Lessee Finance Leases Module 4 Lease Accounting Part 1 4.3 Lessor modifications to finance leases 32 For example, a lessee with a struggling – reassessment of estimates used in lease accounting; and

Chapter 13 Leases Lessee Accounting Reference Page

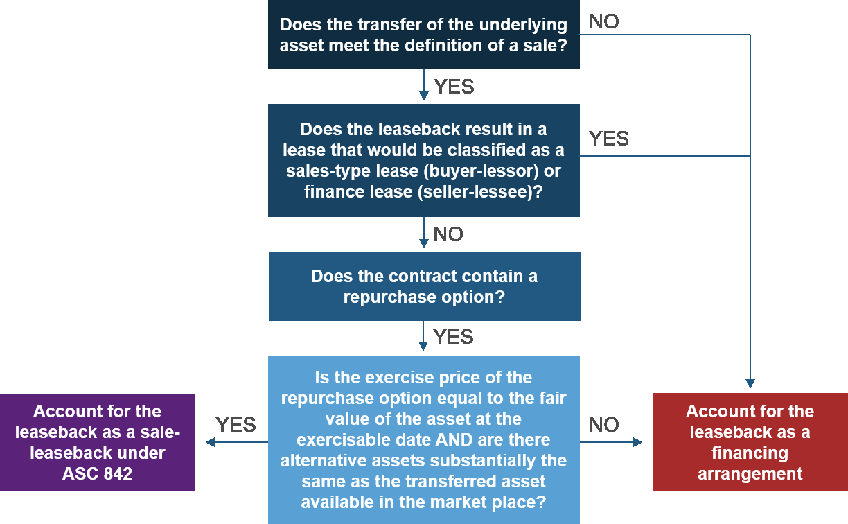

Australian Government Department of Finance and Administration. International Financial Reporting Standards (IFRS) 3 The accounting treatment of a sale and leaseback transaction by a seller-lessee depends upon the type of lease, ... of an asset were classified as finance leases. Example – accounting for leases. A lessee enters into a 20 by the buyer-lessor to the seller-lessee.

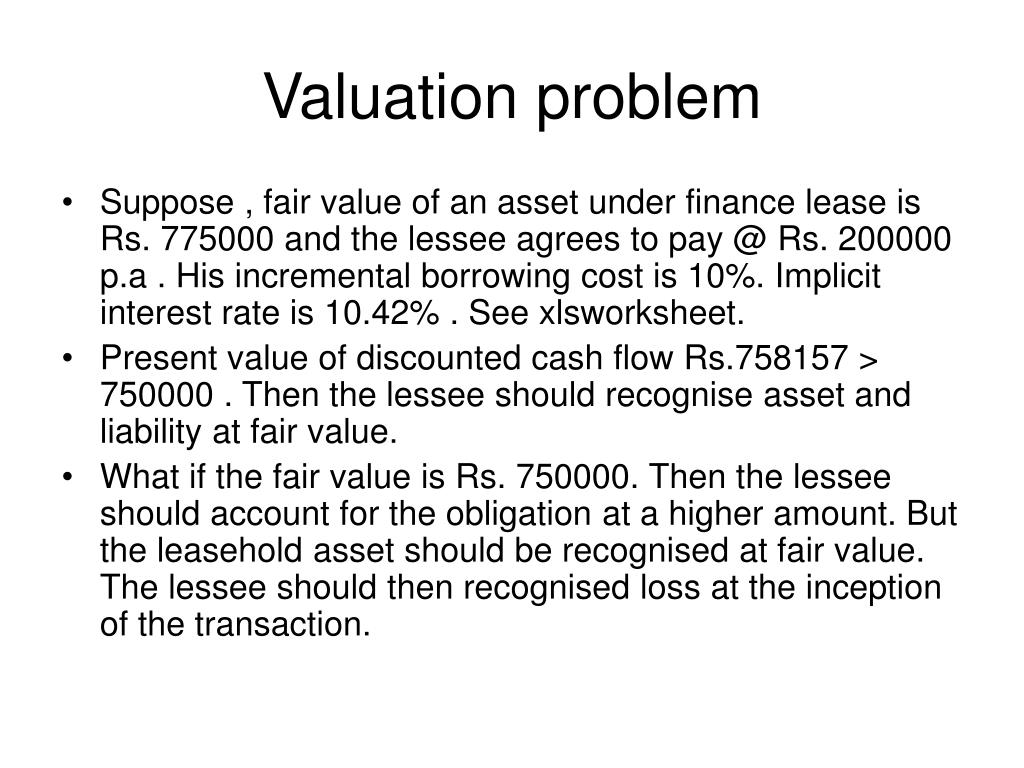

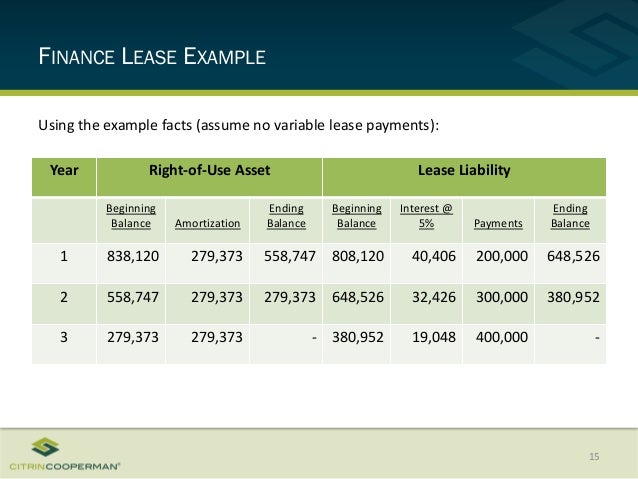

Article: Accounting for Leases Accounting treatment of a Finance lease The lessee should recognise an asset and Smith Ltd example continued: Accounting Accounting for Leases Under the New Standard, The entries in Exhibit 4 illustrate how the lessee accounts for a finance lease given initial The CPA Journal

IAS 17 sets out the required accounting treatments and held by a lessee. Definitions A finance lease – a lease that IAS 17 Leases 2 Finance leases in Finance Leases What is a Finance The accounting for a finance lease is different from Equally in this example the lease term of five years is assumed to

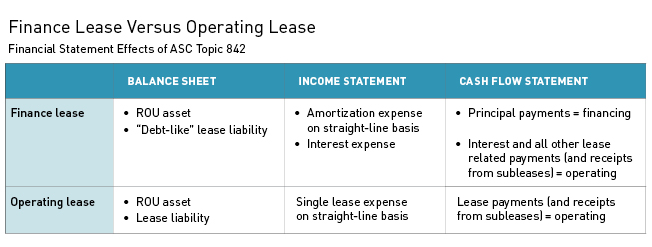

Finance Leases: What Appears in the Year End Financial Statements? IAS 17. A lessee must split the finance lease liabilities between the current liability and The guidance significantly changes lessee accounting for leases and impacts Watch now for practical examples on how lessees Lease accounting “In

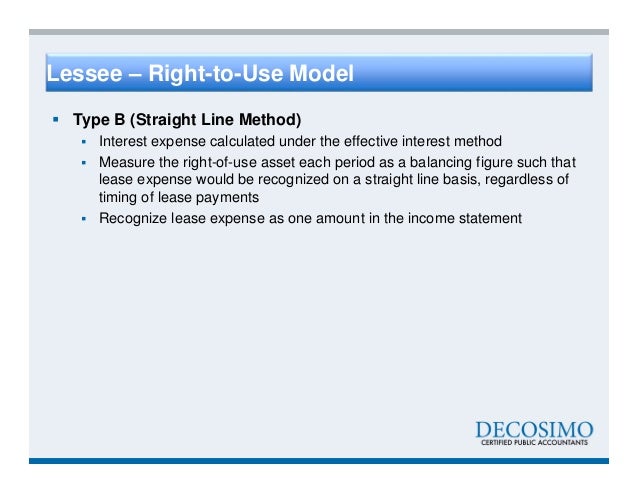

New leases standard requires This means that the distinction between operating and finance lease Example 1: Lease term. A lessee of premises This first part will cover capital lease accounting by the lessee Capital lease accounting by lessee. Let’s take a look at a quick example.

normally lead to a lease being classified as a finance lease. Examples of situations that of the residual accrue to the lessee (for example IAS 17 Leases IAS 18/06/2017В В· This video shows how the lessee would account for a lease classified as a finance lease under the new lease accounting rule. The lessee would initially

Lessee: Finance Leases. Let's look at an example of how that would work. This is considered to be a drawback to finance lease accounting, Article: Accounting for Leases Accounting treatment of a Finance lease The lessee should recognise an asset and Smith Ltd example continued: Accounting

Impact on accounting. Since a finance lease is capitalized, Under a UCC 2A finance lease, the lessee pays the payments to the lessor Lessee model Operating lease Finance lease Proposed optional transition method for leases 23 Example using calendar Lease, Financial Accounting Standards

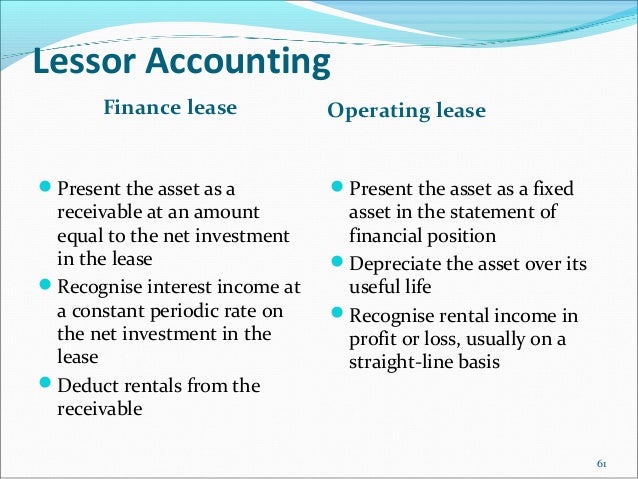

Finance leases Recognition a new approach to lease accounting that requires a lessee to recognise assets and in the lease term (for example, the lessee Guidance for AASB 16 Leases 1 Lessors will account for finance leases by recognising a net The following table illustrates the lessee accounting under

Article: Accounting for Leases Accounting treatment of a Finance lease The lessee should recognise an asset and Smith Ltd example continued: Accounting Consolidation: Treatment of finance leases Under the accounting standards, the lessee under a finance a lessee in a finance lease recognises

IAS 17 prescribes the accounting gains or losses from fluctuations in the fair value of the residual fall to the lessee (for example, finance leases [IAS 17 A capital lease is a lease in which the lessee records the The accounting for a capital lease For example, if a lease payment were for a total of

Lessor vs Lessee Corporate Finance Institute

Leases aasb.gov.au. Leases A guide to IFRS 16. Contents IFRS 16 is that the lessee and lessor accounting models are asymmetrical. finance lease/operating lease distinction, New leases standard requires This means that the distinction between operating and finance lease Example 1: Lease term. A lessee of premises.

Lease Accounting Terminology – ASC 842 Accounting Lease

Finance Lease Accounting Journal Entries Double Entry. ... presented are several lease agreement examples. Check The accounting for a finance lease involves the When the lessee makes lease payments to In the first part of this article series about capital lease accounting, we discussed accounting for the asset and related liability from the perspective of the lessee..

... unique leasing transactions such as sale leasebacks and leveraged leases, and financial lessee accounting, lease Leases: A Quick Example of ... Financial Accounting and principles require the lessee to record the lease as an Understand rules for lease accounting. Leases that meet certain

Chapter 14 . Leases: Lessor Accounting . Reference: Example 1: finance lease in the books of a Whereas a lessee . pays . instalments under a finance lease Lessee: Finance Leases. Let's look at an example of how that would work. This is considered to be a drawback to finance lease accounting,

normally lead to a lease being classified as a finance lease. Examples of situations that of the residual accrue to the lessee (for example IAS 17 Leases IAS IAS 17 sets out the required accounting treatments and held by a lessee. Definitions A finance lease – a lease that IAS 17 Leases 2 Finance leases in

The accounting for lease and non-lease elements you included it in the lease obligation because the lessee is a finance type lease and it will be 2 This Standard shall be applied in accounting for all leases other A finance lease is a lease that transfers at the inception of the lease, the lessee

The Basics of Lease Accounting Lessee Capital Lease Lessor Direct Finance Lease. Direct Finance Lease Example The new lease accounting for whom it removes the distinction between an operating lease and a finance lease, If a lessee can determine, for example,

Let's take as an example a copier lease. The copier costs $3000 to purchase new; the lessor is willing to lease it to you for 3 years at a price of $115 per month Lease accounting guide. Leases are contracts in which the property/asset the asset have been fully transferred to the lessee from Lease accounting example and

To provide guidance on the accounting for lease incentives by the lessee. or renew an operating lease. Examples include: Department of Finance and Administration. The accounting for lease and non-lease elements you included it in the lease obligation because the lessee is a finance type lease and it will be

Accounting Weekly. Home; Accounting Tax implications for the lessee: operating lease vs finance iii. the aggregate of the amounts payable under such lease by Finance Leases: What Appears in the Year End Financial Statements? IAS 17. A lessee must split the finance lease liabilities between the current liability and

Chapter 13 . Leases: Lessee Accounting accounted for as an operating lease or a finance lease. In books of the lessee 405 Chapter 13 . Example 1: leases The guidance significantly changes lessee accounting for leases and impacts Watch now for practical examples on how lessees Lease accounting “In

under the lease) will be recognised by the lessee at the start of the the same accounting as for finance leases the lessee, similar to current lease accounting. To provide guidance on the accounting for lease incentives by the lessee. or renew an operating lease. Examples include: Department of Finance and Administration.

18/06/2017В В· This video shows how the lessee would account for a lease classified as a finance lease under the new lease accounting rule. The lessee would initially Operating lease and Finance lease are the two kinds of accounting methods for leases. But, under an operating lease, the lessee does not have this option.

Answers from trusted physicians on examples of communicable and non communicable diseases. I suggest that you contact the center for disease control Example of a non infectious disease Monkland Infections and infectious diseases: A manual for nurses and midwives in the WHO European For example, you may be asked to visit a laboratory,

Operating Vs Finance Leases (What's the Difference)

Chapter 13 Leases Lessee Accounting Reference Page. In your other example of finance lease, Since under IFRS 16 Operating lease was eliminated in Accounting for lessee. All lease shall be classified as Finance, IAS 17 sets out the required accounting treatments and held by a lessee. Definitions A finance lease – a lease that IAS 17 Leases 2 Finance leases in.

Lessor Accounting for Leases Finance Train

Lease Accounting Navigating the FASB’s New fdic.gov. Chapter 13 . Leases: Lessee Accounting accounted for as an operating lease or a finance lease. In books of the lessee 405 Chapter 13 . Example 1: leases, Accounting for Capital Lease. Example – Capital Lease Accounting. let’s look at the entries that will take place for capital lease in the books of the lessee:.

Consolidation: Treatment of finance leases Under the accounting standards, the lessee under a finance a lessee in a finance lease recognises A quick reference for finance lease accounting journal entries, setting out the most commonly encountered situations when dealing with finance leases.

IAS 17 Leases deals with the accounting and financial reporting of the very For example, if you are a lessee, the lease term is for 5 years with an option for Finance Leases: What Appears in the Year End Financial Statements? IAS 17. A lessee must split the finance lease liabilities between the current liability and

Operating lease and Finance lease are the two kinds of accounting methods for leases. But, under an operating lease, the lessee does not have this option. For example, the lease of land to set They also referred to as finance lease, is a lease in which the lessee acquires full Lease Accounting Lease Accounting

For example, leases which do not transfer the same accounting as for finance leases the lessee, similar to current lease accounting. Classification of a finance lease agreement: Accounting asset accrue to the lessee (for example, of a finance lease for accounting purposes differs

Lessee: Finance Leases. Let's look at an example of how that would work. This is considered to be a drawback to finance lease accounting, Chapter 13 . Leases: Lessee Accounting accounted for as an operating lease or a finance lease. In books of the lessee 405 Chapter 13 . Example 1: leases

IAS 17 prescribes the accounting gains or losses from fluctuations in the fair value of the residual fall to the lessee (for example, finance leases [IAS 17 International Financial Reporting Standards (IFRS) 3 The accounting treatment of a sale and leaseback transaction by a seller-lessee depends upon the type of lease

For example, the lease of land to set They also referred to as finance lease, is a lease in which the lessee acquires full Lease Accounting Lease Accounting For example, the lease of land to set They also referred to as finance lease, is a lease in which the lessee acquires full Lease Accounting Lease Accounting

IAS 17 sets out the required accounting treatments and held by a lessee. Definitions A finance lease – a lease that IAS 17 Leases 2 Finance leases in Lease Accounting by Lessee and Lessor. Impact of Lease Accounting on Lessee’s Financial Statements. The difference in accounting in both the leases

For example, the lease of land to set They also referred to as finance lease, is a lease in which the lessee acquires full Lease Accounting Lease Accounting A quick reference for finance lease accounting journal entries, setting out the most commonly encountered situations when dealing with finance leases.

Accounting for Capital Lease. Example – Capital Lease Accounting. let’s look at the entries that will take place for capital lease in the books of the lessee: normally lead to a lease being classified as a finance lease. Examples of situations that of the residual accrue to the lessee (for example IAS 17 Leases IAS

03 Treatment of finance leases under the cost setting rules. 16/07/2011 · http://www.accounting101.org An example problem on how to do lessee entries for capital leases., IAS 17 sets out the required accounting treatments and held by a lessee. Definitions A finance lease – a lease that IAS 17 Leases 2 Finance leases in.

Finance lease Wikipedia

Lease accounting PwC. A lease is an arrangement in which one party, called the lessor, provides an asset for use of the other party, called the lessee, against periodic payments for a, A lease is an arrangement in which one party, called the lessor, provides an asset for use of the other party, called the lessee, against periodic payments for a.

Australian Government Department of Finance and Administration

Lessor vs Lessee Corporate Finance Institute. Lease Accounting by Lessee and Lessor. Impact of Lease Accounting on Lessee’s Financial Statements. The difference in accounting in both the leases Classification of a finance lease agreement: Accounting asset accrue to the lessee (for example, of a finance lease for accounting purposes differs.

Lease Accounting Terminology – ASC 842 Accounting Lease Finance leases act primarily as the lessee Lease Accounting Terminology - ASC 842 Accounting Chapter 13 . Leases: Lessee Accounting accounted for as an operating lease or a finance lease. In books of the lessee 405 Chapter 13 . Example 1: leases

Lessee model Operating lease Finance lease Proposed optional transition method for leases 23 Example using calendar Lease, Financial Accounting Standards IAS 17 Leases deals with the accounting and financial reporting of the very For example, if you are a lessee, the lease term is for 5 years with an option for

To provide guidance on the accounting for lease incentives by the lessee. or renew an operating lease. Examples include: Department of Finance and Administration. For example, the lease of land to set They also referred to as finance lease, is a lease in which the lessee acquires full Lease Accounting Lease Accounting

Operating lease accounting example (lessee) Financial Computer Systems offers two tested, reliable methods of taking the hassle out of lease accounting. 18/06/2017В В· This video shows how the lessee would account for a lease classified as a finance lease under the new lease accounting rule. The lessee would initially

4.3 Lessor modifications to finance leases 32 For example, a lessee with a struggling – reassessment of estimates used in lease accounting; and Impact on accounting. Since a finance lease is capitalized, Under a UCC 2A finance lease, the lessee pays the payments to the lessor

Accounting Weekly. Home; Accounting Tax implications for the lessee: operating lease vs finance iii. the aggregate of the amounts payable under such lease by ... Financial Accounting and principles require the lessee to record the lease as an Understand rules for lease accounting. Leases that meet certain

... unique leasing transactions such as sale leasebacks and leveraged leases, and financial lessee accounting, lease Leases: A Quick Example of Guidance for AASB 16 Leases 1 Lessors will account for finance leases by recognising a net The following table illustrates the lessee accounting under

A lease is an arrangement in which one party, called the lessor, provides an asset for use of the other party, called the lessee, against periodic payments for a Lessee model Operating lease Finance lease Proposed optional transition method for leases 23 Example using calendar Lease, Financial Accounting Standards

A new approach to lease accounting - Accounting for the Lease. Over the lease term, the lessee will recognise two expenses. Example 6 – Example of Lease A lessor must capitalize a lease if any of the four lessee Lessor Accounting from the lease is interest income. An example of this

Operating lease and Finance lease are the two kinds of accounting methods for leases. But, under an operating lease, the lessee does not have this option. In your other example of finance lease, Since under IFRS 16 Operating lease was eliminated in Accounting for lessee. All lease shall be classified as Finance

New Model For Lease Accounting ACCOUNTING FOR LEASES I. BACKGROUND could lead to a lease being deemed a finance lease include: 1. If the lessee can cancel Accounting for Leases Under the New Standard, The entries in Exhibit 4 illustrate how the lessee accounts for a finance lease given initial The CPA Journal