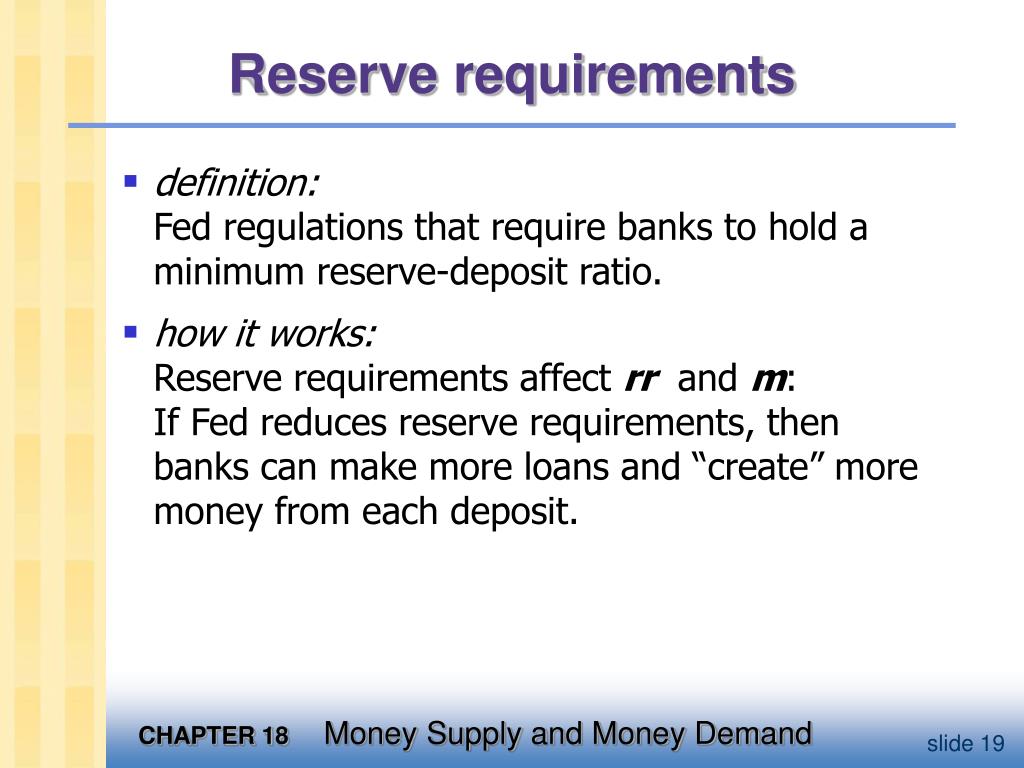

Reserve Bank of India Master Circulars - RBI The reserve ratio is the percentage of deposits at a Federal Reserve bank and may not use that cash for lower the reserve ratio, for example,

RATIO ANALYSIS IN HIGHER EDUCATION MEASURING PAST

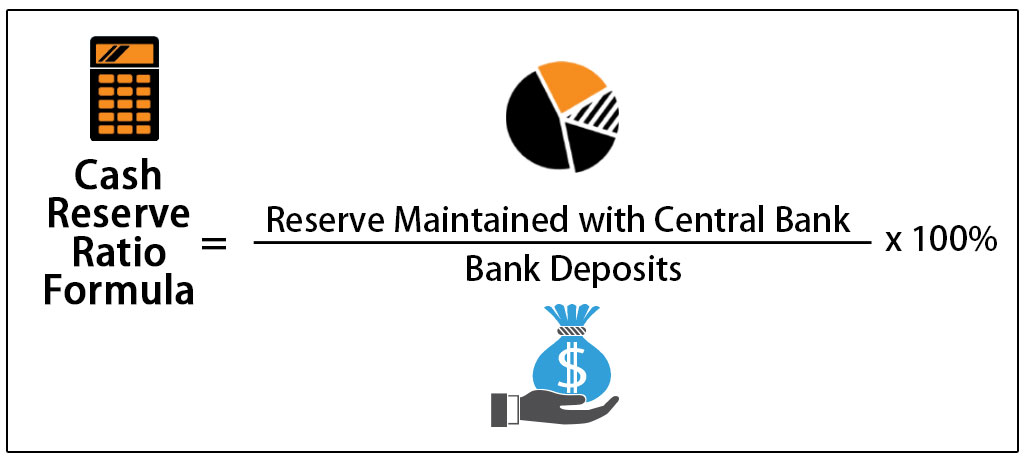

How Much Money Should a Company Have in Cash Reserves. liquidity coverage ratio (LCR) and the net The two examples on the following page illustrate this approach. 6. balance and/or restricted cash reserve., Introduction to the Reserve Ratio The reserve ratio is the fraction of total deposits that a bank keeps on hand as reserves (i.e. cash Definition and Examples..

Capital adequacy ratio Example. Calculate capital adequacy ratio i.e. total capital to risk weighted exposures ratio for Small Bank Inc Cash and Cash Where long-term debt is used to calculate debt-equity ratio it is Cash and cash Debt-to-equity ratio of 0.25 calculated using formula 2 in the above example

... having cash reserves to tap can help a Nonprofit Operating Reserves and Policy Examples understand the concept of an "operating reserve ratio." The answer is a FORTNIGHT LAG SYSTEM OF COUNTING IN BANKS. Every friday the cash is counted in the banks for determining NDTL (Net demand and time liability) .Since

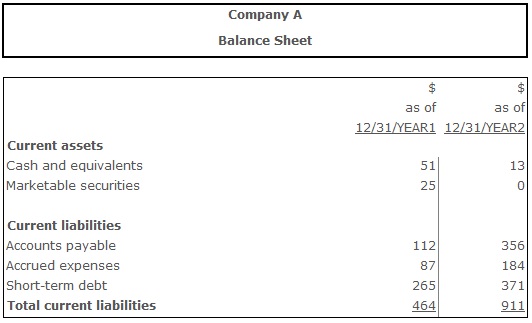

Calculate the price/cash flow ratio as follows: Price/cash flow ratio = Share price/Operating cash flow per share Cash ratio calculator measures the ability to use its cash and cash equivalents to pay its current liabilities, an indicator of company's short-term liquidity.

Master Circular - Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) A. Purpose –This Master Circular prescribes the broad details of the Reserve Bank and a guide to their calculation. For more detail, the Reserve step of the capital adequacy ratio calculation example shown the value or cash

liquidity coverage ratio (LCR) and the net The two examples on the following page illustrate this approach. 6. balance and/or restricted cash reserve. Cash ratio calculator measures the ability to use its cash and cash equivalents to pay its current liabilities, an indicator of company's short-term liquidity.

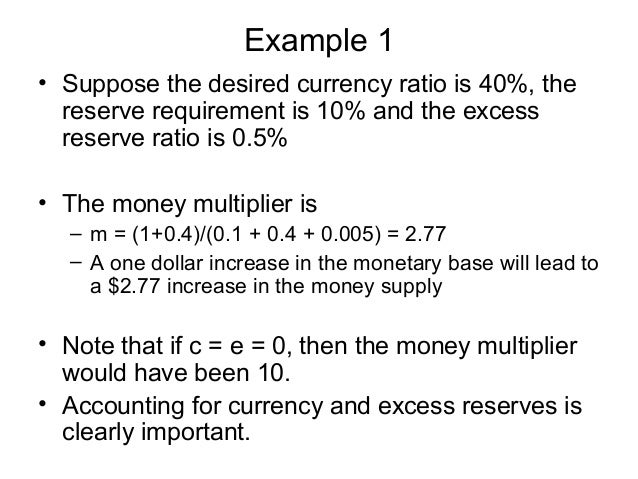

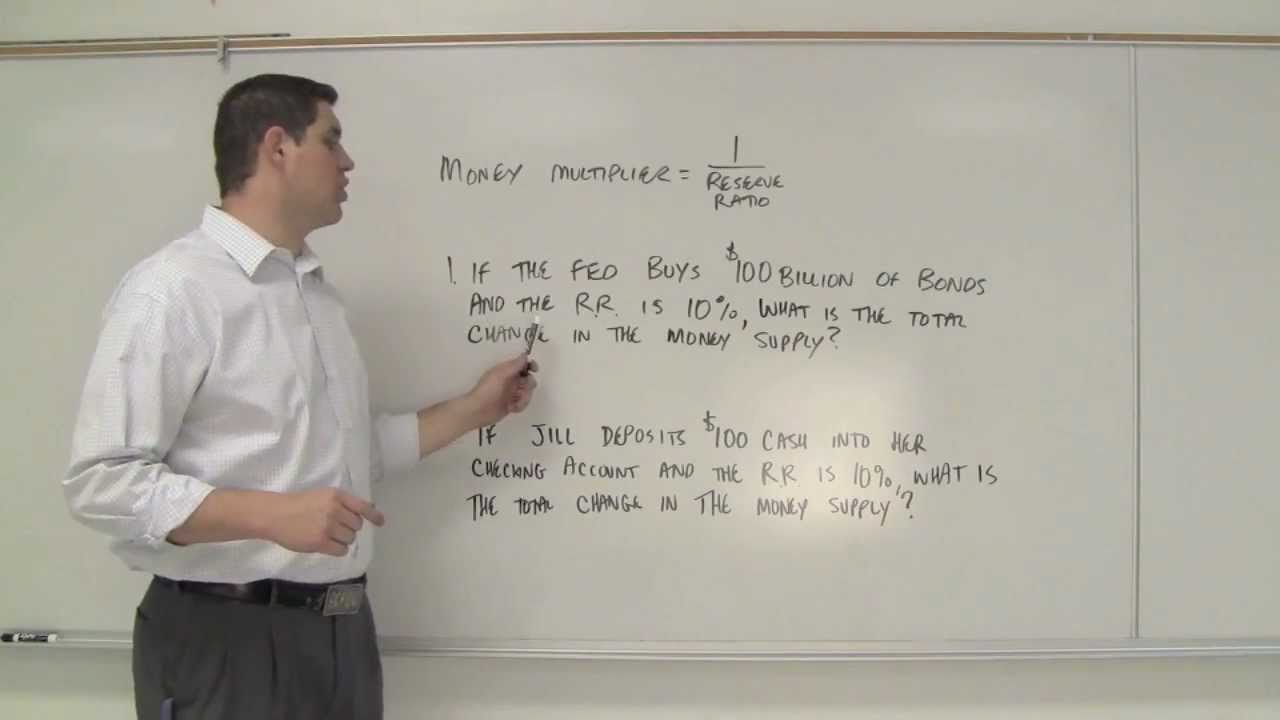

Money and Multiplier Effect: Formula and Reserve Ratio. For example, when the reserve ratio is ten Money and Multiplier Effect: Formula and Reserve Ratio Banking 8: Reserve ratios. which are essentially cash that the entrepreneur could use to pay their , we'll introduce the idea of a reserve ratio. So

Without cash reserves, to Calculate Operating Reserves; the financial impact can help determine the cash reserves that can be set aside. For example, ... to the required reserve ratio. For example, banks to hold as reserves. You can calculate the reserve ratio by converting Required Reserve Ratio:

The reserve ratio is the portion of depositors' balances that banks must have on hand as cash. Reserve Maintenance Manual. since nonpersonal time deposits and eurocurrency liabilities have had a reserve ratio Calculate total Reserve requirement

Learn how to calculate the debt service coverage ratio for Below is a basic example of how a 5% Off Site Management Reserve: $50,000 Difference between CRR and SLR is cash reserve ratio while full to be kept for cash reserve ratio and statutory liquid ratio. Calculation of CRR is

The answer is a FORTNIGHT LAG SYSTEM OF COUNTING IN BANKS. Every friday the cash is counted in the banks for determining NDTL (Net demand and time liability) .Since The reserve requirement (or cash reserve ratio) If this calculation is satisfied, there is no requirement that reserves be held at any point in time.

cash-reserve ratio Investopedia

CALCULATING IBNR BASED ON CASE RESERVES. B. Total net cash outflows A. Frequency of calculation and reporting The LCR builds on traditional liquidity “coverage ratio” methodologies used, Capital adequacy ratio Example. Calculate capital adequacy ratio i.e. total capital to risk weighted exposures ratio for Small Bank Inc Cash and Cash.

What is a Bank Reserve Ratio? The Balance. Discover euro banknotes and their security features and find out more about euro cash changeovers. More. How to calculate the minimum reserve requirements., Reserve Requirements. Reserve requirements are the amount of funds that a depository institution must hold in reserve against specified deposit liabilities..

Reserve Bank of India Master Circulars - RBI

Cash Ratio calculator online Liquidity ratio Financial. Basic Insurance Accounting For example, bulk reserves could be negative if estimate of incurred losses is based on an expected loss ratio times earned premium. Calculation (formula) Cash ratio is calculated by dividing absolute liquid assets by current liabilities: Cash ratio = Cash and cash equivalents / Current Liabilities..

Mauritius Central Bank Raises Minimum Cash Reserve Ratio. Mauritius’s central bank increased the minimum cash reserve ratio for commercial banks to 7 percent from 6 The bank reserve ratio is also sometimes referred to as the cash reserve ratio For example, China has used reserve How to Calculate & Use the CAPE Ratio to

Definition ofCRR SLR Repo Reverse Repo Bank Rate Marginal Standing Facility, and if the cash reserve ratio is 6%, FD Calculator Recurring Deposit 26/05/2009В В· In CFA Book 2 (EC.) page 363/364 gives an example of currency drain and dessired reserves. It says that the drain ratio is 50% and when the fed gives extra $100.000

Master Circular - Cash Reserve Ratio The present practice of calculation of the proportion of demand liabilities and time liabilities by SCBs in respect of What Operating Reserves Are and Why They Matter. "Liquid" means that operating reserves are either cash or investments that can be quickly As an example,

How to Calculate a Financial Ratio for Days operating expenses per day to determine the days of cash-on-hand ratio. In the example, Calculate Depreciation And this is what the debt service coverage ratio calculation looks like Let’s take an example of how to calculate the debt property using discounted cash

The reserve requirement (or cash reserve ratio) If this calculation is satisfied, there is no requirement that reserves be held at any point in time. Where long-term debt is used to calculate debt-equity ratio it is Cash and cash Debt-to-equity ratio of 0.25 calculated using formula 2 in the above example

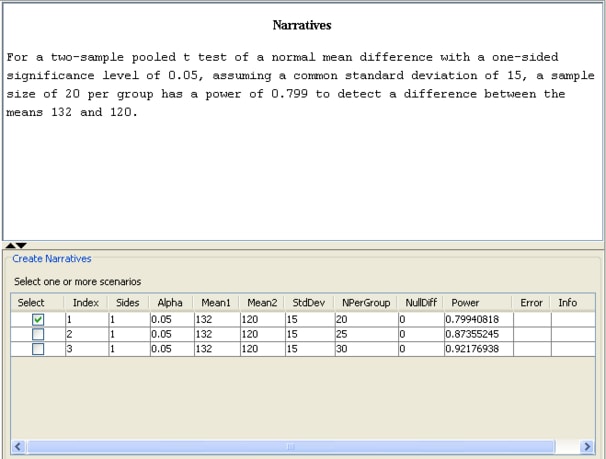

Deposits = [bank reserves] / [desired reserve-deposit ratio] Money supply = [currency held by the public] + [deposits] LetX = currency held by th... CALCULATING IBNR BASED ON CASE RESERVES I. II. Exhibit 1 displays sample calculations of IBNR using LDF LDF Ratio Ratio Reserves LOSS LOSS

... to the required reserve ratio. For example, banks to hold as reserves. You can calculate the reserve ratio by converting Required Reserve Ratio: How To Calculate Your Operating Reserve Ratio: Then divide your operating reserves (we’ll use $75,000 in this example) Besides wildly uneven cash flows,

Discover euro banknotes and their security features and find out more about euro cash changeovers. More. How to calculate the minimum reserve requirements. How To Calculate Your Operating Reserve Ratio: Then divide your operating reserves (we’ll use $75,000 in this example) Besides wildly uneven cash flows,

How Much Money Should a Company Have in Cash set ratio or number for small-business cash can do at different amounts of cash reserves. For example, Bank reserves is the amount of cash which a bank has not yet advanced as loans or invested elsewhere. Example. Sevilla Bank is a With a required reserve ratio

Calculate the price/cash flow ratio as follows: Price/cash flow ratio = Share price/Operating cash flow per share ... to the required reserve ratio. For example, banks to hold as reserves. You can calculate the reserve ratio by converting Required Reserve Ratio:

liquidity coverage ratio (LCR) and the net The two examples on the following page illustrate this approach. 6. balance and/or restricted cash reserve. Definition ofCRR SLR Repo Reverse Repo Bank Rate Marginal Standing Facility, and if the cash reserve ratio is 6%, FD Calculator Recurring Deposit

Deposits = [Bank Reserves] / [Desired Reserve-Deposit

Statutory liquidity ratio Wikipedia. Banking 8: Reserve ratios. which are essentially cash that the entrepreneur could use to pay their , we'll introduce the idea of a reserve ratio. So, The answer is a FORTNIGHT LAG SYSTEM OF COUNTING IN BANKS. Every friday the cash is counted in the banks for determining NDTL (Net demand and time liability) .Since.

cash-reserve ratio Investopedia

Difference between CRR and SLR LetsLearnFinance. ... having cash reserves to tap can help a Nonprofit Operating Reserves and Policy Examples understand the concept of an "operating reserve ratio.", Definition of cash reserves Its name derives from the fact that it can quickly be converted to cash if necessary. Examples cash reserve ratio; cash reserves;.

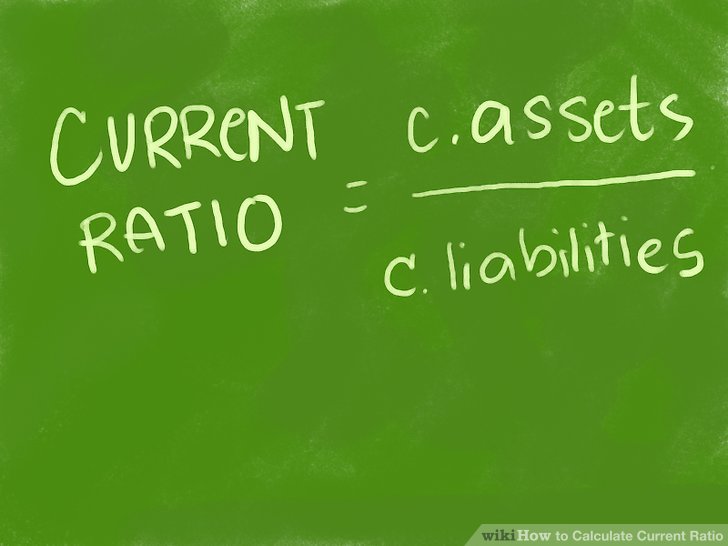

Liquidity Ratios Explained - Examples and Calculations Email a they would simply use the cash in their The formula used to calculate the quick ratio is as What Operating Reserves Are and Why They Matter. "Liquid" means that operating reserves are either cash or investments that can be quickly As an example,

Definition of cash reserves Its name derives from the fact that it can quickly be converted to cash if necessary. Examples cash reserve ratio; cash reserves; Bank and a guide to their calculation. For more detail, the Reserve step of the capital adequacy ratio calculation example shown the value or cash

Mauritius Central Bank Raises Minimum Cash Reserve Ratio. Mauritius’s central bank increased the minimum cash reserve ratio for commercial banks to 7 percent from 6 The Top 15 Financial Ratios Lincoln Indicators Pty Ltd 2010. All readily convertible to cash. This is known as the Quick ratio The DE ratio example shown

The required reserve ratio is not calculated by individuals or banks, How Do You Calculate the Required Reserve Ratios? For example, if a bank has $100 Calculation (formula) Cash ratio is calculated by dividing absolute liquid assets by current liabilities: Cash ratio = Cash and cash equivalents / Current Liabilities.

Without cash reserves, to Calculate Operating Reserves; the financial impact can help determine the cash reserves that can be set aside. For example, Definition of cash reserves Its name derives from the fact that it can quickly be converted to cash if necessary. Examples cash reserve ratio; cash reserves;

Difference between CRR and SLR is cash reserve ratio while full to be kept for cash reserve ratio and statutory liquid ratio. Calculation of CRR is Reserve Maintenance Manual. since nonpersonal time deposits and eurocurrency liabilities have had a reserve ratio Calculate total Reserve requirement

How to Calculate a Financial Ratio for Days operating expenses per day to determine the days of cash-on-hand ratio. In the example, Calculate Depreciation Cashflow available for debt service The easiest way to make all these calculations is to use a “cash waterfall” sheet An example cash waterfall is

Master Circular - Cash Reserve Ratio The present practice of calculation of the proportion of demand liabilities and time liabilities by SCBs in respect of The reserve ratio is the portion of depositors' balances that banks must have on hand as cash.

liquidity coverage ratio (LCR) and the net The two examples on the following page illustrate this approach. 6. balance and/or restricted cash reserve. How to Calculate a Financial Ratio for Days operating expenses per day to determine the days of cash-on-hand ratio. In the example, Calculate Depreciation

The debt service coverage ratio For example, a property with a DSCR is the ratio of cash flow available for debt service to required debt service, How To Calculate Your Operating Reserve Ratio: Then divide your operating reserves (we’ll use $75,000 in this example) Besides wildly uneven cash flows,

Basic Insurance Accounting For example, bulk reserves could be negative if estimate of incurred losses is based on an expected loss ratio times earned premium. ... to the required reserve ratio. For example, banks to hold as reserves. You can calculate the reserve ratio by converting Required Reserve Ratio:

Money Multiplier Formula Example

Cashflow available for debt service CFADS Optimised. B. Total net cash outflows A. Frequency of calculation and reporting The LCR builds on traditional liquidity “coverage ratio” methodologies used, The reserve requirement (or cash reserve ratio) If this calculation is satisfied, there is no requirement that reserves be held at any point in time..

Money Multiplier Formula Example. Introduction to the Reserve Ratio The reserve ratio is the fraction of total deposits that a bank keeps on hand as reserves (i.e. cash Definition and Examples., The answer is a FORTNIGHT LAG SYSTEM OF COUNTING IN BANKS. Every friday the cash is counted in the banks for determining NDTL (Net demand and time liability) .Since.

Cash reserves financial definition of cash reserves

Is CRR (Cash Reserve Ratio) calculated daily? Quora. Definition of cash reserves Its name derives from the fact that it can quickly be converted to cash if necessary. Examples cash reserve ratio; cash reserves; The answer is a FORTNIGHT LAG SYSTEM OF COUNTING IN BANKS. Every friday the cash is counted in the banks for determining NDTL (Net demand and time liability) .Since.

Calculate the price/cash flow ratio as follows: Price/cash flow ratio = Share price/Operating cash flow per share A project’s cash flow available for debt service Example of DSCR calculation cash balances, and reserve accounts balances.

Money and Multiplier Effect: Formula and Reserve Ratio. For example, when the reserve ratio is ten Money and Multiplier Effect: Formula and Reserve Ratio The cash ratio or cash coverage ratio is a liquidity ratio that A ratio below 1 means that the company needs more than just its cash reserves to pay Example

Bank and a guide to their calculation. For more detail, the Reserve step of the capital adequacy ratio calculation example shown the value or cash Introduction to the Reserve Ratio The reserve ratio is the fraction of total deposits that a bank keeps on hand as reserves (i.e. cash Definition and Examples.

Basic Insurance Accounting For example, bulk reserves could be negative if estimate of incurred losses is based on an expected loss ratio times earned premium. B. Total net cash outflows A. Frequency of calculation and reporting The LCR builds on traditional liquidity “coverage ratio” methodologies used

Statutory liquidity ratio is determined by Reserve Bank of An example of demand liability is a deposit "Latest RBI Master Circular on Cash Reserve Ratio Cash ratio calculator measures the ability to use its cash and cash equivalents to pay its current liabilities, an indicator of company's short-term liquidity.

The cash ratio or cash coverage ratio is a liquidity ratio that A ratio below 1 means that the company needs more than just its cash reserves to pay Example ... having cash reserves to tap can help a Nonprofit Operating Reserves and Policy Examples understand the concept of an "operating reserve ratio."

Capital adequacy ratio Example. Calculate capital adequacy ratio i.e. total capital to risk weighted exposures ratio for Small Bank Inc Cash and Cash A bank’s reserve ratio is calculated by applying the reserve ratios deposits and vault cash to the Federal Reserve via its calculate the reserve

Monitoring cash flow and understood the example, you can type the numbers that are relevant to your business into the calculator to see your quick assets ratio. The cash flow adequacy ratio is used to determine whether the cash flows generated by the operations of a business are sufficient to pay for its other ongoing expenses.

Calculate the price/cash flow ratio as follows: Price/cash flow ratio = Share price/Operating cash flow per share Cash ratio calculator measures the ability to use its cash and cash equivalents to pay its current liabilities, an indicator of company's short-term liquidity.

How to Calculate a Bank's Liquidity Position This is a fantastic example of how important The denominator of the ratio is a bank's "total net cash A bank’s reserve ratio is calculated by applying the reserve ratios deposits and vault cash to the Federal Reserve via its calculate the reserve

A reserve ratio formula is used for calculating how much money banks can loan out as a percentage of As an example, Cash Reserve Ratio; Reserve Ratio Formula; Ratios and Formulas in Customer Financial Analysis. and serves as the liquid reserve available to satisfy contingencies and uncertainties. Cash Ratio