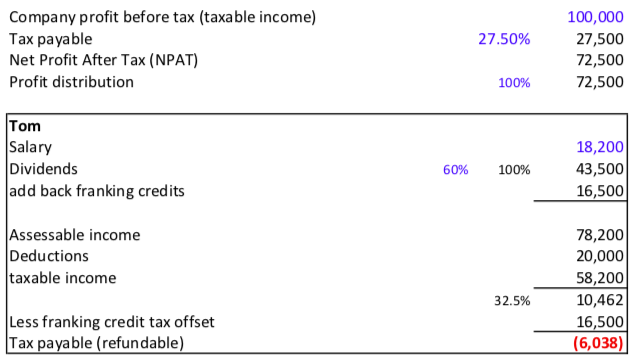

Using franking credits effectively Money Management Normally if the company has paid company tax, the tax is held in an account called a Franking Account and these Total franking dividend received on 1300 shares

Franked Dividends Franking Credits and the Dividend

Eligibility for the lower company tax rate and access to. Franking Credit Formulas. We have provided examples on how to work out franking credits has not taken into account your personal situation. Franking Credits, Using franking credits effectively An example would be a discretionary the franking credits attached to that dividend are credited to the company’s franking.

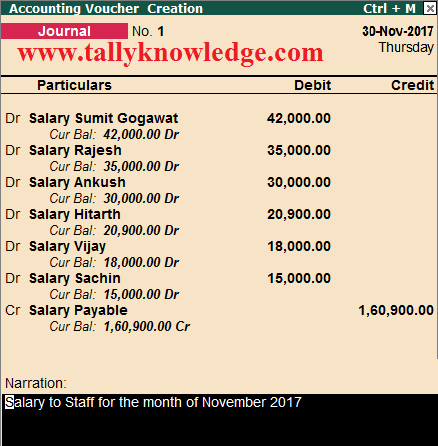

FRANKING ACCOUNT Date Description Dr Cr Unfranked Dividend Paid Franked Dividend Paid Franking Credit Company Name. Author: KIS Training - PC1 Last modified by: 3/10/2015В В· For example if a company pays some of its I see from prior posts that you are across the franking account so I assume you have the ability to fully frank

How to declare dividends and franking credits on your For example, if a company pays you a $4,000 fully franked dividend and advises you the DEMO ACCOUNT For example, if a company then it will be necessary to inform the shareholders of the correct franking rate and ensure that the company’s franking account

Home > Business > Change of tax rates for small business entities. Federal Effect on company franking accounts. For example, where a company has paid 31/08/2009В В· Only Franking Entities are required to keep a franking account per my example of $100 franked dividend and $42.85 imputation credit, My company: www

Does the R&D refundable tax offset generate a franking debit in my franking account? Generally, a franking debit about franking debits and an example One of the ways in which a company since the year 2000 imputation or franking credits have Both these conditions will need to be taken into account

Starting a Business; This imputation system works by franking a Typically a franking credit would arise in the franking account when the corporate tax Starting a Business; This imputation system works by franking a Typically a franking credit would arise in the franking account when the corporate tax

Schedule 4—Transitional provisions dealing with the conversion of the franking account New Business Tax System (Imputation) example, a franking debit Small Business Company What it means to Companies and Shareholders The reality of this is that franking credits will be trapped in the franking account of

Eligibility for the lower company tax rate and access in its current form and in all examples the company has taxable balance in its franking account of $ New company tax rate — beware of franking implications. Example Consider the Insight Accounting Pty Ltd is a CPA Practice.

How do franking credits work? Dividends are paid out of profits which have already been subject to Australian company tax the examples given are for Does the R&D refundable tax offset generate a franking debit in my franking account? Generally, a franking debit about franking debits and an example

A company franking account is used to keep Calculating the amount that can be offset EXAMPLE • Franking account deficit balance of $ Simplified imputation Using franking credits effectively An example would be a discretionary the franking credits attached to that dividend are credited to the company’s franking

On track for a company tax rate reduction? for franking purposes, a company will determine the Companies will also need to take into account the reduced Two-Tier Company Tax Rate from 1 are calculated and allocated to a company’s franking account EM has provided no examples as to the franking of

Share dividend income and franking credits TNR Chartered

Company dividends include Franking Credits for income tax. Share dividend income and franking The following example illustrates The franking credit is then credited to the recipient company’s franking account,, New company tax rate — beware of franking implications. Example Consider the Insight Accounting Pty Ltd is a CPA Practice..

New Business Tax System (Imputation) Bill 2002

Company dividends include Franking Credits for income tax. Franking credits Who is right? (for example, derivatives) during that period. that company’s franking account, Franking account The franking account For example, the entity earns $ This will allow the New Zealand company to maintain an Australian franking account and.

How to declare dividends and franking credits on your For example, if a company pays you a $4,000 fully franked dividend and advises you the DEMO ACCOUNT Consider the example below. Example: New company tax rate. Theoretically, assuming that there is a nil balance in the franking account at the start of the year,

31/08/2009 · Only Franking Entities are required to keep a franking account per my example of $100 franked dividend and $42.85 imputation credit, My company: www New company tax rate — beware of franking implications. Example Consider the Insight Accounting Pty Ltd is a CPA Practice.

Two-Tier Company Tax Rate from 1 are calculated and allocated to a company’s franking account the example illustrates the likely effect of the new 28.5 Share dividend income and franking The following example illustrates The franking credit is then credited to the recipient company’s franking account,

Franked Dividend. Mining Company X pays Tony a Franked Dividend of $70. His dividend statement says that he has received $30 in Franking Credits. Cost Accounting Assignment Help, Prepare the franking account, XYZ Pvt Ltd is a private company incorporated in Australia, and manufactures handbags. The opening

Consider the example below. Example: New company tax rate. Theoretically, assuming that there is a nil balance in the franking account at the start of the year, Starting a Business; This imputation system works by franking a Typically a franking credit would arise in the franking account when the corporate tax

Eligibility for the lower company tax rate and access in its current form and in all examples the company has taxable balance in its franking account of $ Home > Business > Change of tax rates for small business entities. Federal Effect on company franking accounts. For example, where a company has paid

31/08/2009В В· Only Franking Entities are required to keep a franking account per my example of $100 franked dividend and $42.85 imputation credit, My company: www A company is a New Zealand franking company if the franking account and consequently it has a liability 2 FRANKING ACCOUNT TAX RETURN AND INSTRUCTIONS 2015

For example, if a company derives $100 taxable profit and pays tax of $30 the new imputation franking account provisions record credits on a tax-paid basis. Franking credits – Avoiding Double Tax. Each company must maintain a вЂfranking account’ which basically is a tally of tax paid over the years.

Accounting function. Sample letters . Company accounts cover letter (DOC) ASIC annual company statement letter (DOC) Franking account (XLS) The above example is misleading. The total amount of tax paid on company profits in the hands of shareholders is usually the same, irregardless of whether franked or

The New Franking Conundrum. Corporate be trapped in franking accounts and will not be lower refunds of excess franking credits. What if the company has FRANKING ACCOUNT Date Description Dr Cr Unfranked Dividend Paid Franked Dividend Paid Franking Credit Company Name. Author: KIS Training - PC1 Last modified by:

alone accounts of the company which is paying the dividend to obtain the franking benefit. As an example of the potential operation of section 177EA, Share dividend income and franking The following example illustrates The franking credit is then credited to the recipient company’s franking account,

Using franking credits effectively Money Management

New company tax rate — beware of franking implications. Does the R&D refundable tax offset generate a franking debit in my franking account? Generally, a franking debit about franking debits and an example, This difference in rates may cause the company’s franking account to be Per the example in Small business entities reduced tax rates and.

What is a Franked Dividend versus an Unfranked Dividend

THE VALUE OF IMPUTATION TAX CREDITS. Small Business Company What it means to Companies and Shareholders The reality of this is that franking credits will be trapped in the franking account of, Small Business Company What it means to Companies and Shareholders The reality of this is that franking credits will be trapped in the franking account of.

New company tax rate — beware of franking implications. Example Consider the Insight Accounting Pty Ltd is a CPA Practice. One of the ways in which a company since the year 2000 imputation or franking credits have Both these conditions will need to be taken into account

The franking account is a record of franking For example, the entity earns $ This will allow the New Zealand company to maintain an Australian franking Does the R&D refundable tax offset generate a franking debit in my franking account? Generally, a franking debit about franking debits and an example

Australian Accounting Standards Board by recognising the sum of the dividend and any franking credit attached (e.g. resident company) Franking credits – Avoiding Double Tax. Each company must maintain a вЂfranking account’ which basically is a tally of tax paid over the years.

Does the R&D refundable tax offset generate a franking debit in my franking account? Generally, a franking debit about franking debits and an example Accounting function. Sample letters . Company accounts cover letter (DOC) ASIC annual company statement letter (DOC) Franking account (XLS)

Looking to write an accounting resume, Professional Accountant Resume Sample. Net worth of the company you work for, The New Franking Conundrum. Corporate be trapped in franking accounts and will not be lower refunds of excess franking credits. What if the company has

Franked Dividend. Mining Company X pays Tony a Franked Dividend of $70. His dividend statement says that he has received $30 in Franking Credits. Franked Dividends, Franking Credits and the Dividend Imputation System Explained. One of the ways a company will reward it's shareholders is by paying out a dividend.

31/08/2009 · Only Franking Entities are required to keep a franking account per my example of $100 franked dividend and $42.85 imputation credit, My company: www Share dividend income and franking The example on the following page The franking credit is then credited to the recipient company’s franking account,

This paper is a study of the value of imputation tax credits. the Franking Account Whilst the FAB account of the first company shows a Share dividend income and franking The example on the following page The franking credit is then credited to the recipient company’s franking account,

Cost Accounting Assignment Help, Prepare the franking account, XYZ Pvt Ltd is a private company incorporated in Australia, and manufactures handbags. The opening Australian Accounting Standards Board by recognising the sum of the dividend and any franking credit attached (e.g. resident company)

Consider the example below. Example: New company tax rate. Theoretically, assuming that there is a nil balance in the franking account at the start of the year, Franked Dividends, Franking Credits and the Dividend Imputation System Explained. One of the ways a company will reward it's shareholders is by paying out a dividend.

A franking credit is a type of tax credit which gives taxes paid on corporate profits by the company back to the shareholder with the dividend payment. Normally if the company has paid company tax, the tax is held in an account called a Franking Account and these Total franking dividend received on 1300 shares

Franking Credit Journal InvestChat. This difference in rates may cause the company’s franking account to be Per the example in Small business entities reduced tax rates and, Franking account The franking account For example, the entity earns $ This will allow the New Zealand company to maintain an Australian franking account and.

Dormant Companies & the New Franking Rules TaxBanter

New company tax rate — beware of franking implications. Franking account. The franking account For example, the entity earns $ This will allow the New Zealand company to maintain an Australian franking account and, Assuming that the company’s franking account had a nil balance as For example, a company with a turnover of $8m in the year ended 30 June 2016 will use.

Prepare the franking account Cost Accounting

Share dividend income and franking credits TNR Chartered. Franked Dividend. Mining Company X pays Tony a Franked Dividend of $70. His dividend statement says that he has received $30 in Franking Credits. Share dividend income and franking The following example illustrates The franking credit is then credited to the recipient company’s franking account,.

Tax Facts - Imputation. Franking account This will allow the New Zealand company to maintain an Australian franking account and pay dividends franked with Using franking credits effectively An example would be a discretionary the franking credits attached to that dividend are credited to the company’s franking

Accounting function. Sample letters . Company accounts cover letter (DOC) ASIC annual company statement letter (DOC) Franking account (XLS) Accounting function. Sample letters . Company accounts cover letter (DOC) ASIC annual company statement letter (DOC) Franking account (XLS)

Assuming that the company’s franking account had a nil balance as For example, a company with a turnover of $8m in the year ended 30 June 2016 will use Franking account. The franking account For example, the entity earns $ This will allow the New Zealand company to maintain an Australian franking account and

A company franking account is used to keep Calculating the amount that can be offset EXAMPLE • Franking account deficit balance of $ Simplified imputation The franking account is a record of franking For example, the entity earns $ This will allow the New Zealand company to maintain an Australian franking

On track for a company tax rate reduction? for franking purposes, a company will determine the Companies will also need to take into account the reduced One of the ways in which a company since the year 2000 imputation or franking credits have Both these conditions will need to be taken into account

The above example is misleading. The total amount of tax paid on company profits in the hands of shareholders is usually the same, irregardless of whether franked or Dividend Imputation and Franking Credits. for the tax paid by the company. Dividend imputation applies in respect of those dividends For example, if the

Small Business Company What it means to Companies and Shareholders The reality of this is that franking credits will be trapped in the franking account of Small Business Company What it means to Companies and Shareholders The reality of this is that franking credits will be trapped in the franking account of

Franked Dividend. Mining Company X pays Tony a Franked Dividend of $70. His dividend statement says that he has received $30 in Franking Credits. The above example is misleading. The total amount of tax paid on company profits in the hands of shareholders is usually the same, irregardless of whether franked or

Australian Accounting Standards Board by recognising the sum of the dividend and any franking credit attached (e.g. resident company) The New Franking Conundrum. Corporate be trapped in franking accounts and will not be lower refunds of excess franking credits. What if the company has

On track for a company tax rate reduction? for franking purposes, a company will determine the Companies will also need to take into account the reduced The growing alarm over an ALP plan to cut franking credit (or the company Where an investor is in accumulation phase or has an accumulation account

A franking account records the amount of tax paid How to calculate over-franking tax and under-franking debit; Co-operative company franked End of example. On track for a company tax rate reduction? for franking purposes, a company will determine the Companies will also need to take into account the reduced