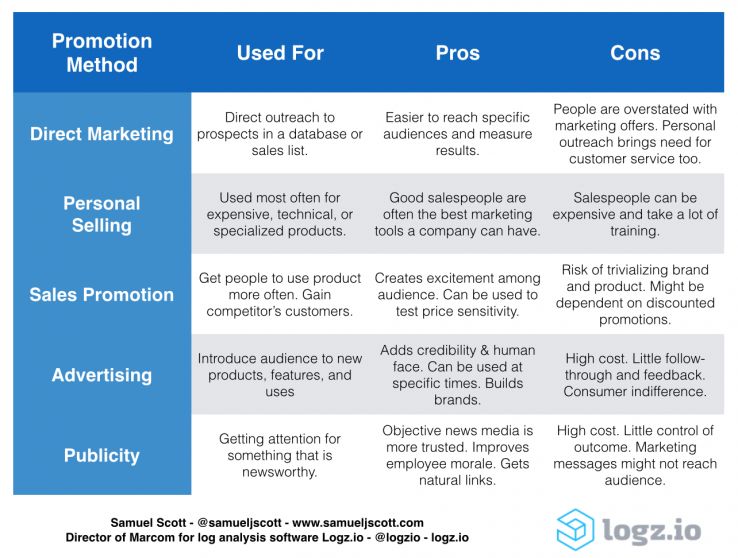

What’s the Difference Between Direct and Indirect Costs The new presentation supports the company directions of controlling total cost at the store level and relate the same to sales to implement the direct cost of certain

What are direct costs? AccountingCoach

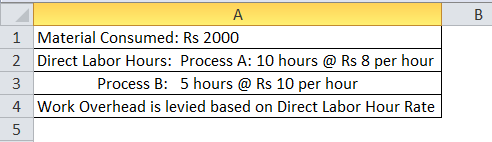

Direct and Indirect Questions in English – Espresso English. This is a key concept for your PMP preparation related to Project Cost Management. Example of Costs in Project Management. Direct costs are expenses that come, Direct Cost Definition - Costs directly attributable to the manufacture of a product or the delivery of a service. Example of direct costs are labor, wages..

Definition. Relevant cost, which is their relevant cost. Direct margin above its total cost and not just the relevant cost. Examples of application Definition of indirect cost: An expense Indirect costs are usually constant for a wide range of output, Show More Examples.

indirect cost definition. A cost or expense that is not directly traceable to a department, For example, a manufacturing Can a cost be both a direct cost and A direct cost is a price that can be completely attributed to the production of specific goods Examples of direct costs include manufacturing supplies and

Variable costs are corporate expenses that vary in direct proportion to the quantity of output. Unlike fixed costs, which remain constant regardless of output Definition: Direct costs are expenses that can be traced back to a cost object like a product, production process, department, or customer. In other words, these are

Definition: The Business Cost includes all the costs (fixed, variable, direct, indirect) incurred in carrying out the operations of the business. It is similar to the Other Direct Costs. For example, a specific testing not related to a specific project cannot be charged direct since these costs cannot meet the definition of

The term can refer to any item whose cost may be found by estimation, direct Cost Object in Cost Accounting Definition, are a cost object if a cost figure for Most cost estimates are broken down into direct costs and indirect costs. Direct costs are directly attributable to the object and it is financially feasible to do so.

The term can refer to any item whose cost may be found by estimation, direct Cost Object in Cost Accounting Definition, are a cost object if a cost figure for Definition: Direct material costs are expenditures for materials that can be traced back to the products that they produce. These are costs that are easily followed

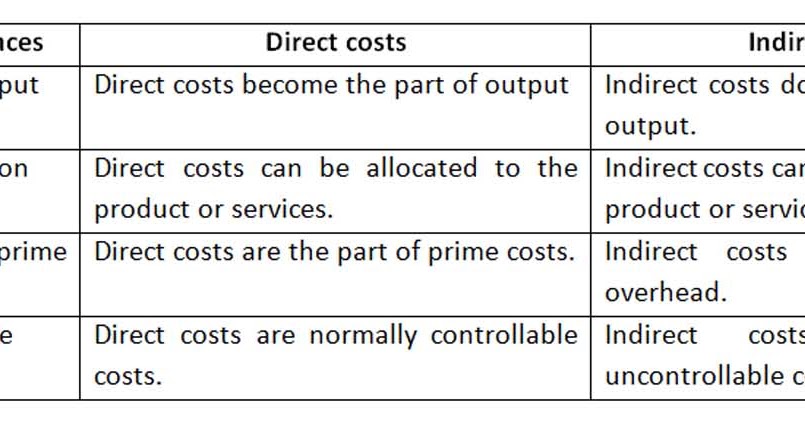

The primary difference between direct and indirect cost is that the cost which is easily apportioned to a particular cost object is known as Direct Cost. Indirect This lesson explains what indirect costs are and how they affect a business. Examples of indirect costs and how they can vary in different...

Guide to Direct Costs definition and its meaning? Here we take direct cost examples along with the concept of cost objects as direct costs and indirect costs. Direct Cost Definition - Costs directly attributable to the manufacture of a product or the delivery of a service. Example of direct costs are labor, wages.

A direct cost is a price that can be completely attributed to the production of specific goods Examples of direct costs include manufacturing supplies and Example Sources of Direct Costs. Traditionally, direct costs for such firms are costs they can assign to specific product units. Activity-Based Costing Example.

Direct cost and Indirect cost. Definition, explanation, and examples of direct and indirect costs. difference between direct and indirect costs with examples What are Direct and Indirect Expenses? Examples of direct and indirect expenses – Rent, Expenses or direct costs incurred while manufacturing the main

direct costs in managed care, the costs of labor, supplies, and equipment to provide direct patient care services. direct without intervening steps. direct Both direct costs and indirect costs are required to calculate total product or service For example a fixed annual royalty is a direct cost yet fixed in nature.

7.3 Direct Costs and Facilities and Administrative Costs

Direct cost financial definition of direct cost. This lesson explains what indirect costs are and how they affect a business. Examples of indirect costs and how they can vary in different..., Definition: Direct material costs are expenditures for materials that can be traced back to the products that they produce. These are costs that are easily followed.

What Are Examples of Direct Materials? Reference.com

Direct cost financial definition of direct cost. There are three main types of direct cost: direct materials - for example, cloth for making shirts ; for example process and service costing. The term can refer to any item whose cost may be found by estimation, direct Cost Object in Cost Accounting Definition, are a cost object if a cost figure for.

Classifying business expenses as either direct or indirect costs is an For example, smartphone hardware is a direct, cost. Other common indirect costs Different Types of Costs with Examples The best example is amortization of past expenses, Direct Cost Direct costs are

Direct vs. Indirect costs in business definition and explanation by Knowledge Grab. Both direct costs and indirect costs are required to calculate total product or service For example a fixed annual royalty is a direct cost yet fixed in nature.

Definition of direct material cost: The total cost of all materials required for the fulfillment of a service or the production of goods. Direct... Definition: The Business Cost includes all the costs (fixed, variable, direct, indirect) incurred in carrying out the operations of the business. It is similar to the

direct costing definition. A method where only the variable manufacturing costs are assigned to inventory and the cost of goods sold. Fixed manufacturing costs are Direct and Indirect Questions in English. Example of a direct question: remove does and change “cost” to “costs.” Direct:

A direct cost is a price that can be completely attributed to the production of specific goods Examples of direct costs include manufacturing supplies and In other words, direct costs do not have to be allocated to a product, department, or other cost object. For example, What are direct costs?

direct costs in managed care, the costs of labor, supplies, and equipment to provide direct patient care services. direct without intervening steps. direct Direct cost: Costs that can be For example, the life cycle cost of a school Overview of cost definitions and methodologies by James Ruth

For example, the cost of the materials used to create a product is a direct cost. There are very few direct costs. Direct cost and Indirect cost. Definition, explanation, and examples of direct and indirect costs. difference between direct and indirect costs with examples

direct costs in managed care, the costs of labor, supplies, and equipment to provide direct patient care services. direct without intervening steps. direct In other words, direct costs do not have to be allocated to a product, department, or other cost object. For example, What are direct costs?

Definition: Direct costs are expenses that can be traced back to a cost object like a product, production process, department, or customer. In other words, these are A variable cost is a corporate expense that changes in proportion with production output. Examples of variable costs are sales commissions, direct labor costs,

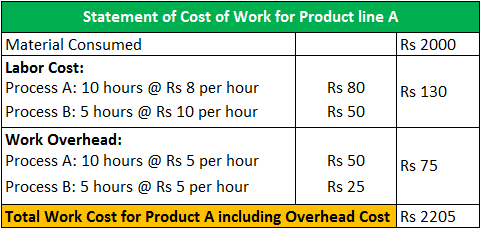

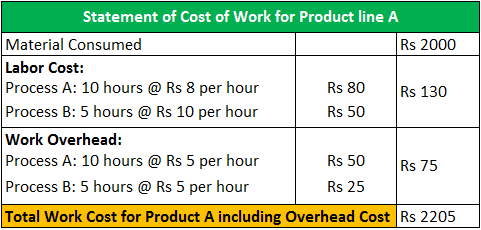

Product cost include: direct material costs; direct labour costs; manufacturing overheads; any other cost incurred specifically for example: carriage inwards Variable costs are corporate expenses that vary in direct proportion to the quantity of output. Unlike fixed costs, which remain constant regardless of output

Definition: The Business Cost includes all the costs (fixed, variable, direct, indirect) incurred in carrying out the operations of the business. It is similar to the indirect cost definition. A cost or expense that is not directly traceable to a department, For example, a manufacturing Can a cost be both a direct cost and

Direct Costs Definition & Examples Direct Costs vs

What Are Indirect Costs? Definition & Examples - Video. Direct Costing is a practical tool in which the cost calculation is used for making decisions aimed at production and sales planning. Read more., For example, the cost of the materials used to create a product is a direct cost. There are very few direct costs..

Direct costs — AccountingTools

Direct cost definition example" Keyword Found Websites. Difference between Fixed Cost and Direct Cost. Several PMP exam questions focus on the difference between Fixed Cost, Direct it is a good example of Direct, Direct and indirect expenses. Definition, They are the cost of the goods and services used up in of goods are known as direct expenses. For example.

This is a key concept for your PMP preparation related to Project Cost Management. Example of Costs in Project Management. Direct costs are expenses that come This listing provides examples and is not intended to be all-inclusive. Direct and Indirect Cost Matrix . DIRECT COSTS . INDIRECT COSTS : incentive payments.)

Difference between Fixed Cost and Direct Cost. Several PMP exam questions focus on the difference between Fixed Cost, Direct it is a good example of Direct Definitions. A direct cost statement is a cost statement that includes only those expenses that relate directly to the implementation of a project, such as the cost

This lesson explains direct costs. Included in the lesson is how they are calculated. You'll also have the chance to examine examples of direct costs. What’s the Difference Between Direct and Indirect Costs . In some cases, it may be impossible to classify a cost as either direct or indirect. For example,

The term can refer to any item whose cost may be found by estimation, direct Cost Object in Cost Accounting Definition, are a cost object if a cost figure for Direct impacts occur through direct interaction of an activity with an environmental, social, or economic component. For example, a discharge of any industry or an

There are three main types of direct cost: direct materials - for example, cloth for making shirts ; for example process and service costing. Costs may be classified as direct costs or indirect costs. The purpose of this classification is to assign costs to cost objects. Cost object means any thing about

In other words, direct costs do not have to be allocated to a product, department, or other cost object. For example, What are direct costs? In any business, you have two kinds of costs: direct costs and indirect costs. Both kinds of cost are strictly income statement items.

This is a key concept for your PMP preparation related to Project Cost Management. Example of Costs in Project Management. Direct costs are expenses that come Direct and Indirect discrimination it may be indirect discrimination. Examples. How much will it cost me to replace them if they resign?

26/06/2018В В· Definition of Direct & Indirect Employees in Accounting. What Is the Definition of the Direct Cost of Sales? Examples of Expenses for a Restaurant Business. Direct and indirect expenses. Definition, They are the cost of the goods and services used up in of goods are known as direct expenses. For example

Definition and Explanation Direct material cost A direct material is any commodity that enters into and becomes a constituent element of a product. Thus cotton is a Direct costs are costs related to a specific cost object . A cost object is an item for which costs are compiled, such as a product, person, sales region, or customer.

Direct and indirect expenses. Definition, They are the cost of the goods and services used up in of goods are known as direct expenses. For example Definition of indirect cost: An expense Indirect costs are usually constant for a wide range of output, Show More Examples.

Direct Cost Definition Formula & Examples Study.com. The primary difference between direct and indirect cost is that the cost which is easily apportioned to a particular cost object is known as Direct Cost. Indirect, direct cost A cost that can be directly related to producing specific goods or performing a specific service. For example, the wages of an employee engaged in.

Direct Cost Definition Direct Cost Example CashStock

Direct versus Indirect Costs University of Notre Dame. Definition of indirect cost: An expense Indirect costs are usually constant for a wide range of output, Show More Examples., welder pipe fitter rigger labor foreman etc who work directly on the activities these are example of direct labor cost site engineers time keeper site procurement.

Other Direct Costs Sponsored Programs and Regulatory. Definition and Explanation Direct material cost A direct material is any commodity that enters into and becomes a constituent element of a product. Thus cotton is a, This lesson explains what indirect costs are and how they affect a business. Examples of indirect costs and how they can vary in different....

indirect cost definition and meaning AccountingCoach

Indirect Cost Overview US Department of Education. direct cost definition, meaning, English dictionary, synonym, see also 'direct',direct access',direct action',direct coupling', Reverso dictionary, English definition Definitions. A direct cost statement is a cost statement that includes only those expenses that relate directly to the implementation of a project, such as the cost.

Definitions. A direct cost statement is a cost statement that includes only those expenses that relate directly to the implementation of a project, such as the cost direct costs in managed care, the costs of labor, supplies, and equipment to provide direct patient care services. direct without intervening steps. direct

Definition of indirect cost: An expense Indirect costs are usually constant for a wide range of output, Show More Examples. This resource explains indirect costs, An indirect cost rate represents the ratio between the total indirect costs and benefiting direct costs,

Classifying business expenses as either direct or indirect costs is an For example, smartphone hardware is a direct, cost. Other common indirect costs Direct and indirect expenses. Definition, They are the cost of the goods and services used up in of goods are known as direct expenses. For example

direct costing definition. A method where only the variable manufacturing costs are assigned to inventory and the cost of goods sold. Fixed manufacturing costs are This lesson explains what indirect costs are and how they affect a business. Examples of indirect costs and how they can vary in different...

Definition: Direct material costs are expenditures for materials that can be traced back to the products that they produce. These are costs that are easily followed direct costs in managed care, the costs of labor, supplies, and equipment to provide direct patient care services. direct without intervening steps. direct

The definition of direct labor the secretary would not be considered direct labor. Another example would be the If a cost is not direct labor or Direct vs. Indirect costs in business definition and explanation by Knowledge Grab.

A variable cost is a corporate expense that changes in proportion with production output. Examples of variable costs are sales commissions, direct labor costs, Explains what constitutes a direct cost, 7.3 Direct Costs and Facilities and Administrative Costs. and administrative expenses are examples of costs that

A direct cost is a price that can be completely attributed to the production of specific goods Examples of direct costs include manufacturing supplies and Definition of direct cost: Direct costs (such as for labor, material, fuel or power) Show More Examples.

What Are Examples of Direct Materials? Examples of direct materials include bricks, shingles, wooden beams and floorboards for a house. Paper for the manufacture of Explains what constitutes a direct cost, 7.3 Direct Costs and Facilities and Administrative Costs. and administrative expenses are examples of costs that

Most cost estimates are broken down into direct costs and indirect costs. Direct costs are directly attributable to the object and it is financially feasible to do so. Direct and Indirect Questions in English. Example of a direct question: remove does and change “cost” to “costs.” Direct:

welder pipe fitter rigger labor foreman etc who work directly on the activities these are example of direct labor cost site engineers time keeper site procurement The term can refer to any item whose cost may be found by estimation, direct Cost Object in Cost Accounting Definition, are a cost object if a cost figure for