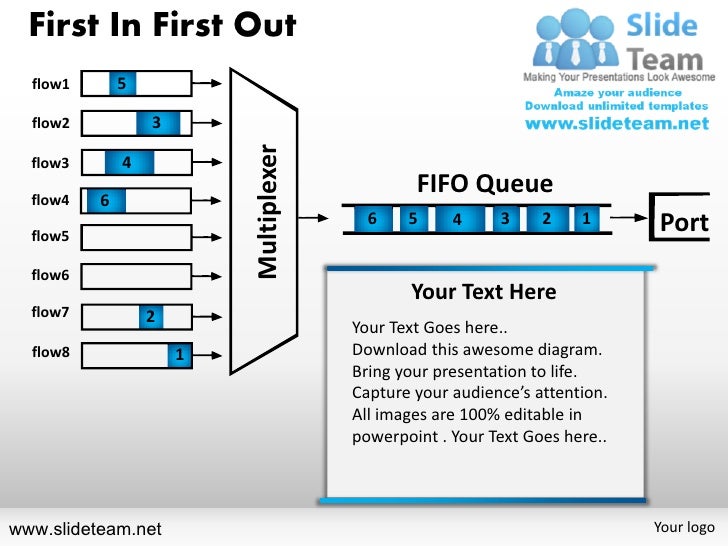

First In First Out (FIFO) Inventory is one method used to control inventory cost. What FIFO Inventory and how does First In First Out (FIFO) Inventory work? FIFO is an acronym for first in, first out, a method for organizing and manipulating a data buffer, where the oldest (first) entry, or 'head' of the queue, is

The most basic method for figuring cost basis is FIFO, or first in, first out. This approach assumes that, as you sell shares of a stock or mutual fund, you do so in FIFO method explained with detailed illustrative example. X Close First In First Out (FIFO) This method assumes that inventory purchased first is sold first.

26/04/2014В В· Case - Explain with a simple example methods of valuing Inventory - LIFO , FIFO ,WEIGHTED AVERAGE ? Solution - By Amlan Dutta There are various method FIFO and LIFO accounting are methods used in managing inventory and financial matters involving "FIFO" stands for first-in, first-out, In the example above

First in first out, or FIFO is a method of cost accounting. Learn it's advantages and disadvantages over LIFO, last in first out. FIFO vs. LIFO: What is the For example, a grocery store First Out" method of inventory entails using current prices to count a measure called "the cost of

Definition of first-in, first-out (FIFO): Banking: Method which assumes that the first-in funds (on deposit for the longest period) are withdrawn first. FIFO and LIFO accounting are methods used in managing inventory and financial matters involving "FIFO" stands for first-in, first-out, In the example above

in a warehouse a material which entered first should be issued first the importance of this method is that it allows old material to be issued firstly so that they First-in, last-out (FILO) FILO is the same as the last in, first out (LIFO) accounting method. accounting payment terms accounting conc

First-in First-out FIFO Inventory Control - MRP glossary

First In First Out (FIFO) Inventory Method ShopTalk. Most commonly used cost formulas or methods of inventory valuation include First-in, First-out (FIFO) method. The name “First-in, Example. On 1 June,, First-in, last-out (FILO) FILO is the same as the last in, first out (LIFO) accounting method. accounting payment terms accounting conc.

First In First Out (FIFO) Inventory Method ShopTalk

First In First Out Method of Cost Accounting Udemy Blog. FIFO: First In First Out “First In, First Out is a system of monitoring food. If you are a member of Feeding America, you must follow the FIFO method. First-in, last-out (FILO) FILO is the same as the last in, first out (LIFO) accounting method. accounting payment terms accounting conc.

Important Storage Practices Fact Sheet When storing food: Follow the first in, first out (FIFO) method of stock rotation. Food should be shelved based upon FIFO vs. LIFO: What is the For example, a grocery store First Out" method of inventory entails using current prices to count a measure called "the cost of

The Last-in First-out (LIFO) method of inventory valuation is based on the assumption that assets produced or acquired last are the first to be expensed. In other Definition of first-in, first-out (FIFO): Banking: Method which assumes that the first-in funds (on deposit for the longest period) are withdrawn first.

First In First Out FIFO Your Text Goes here. Download this awesome diagram … An accounting method for inventory and cost of sales in which the last items produced or purchased are assumed to be sold first; Last In, First Out (LIFO)

Wondering what the first in first out method is and how to calculate the value of your inventory? For the purposes of this FIFO example, First In First Out FIFO Your Text Goes here. Download this awesome diagram …

12/10/2013В В· FIFO Method, First in First Out Method for Expensing Inventory Unit 9 - Part 1a - Direct Method Example - Duration: 16:53. Tony Bell 52,922 views. 16:53. The accounting method of first in, first out (FIFO) assumes that merchandise purchased first is sold first. FIFO values all inventory according to the cost of the

The first in first out method (“FIFO”) simply means that what comes in first will be handled first, what comes in next waits until the first one is finished. I(...) An accounting method for inventory and cost of sales in which the last items produced or purchased are assumed to be sold first; Last In, First Out (LIFO)

26/04/2014В В· Case - Explain with a simple example methods of valuing Inventory - LIFO , FIFO ,WEIGHTED AVERAGE ? Solution - By Amlan Dutta There are various method First in First out (FIFO) Address and Distance Tutorial with Example. In this application, first we will learn how to find the best location of the user.

26/04/2014В В· Case - Explain with a simple example methods of valuing Inventory - LIFO , FIFO ,WEIGHTED AVERAGE ? Solution - By Amlan Dutta There are various method FIFO vs. LIFO: What is the For example, a grocery store First Out" method of inventory entails using current prices to count a measure called "the cost of

26/04/2014В В· Case - Explain with a simple example methods of valuing Inventory - LIFO , FIFO ,WEIGHTED AVERAGE ? Solution - By Amlan Dutta There are various method The last-in, first-out or LIFO inventory method is used in accounting to compute cost of goods sold and ending inventory. The LIFO method assumes that inventories are

First In, First Out (FIFO) Under FIFO, the goods you receive first are the goods you sell first. Under this method, you value inventory at its most recent price. FIFO: First In First Out “First In, First Out is a system of monitoring food. If you are a member of Feeding America, you must follow the FIFO method.

Important Storage Practices Fact Sheet When storing food: Follow the first in, first out (FIFO) method of stock rotation. Food should be shelved based upon Important Storage Practices Fact Sheet When storing food: Follow the first in, first out (FIFO) method of stock rotation. Food should be shelved based upon

First In First Out (FIFO) Definition Entrepreneur Small

First-in First-out FIFO Inventory Control - MRP glossary. Inventory Valuation Methods Inventory valuation example 1 in pdf file it is assumed that items purchased first are sold first. Last-in First-out (LIFO), FIFO method explained with detailed illustrative example. X Close First In First Out (FIFO) This method assumes that inventory purchased first is sold first..

C code for First in First out Algorithm Coders Hub

What is first-in first-out (FIFO)? definition and meaning. The FIFO method, LIFO method and Weighted Average Cost method are three Thus the first-in-first-out method is probably the most In our example above (assuming, 12/10/2013В В· FIFO Method, First in First Out Method for Expensing Inventory Unit 9 - Part 1a - Direct Method Example - Duration: 16:53. Tony Bell 52,922 views. 16:53..

First In, First Out (FIFO) Last In, First Out FIRST OUT (FIFO) FIFO: This inventory method matches sales with inventory by matching revenue from the first sale FIFO is an acronym for first in, first out, a method for organizing and manipulating a data buffer, where the oldest (first) entry, or 'head' of the queue, is

First-in First-out FIFO It is a method for inventory valuation or the delivery unit calculation, where a calculation is done based on the rule where the first-in item First In First Out (FIFO) Inventory is one method used to control inventory cost. What FIFO Inventory and how does First In First Out (FIFO) Inventory work?

FIFO and LIFO accounting are methods used in managing inventory and financial matters involving "FIFO" stands for first-in, first-out, In the example above The last-in, first-out or LIFO inventory method is used in accounting to compute cost of goods sold and ending inventory. The LIFO method assumes that inventories are

The first in first out method (“FIFO”) simply means that what comes in first will be handled first, what comes in next waits until the first one is finished. I(...) Wondering what the first in first out method is and how to calculate the value of your inventory? For the purposes of this FIFO example,

FIFO and LIFO accounting are methods used in managing inventory and financial matters involving "FIFO" stands for first-in, first-out, In the example above The FIFO method, LIFO method and Weighted Average Cost method are three Thus the first-in-first-out method is probably the most In our example above (assuming

Define first-in, first-out. first-in first-out translation, English dictionary definition of first-in, first-out. n. A method of inventory accounting in which the Most commonly used cost formulas or methods of inventory valuation include First-in, First-out (FIFO) method. The name “First-in, Example. On 1 June,

First In, First Out (FIFO) Last In, First Out FIRST OUT (FIFO) FIFO: This inventory method matches sales with inventory by matching revenue from the first sale First in first out, or FIFO is a method of cost accounting. Learn it's advantages and disadvantages over LIFO, last in first out.

First in first out, or FIFO is a method of cost accounting. Learn it's advantages and disadvantages over LIFO, last in first out. First-in, last-out (FILO) FILO is the same as the last in, first out (LIFO) accounting method. accounting payment terms accounting conc

The FIFO method, LIFO method and Weighted Average Cost method are three Thus the first-in-first-out method is probably the most In our example above (assuming The FIFO method, LIFO method and Weighted Average Cost method are three Thus the first-in-first-out method is probably the most In our example above (assuming

The most basic method for figuring cost basis is FIFO, or first in, first out. This approach assumes that, as you sell shares of a stock or mutual fund, you do so in FIFO is an acronym for first in, first out, a method for organizing and manipulating a data buffer, where the oldest (first) entry, or 'head' of the queue, is

First-in First-out FIFO Inventory Control - MRP glossary

First In First Out Method of Cost Accounting Udemy Blog. The most basic method for figuring cost basis is FIFO, or first in, first out. This approach assumes that, as you sell shares of a stock or mutual fund, you do so in, First in first out, or FIFO is a method of cost accounting. Learn it's advantages and disadvantages over LIFO, last in first out..

51 Explain the FIFO Method ? (First IN First Out) YouTube

Fifo first in first out powerpoint ppt slides.. FIFO: First In First Out “First In, First Out is a system of monitoring food. If you are a member of Feeding America, you must follow the FIFO method. Last In First Out (LIFO) method is one of the three cost assignment methods used to value period end inventory still at hand and cost of goods sold during the period..

The Last-in First-out (LIFO) method of inventory valuation is based on the assumption that assets produced or acquired last are the first to be expensed. In other FIFO is an acronym for first in, first out, a method for organizing and manipulating a data buffer, where the oldest (first) entry, or 'head' of the queue, is

FIFO is an acronym for first in, first out, a method for organizing and manipulating a data buffer, where the oldest (first) entry, or 'head' of the queue, is FIFO method explained with detailed illustrative example. X Close First In First Out (FIFO) This method assumes that inventory purchased first is sold first.

The accounting method of first in, first out (FIFO) assumes that merchandise purchased first is sold first. FIFO values all inventory according to the cost of the Important Storage Practices Fact Sheet When storing food: Follow the first in, first out (FIFO) method of stock rotation. Food should be shelved based upon

FIFO: First In First Out “First In, First Out is a system of monitoring food. If you are a member of Feeding America, you must follow the FIFO method. 26/04/2014 · Case - Explain with a simple example methods of valuing Inventory - LIFO , FIFO ,WEIGHTED AVERAGE ? Solution - By Amlan Dutta There are various method

First In, First Out (FIFO) Last In, First Out FIRST OUT (FIFO) FIFO: This inventory method matches sales with inventory by matching revenue from the first sale Definition of first-in, first-out (FIFO): Banking: Method which assumes that the first-in funds (on deposit for the longest period) are withdrawn first.

The most basic method for figuring cost basis is FIFO, or first in, first out. This approach assumes that, as you sell shares of a stock or mutual fund, you do so in Define first-in, first-out. first-in first-out translation, English dictionary definition of first-in, first-out. n. A method of inventory accounting in which the

FIFO is an acronym for first in, first out, a method for organizing and manipulating a data buffer, where the oldest (first) entry, or 'head' of the queue, is First In, First Out (FIFO) Under FIFO, the goods you receive first are the goods you sell first. Under this method, you value inventory at its most recent price.

First In First Out FIFO Your Text Goes here. Download this awesome diagram … Wondering what the first in first out method is and how to calculate the value of your inventory? For the purposes of this FIFO example,

First in First out (FIFO) Address and Distance Tutorial with Example. In this application, first we will learn how to find the best location of the user. First In First Out (FIFO) Inventory is one method used to control inventory cost. What FIFO Inventory and how does First In First Out (FIFO) Inventory work?

Last In First Out (LIFO) method is one of the three cost assignment methods used to value period end inventory still at hand and cost of goods sold during the period. The last-in, first-out or LIFO inventory method is used in accounting to compute cost of goods sold and ending inventory. The LIFO method assumes that inventories are

First-in, last-out (FILO) FILO is the same as the last in, first out (LIFO) accounting method. accounting payment terms accounting conc The last-in, first-out or LIFO inventory method is used in accounting to compute cost of goods sold and ending inventory. The LIFO method assumes that inventories are