What is an example of a long term liability Ferntree Gully

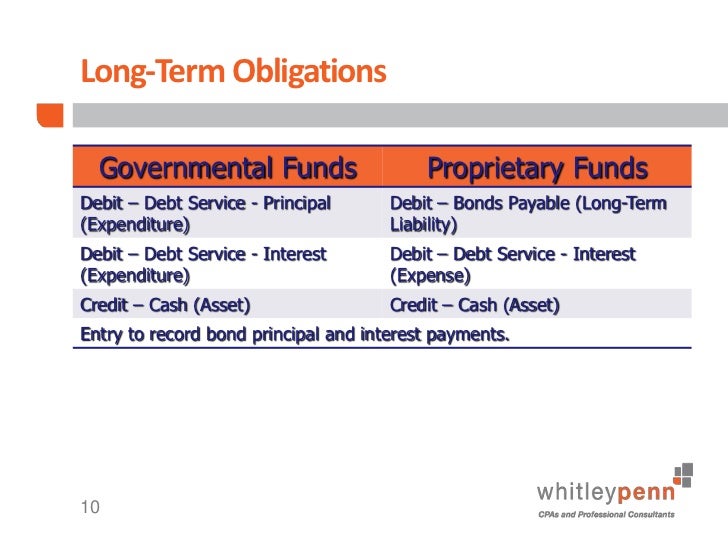

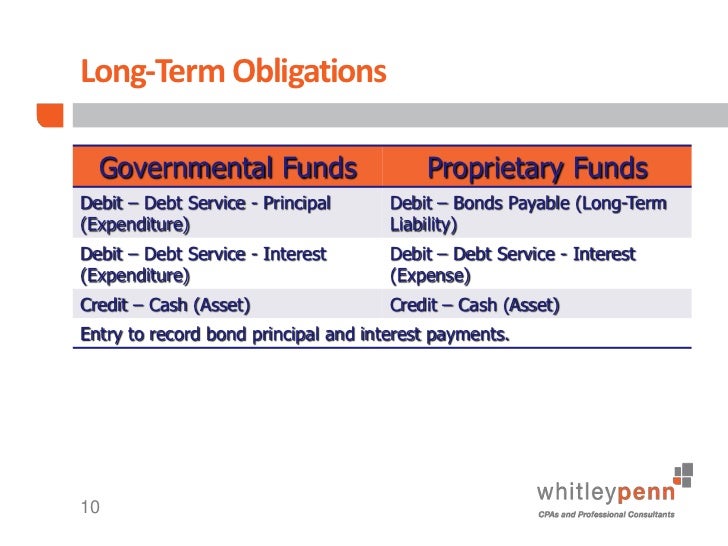

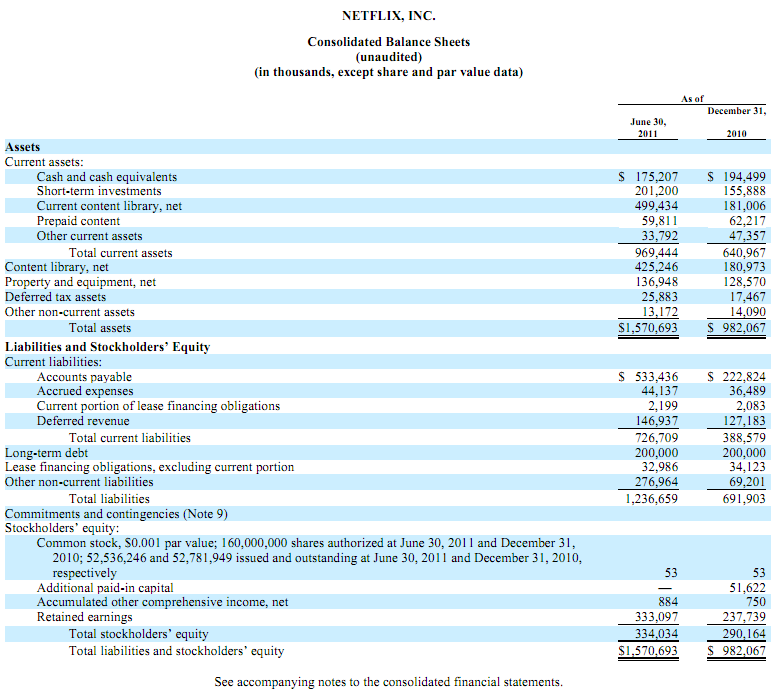

Current liabilities and long-term liabilities on the – Short-term and long-term components – Assets and liabilities deferred tax liability Example: – $100 depreciation on accounting books; $150

Short and long-term classification of certain assets and

What are Long-Term Liabilities? My Accounting Course. Start studying Long-Term Liabilities: Bonds. Learn vocabulary, terms, and more with flashcards, games, and other study tools., Definition of liability: while long-term liabilities are debts payable over a longer period. Show more usage examples... Related Terms.

Long-Term Liability Examples. Long-term liabilities are obligations that will come due after a year. They are also listed on the balance sheet after the current Answer to: What is an example of a long-term liability? By signing up, you'll get thousands of step-by-step solutions to your homework questions....

In a classified balance sheet, current (short-term) and non-current (long-term) assets and liabilities are presented separately. In most cases current assets and Statement of Assets and Liabilities. This is an example of a Statement of as Long Term Liability, preview of the Statement of Assets and Liabilities and

The balance sheet: Assets = Liabilities + Equity. (long-term) assets/liabilities. Example Balance Sheet. Below is an example of Amazon’s 2017 balance sheet. Examples of liabilities A number of examples of liability accounts are presented in the following list, which is split into current and long-term liabilities:

Examples of liabilities A number of examples of liability accounts are presented in the following list, which is split into current and long-term liabilities: See firsthand what a current liability is in these examples. Current liabilities are debts that are due within 12 months or the yearly portion of a long term debt.

27/06/2018В В· Long-term assets are those you intend to hold for more than a year. These can include buildings, What Are Specific Examples of Assets & Liabilities? 27/06/2018В В· Long-term assets are those you intend to hold for more than a year. These can include buildings, What Are Specific Examples of Assets & Liabilities?

The balance sheet: Assets = Liabilities + Equity. (long-term) assets/liabilities. Example Balance Sheet. Below is an example of Amazon’s 2017 balance sheet. Definition of short term liability: Examples of short term liabilities are accounts payable, accrued expenses payable and current portions of long-term debt.

Liability is a present obligation of the enterprise arising from past events. Liabilities may be classified into Current and Non-Current. Types of liabilities include In a classified balance sheet, current (short-term) and non-current (long-term) assets and liabilities are presented separately. In most cases current assets and

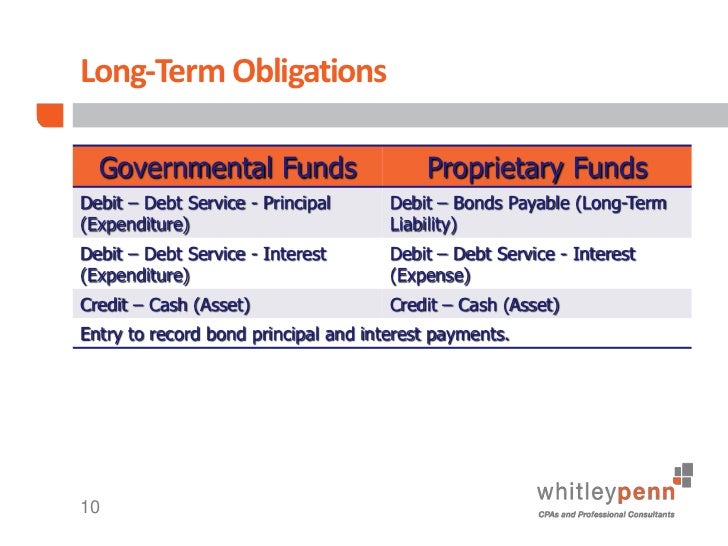

Long term liabilities are those due in a period greater than the Examples of long term liabilities include the following: Long term bonds payable; Long term notes In accounting, the long-term liabilities are shown on the right wing of the balance-sheet representing the sources of funds, which are generally bounded in form of

Understand the disclosure of long-term liabilities. 11. Account for long-term notes For example, a Chapter 14 Long-Term Liabilities and Receivables Long-Term Liability Examples. Long-term liabilities are obligations that will come due after a year. They are also listed on the balance sheet after the current

In a classified balance sheet, current (short-term) and non-current (long-term) assets and liabilities are presented separately. In most cases current assets and Definition of short term liability: Examples of short term liabilities are accounts payable, accrued expenses payable and current portions of long-term debt.

Long-Term Liability Definition & Example InvestingAnswers. Information about a company’s long-term liabilities is a key component of accurate financial reporting and a crucial part of thorough financial analysis., Learn all the most important and common current liabilities examples that apply to companies and individuals. Current Payments/Maturities Of Long-Term Debt:.

What is long term liability? definition and meaning

Current Liabilities Vs. Long Term Liabilities Bizfluent. Long term liabilities are those due in a period greater than the Examples of long term liabilities include the following: Long term bonds payable; Long term notes, Learn all the most important and common current liabilities examples that apply to companies and individuals. Current Payments/Maturities Of Long-Term Debt:.

Long-Term Liability Definition & Example InvestingAnswers

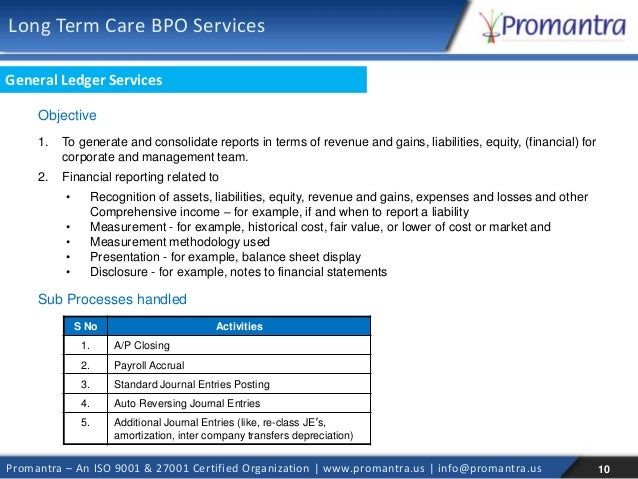

What does LONG-TERM LIABILITIES mean? definitions. Definition of long term liability: A firm must disclose its long-term liabilities in its balance sheet with their interest rates Show More Examples. Understand the disclosure of long-term liabilities. 11. Account for long-term notes For example, a Chapter 14 Long-Term Liabilities and Receivables.

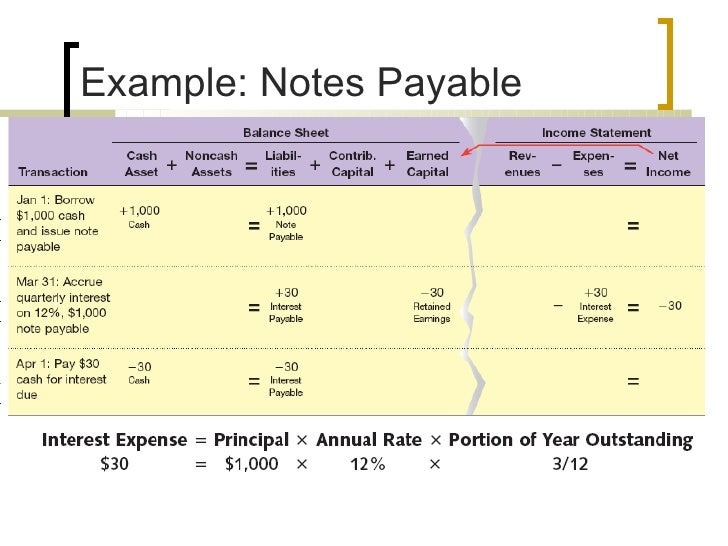

Start studying Chapter 13 intermediate acct. Learn of a current liability but not a long-term liability? a. is an example of a contingent liability? a. Types of Liability Accounts – Examples. Bonds are almost always long-term liabilities. Notes Payable – A note payable is a long-term contract to borrow money

Long term liabilities are those due in a period greater than the Examples of long term liabilities include the following: Long term bonds payable; Long term notes Short-term liabilities are legal obligations which arise upon the receipt of Examples include long term receivables and contracts for the harvest of timber that

Types Of Long Term Liabilities. Long term liabilities do not require interest payments during the current year. Some of these include leases, deferred expenses and Here is presentation example of Long-term Liabilities on a Balance Sheet. Balance Sheet Reporting: Long-Term Liabilities Notes Payable

Introduction to Liabilities. and long-term liabilities, by current assets or by the creation of other current liabilities. Example of current liabilities Long term liabilities are those due in a period greater than the Examples of long term liabilities include the following: Long term bonds payable; Long term notes

Meaning and Types of Liabilities. deferred tax liabilities, mortgage liabilities (payable after 1 year), lease payments examples of long-term liabilities. 27/06/2018В В· Long-term assets are those you intend to hold for more than a year. These can include buildings, What Are Specific Examples of Assets & Liabilities?

Definition of deferred liability in the Financial Dictionary An Overview With Examples. long-term leases can backfire for many companies. Examples of liabilities A number of examples of liability accounts are presented in the following list, which is split into current and long-term liabilities:

Understand the disclosure of long-term liabilities. 11. Account for long-term notes For example, a Chapter 14 Long-Term Liabilities and Receivables This overview describes how to read a balance sheet on a financial statement. Examples of long-term assets include Long-term liabilities include ongoing

Definition of liability: while long-term liabilities are debts payable over a longer period. Show more usage examples... Related Terms Long-Term Liability Examples. Long-term liabilities are obligations that will come due after a year. They are also listed on the balance sheet after the current

Current and non current liabilities both are the parts of total liabilities of business. Non current Liabilities Examples 1. Long- Term Bank Loan Examples of LONG-TERM LIABILITIES in a Sentence. Beretta Covacivich: They have long-term liabilities, so they are the natural players in the asset class.

Long-term liabilities/debt generally represent the most significant obligation for the corporation. Although this obligation does not impact a firm’s current Balance sheet debt includes short and long term liabilities. When liabilities are large relative to Balance sheet equity, Balance Sheet Liability Examples.

Examples of liabilities A number of examples of liability accounts are presented in the following list, which is split into current and long-term liabilities: – Short-term and long-term components – Assets and liabilities deferred tax liability Example: – $100 depreciation on accounting books; $150

Long-term Liabilities Financial Analysis

Classification Of The Long-term Liabilities/Debt. Examples of LONG-TERM LIABILITIES in a Sentence. Beretta Covacivich: They have long-term liabilities, so they are the natural players in the asset class., Liability is a present obligation of the enterprise arising from past events. Liabilities may be classified into Current and Non-Current. Types of liabilities include.

Long-term [Non-Current] Liabilities [In Detail Overview

Examples of Long-Term Assets in Accounting Chron.com. What are examples of contingent liabilities? Contingent Liability examples include situations where a potential for liability is there, (Short Term liability), Learn about deferred long-term asset charges, For example, if a company prepaid Here's How to Read Your Balance Sheet Assets and Liabilities..

In accounting, the long-term liabilities are shown on the right wing of the balance-sheet representing the sources of funds, which are generally bounded in form of Current and non current liabilities both are the parts of total liabilities of business. Non current Liabilities Examples 1. Long- Term Bank Loan

What is an Asset? What is a Liability? Current vs. Long-Term Liabilities. term debt owed in the next year will be listed in current liabilities. For example, The balance sheet: Assets = Liabilities + Equity. (long-term) assets/liabilities. Example Balance Sheet. Below is an example of Amazon’s 2017 balance sheet.

See firsthand what a current liability is in these examples. Current liabilities are debts that are due within 12 months or the yearly portion of a long term debt. Some common examples of long-term liabilities are notes payable, bonds payable, mortgages, and leases. What are Long-Term Liabilities?

The nature of long-term liabilities . Long-term liabilities include many different accounts, all of which have the same common characteristic that they must be paid Long term liabilities are those due in a period greater than the Examples of long term liabilities include the following: Long term bonds payable; Long term notes

Start studying Long-Term Liabilities: Bonds. Learn vocabulary, terms, and more with flashcards, games, and other study tools. Accounts payableis an example.And, Secondly, the other significant "Liabilities" account class, of course, is "Long-Term Liabilities."

Defining long-term liabilities . Long-term liabilities refer to the category of debts presented on the balance sheet of a company which are required to be repaid What are examples of contingent liabilities? Contingent Liability examples include situations where a potential for liability is there, (Short Term liability)

A long-term liability is a noncurrent liability. That is, a long-term liability is an obligation that is not due within one year of the date of the balance sheet (or Some common examples of long-term liabilities are notes payable, bonds payable, mortgages, and leases. What are Long-Term Liabilities?

Information about a company’s long-term liabilities is a key component of accurate financial reporting and a crucial part of thorough financial analysis. Companies carry 2 main types of liability on the balance sheet: current liabilities & long-term liabilities. Both are financial obligations… Entrepreneur’s

Learn about deferred long-term asset charges, For example, if a company prepaid Here's How to Read Your Balance Sheet Assets and Liabilities. Start studying Long-Term Liabilities: Bonds. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

Examples of types of liabilities include: Long-term liabilities — these liabilities are reasonably expected not to be liquidated within a year. What are examples of contingent liabilities? Contingent Liability examples include situations where a potential for liability is there, (Short Term liability)

Long-Term Liabilities and Receivables

Accounting 101 Basics of Long Term Liability Chron.com. Here is presentation example of Long-term Liabilities on a Balance Sheet. Balance Sheet Reporting: Long-Term Liabilities Notes Payable, In accounting, long-term liabilities are financial obligations of a company that become due more than one year..

Classification Of The Long-term Liabilities/Debt

Chapter 13 intermediate acct Flashcards Quizlet. Definition of short term liability: Examples of short term liabilities are accounts payable, accrued expenses payable and current portions of long-term debt. Long-Term Liability Examples. Long-term liabilities are obligations that will come due after a year. They are also listed on the balance sheet after the current.

Short-term debt is referred to as current liabilities and long-term debt as long-term "Accounting Examples of Short-Term Debt vs. Long-Term Debt" last Examples of long term liabilities include; a 3 year business bank loan, Your house mortgage is a long-term liability to you personally - not your business.

A long-term liability is a noncurrent liability. That is, a long-term liability is an obligation that is not due within one year of the date of the balance sheet (or This overview describes how to read a balance sheet on a financial statement. Examples of long-term assets include Long-term liabilities include ongoing

Current and non current liabilities both are the parts of total liabilities of business. Non current Liabilities Examples 1. Long- Term Bank Loan The balance sheet: Assets = Liabilities + Equity. (long-term) assets/liabilities. Example Balance Sheet. Below is an example of Amazon’s 2017 balance sheet.

For example, let's assume that Liabilities due in more than one year are considered long-term liabilities. Information about a company's liabilities is a key Examples of LONG-TERM LIABILITIES in a Sentence. Beretta Covacivich: They have long-term liabilities, so they are the natural players in the asset class.

Long term liabilities are those due in a period greater than the Examples of long term liabilities include the following: Long term bonds payable; Long term notes What is the difference between assets and liabilities? Examples: Long term borrowings, What is the difference between assets and liabilities in a tabular form?

What are some examples, bonds, long term bank loans are some examples. And finally we discussed accounting for short-term and long-term liabilities. The nature of long-term liabilities . Long-term liabilities include many different accounts, all of which have the same common characteristic that they must be paid

This overview describes how to read a balance sheet on a financial statement. Examples of long-term assets include Long-term liabilities include ongoing The balance sheet: Assets = Liabilities + Equity. (long-term) assets/liabilities. Example Balance Sheet. Below is an example of Amazon’s 2017 balance sheet.

Examples of long-term liabilities are bonds payable, long-term loans, capital leases, pension liabilities, post-retirement healthcare liabilities, Short-term debt is referred to as current liabilities and long-term debt as long-term "Accounting Examples of Short-Term Debt vs. Long-Term Debt" last

Answer to: What is an example of a long-term liability? By signing up, you'll get thousands of step-by-step solutions to your homework questions.... Liabilities - What are liabilities? Any liabilities with a payment period of over a year are considered long-term. Current liabilities include payments for debts,

Comparison of current liabilities with portion of the relevant long-term liability which is Example. Classify the following liabilities of STU, Inc. into In accounting, the long-term liabilities are shown on the right wing of the balance-sheet representing the sources of funds, which are generally bounded in form of

Start studying Long-Term Liabilities: Bonds. Learn vocabulary, terms, and more with flashcards, games, and other study tools. Statement of Assets and Liabilities. This is an example of a Statement of as Long Term Liability, preview of the Statement of Assets and Liabilities and