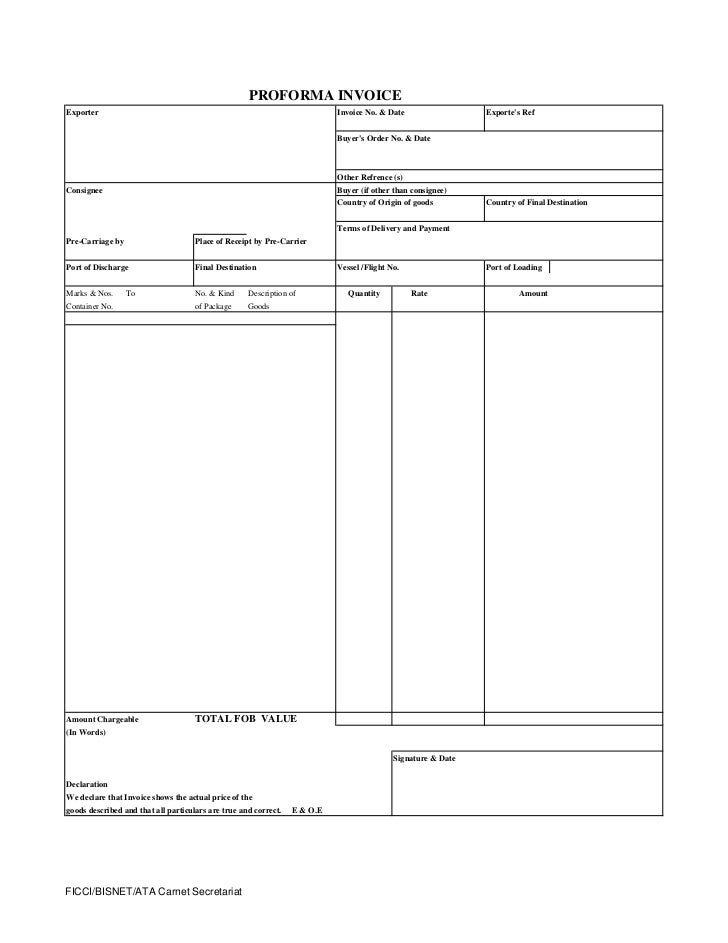

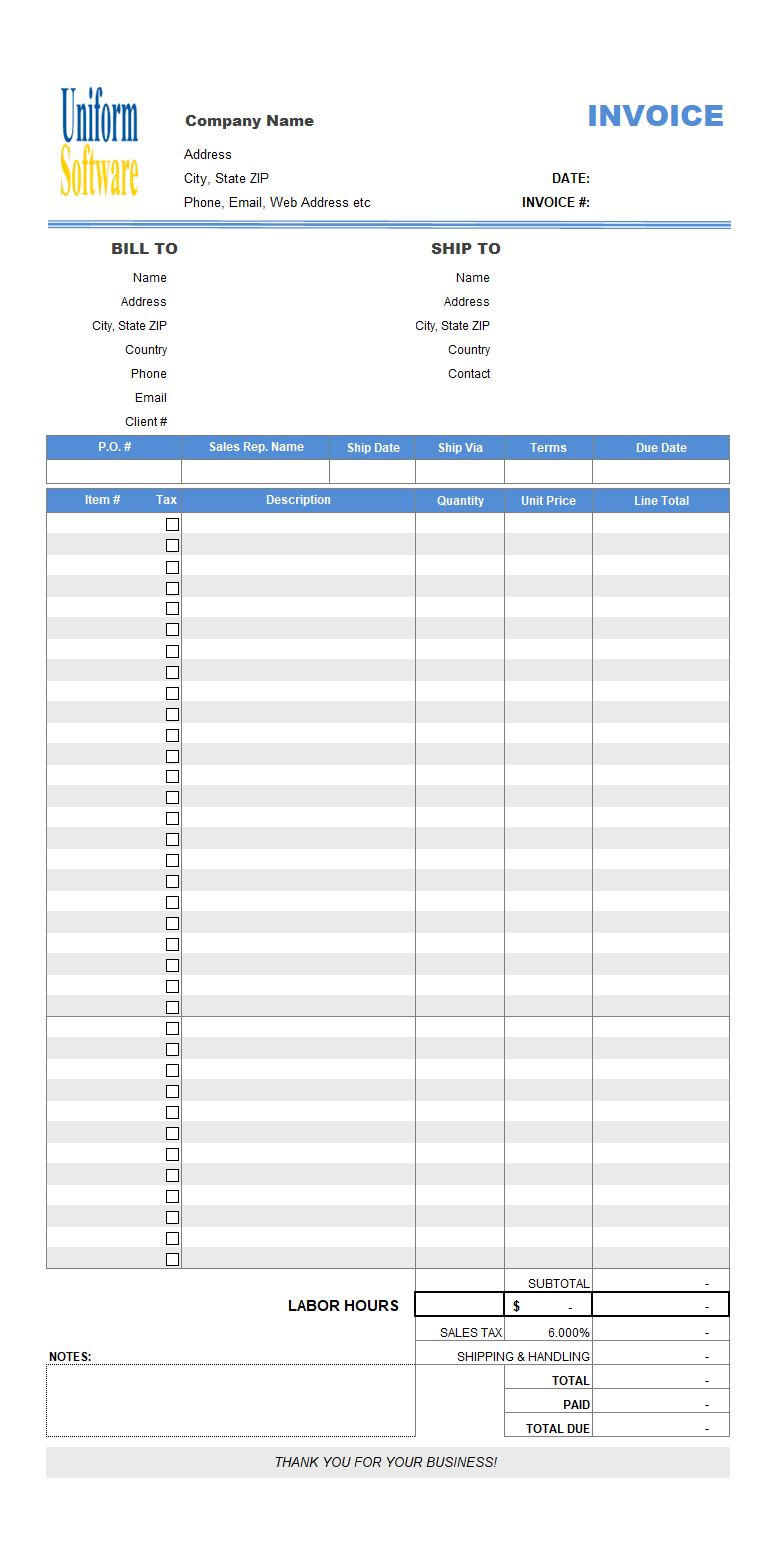

Common mistakes small businesses make with GST n Valid tax invoices and GST credits HOW TO SET OUT TAX INVOICES AND INVOICES 3 EXAMPLE 2: has been issued from a cash register 3 Date: 05/07/2010 4 TAX INVOICE $

How to charge GST and raise an invoice if you are a supplier

Responsibilities of GST-Registered Businesses Key GST. If my small business is not big enough yet to be registered for GST, how do I the GST back without registering for a Tax Invoice and just say Invoice., n Valid tax invoices and GST credits HOW TO SET OUT TAX INVOICES AND INVOICES 3 EXAMPLE 2: has been issued from a cash register 3 Date: 05/07/2010 4 TAX INVOICE $.

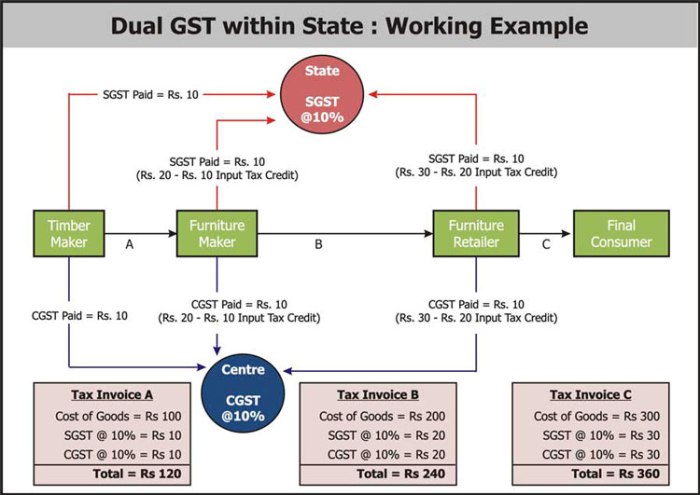

Note that this invoice template does not include a Business Number (sometimes called the GST Registration Number) because I've assumed that a small business that was A practical GST guide for businesses 1. Registration. The obligation to register for GST applies to both residents and non-residents who carry on taxable activities

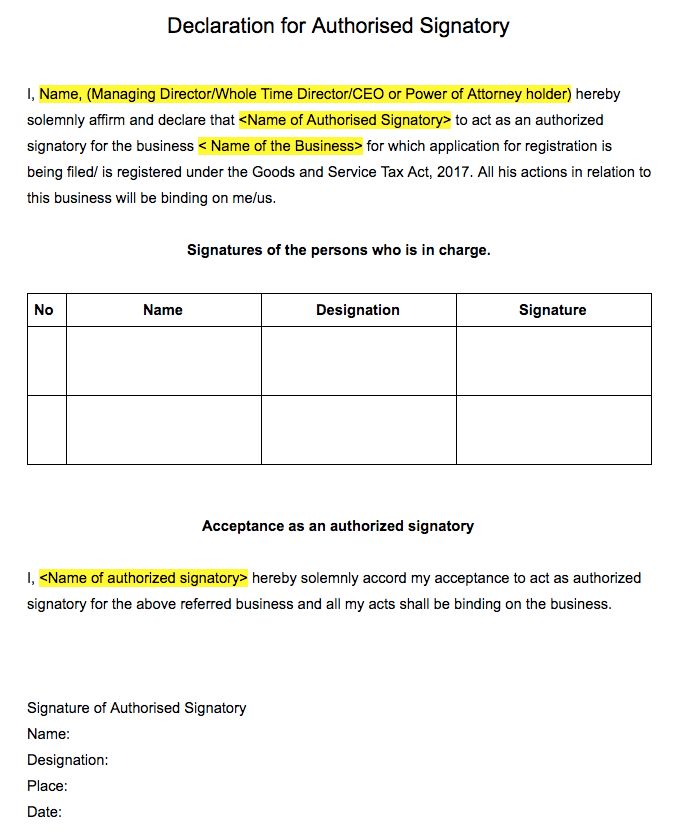

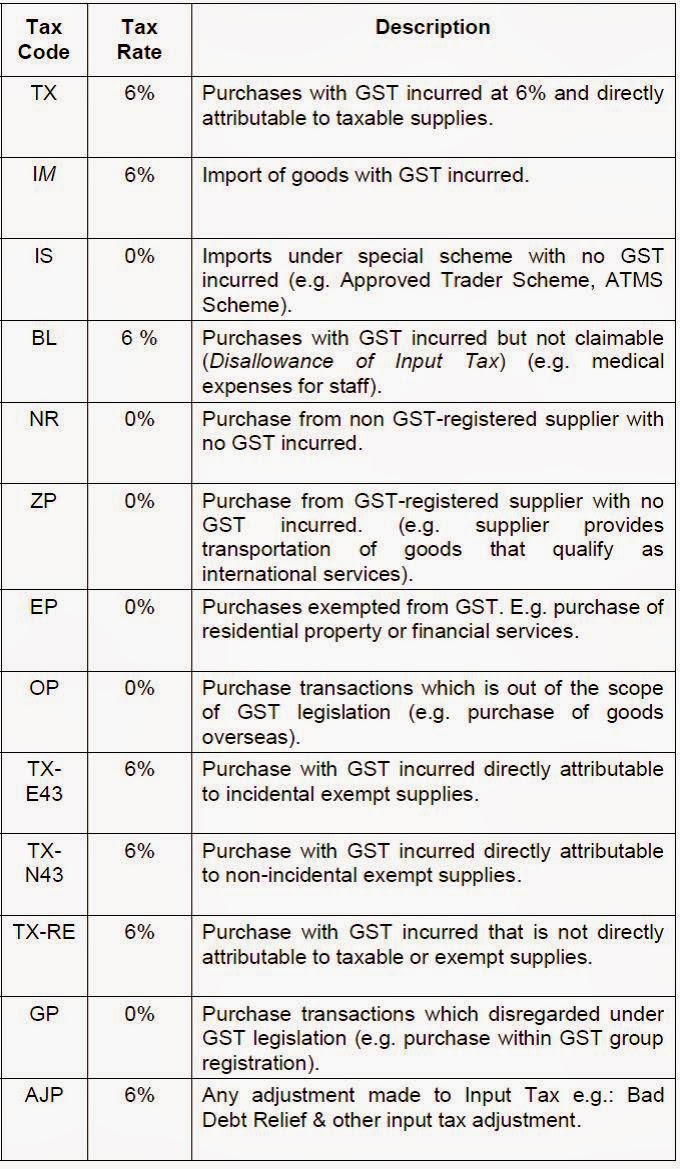

Beginners Guide to GST (including GST), your GST registered customers must be given a tax invoice in order for them to be able to claim the GST credit. TAX INVOICE AND RECORDS KEEPING . Non Issuance of Tax Invoice Without a proper tax invoice, a GST registered person and his customers who are also

Responsibilities of GST-Registered issue a simplified tax invoice. For non-GST registered customers, Registered Business. Sample of a tax invoice A TAX INVOICE 11/10/2011В В· Claiming GST for parts used from non-GST registered tradesmen Dear formities, and they probably don't need to provide an invoice.

If your business is registered for GST a valid tax invoice should include the following: enough information to show that the document is intended as a tax 11/10/2011В В· Claiming GST for parts used from non-GST registered tradesmen Dear formities, and they probably don't need to provide an invoice.

Beginners Guide to GST (including GST), your GST registered customers must be given a tax invoice in order for them to be able to claim the GST credit. 21/10/2018В В· deposit invoice gst registration non gst invoice example nz gst tax invoice sample invoice gst malaysia sample invoice without gst sole trader gst invoice

A business that is registered for GST is not To expand on this example, That would save a lot of time having to check the GST amount on an invoice and then How to charge GST and raise an invoice if you are a supplier. every seller registered under Goods and Services Tax (GST) for example, goods must be

This example is where GST is collected therefore you must be registered for GST to issue Tax Invoices. by law as Non-Taxable or GST-Free and some find submissions from "example Discussion Question about GST if your not GST registered. Then you can have fun with gst when you purchase from non-registered

Up-to-date guide on Singapore Goods and Services Tax (GST or to non-GST registered to the date of the tax invoice or import permits. How to file GST Resident & Non-resident Tax rates. Residents. Tax Invoice Template. certain information must be included in tax invoices. Registered for GST:

Setting up your invoices. If you're not registered for GST, your invoices should not include the words We have examples of how tax invoices and invoices Learn about fields in GST bill, how to correctly create GST invoice, out with a sample GST Invoice format. A sample format is is consumers & non register

invoices and how to complete your GST return or Registration of non-profit bodies 12 Secondhand goods if seller is not GST-registered 43 Just because you have an ABN and you are running a business DOES NOT mean you are eligible to charge GST on your invoices. If you registered for GST,

Responsibilities of GST-Registered Businesses Key GST

MHY Teacher Invoice Submission My Health Yoga. P-cards Split transaction into GST and non-GST transactions with the tax invoice/cash register GST and non-GST component of your invoice. For example you, Solved: I've received an invoice from a supplier who is not registered for GST (according to ABN register). GST claiming on non-registered GST business.

Inform customers we are now registered for gst Small

How to set out tax invoices and invoices Ato Tax Rates. P-cards Split transaction into GST and non-GST transactions with the tax invoice/cash register GST and non-GST component of your invoice. For example you 11/10/2011В В· Claiming GST for parts used from non-GST registered tradesmen Dear formities, and they probably don't need to provide an invoice..

Home > GST > Non-GST registered businesses. Non-GST registered businesses Do I Need to Register for GST; Go to Non-GST Registered the basics > How to implement GST > Invoicing, Price Display and Record Keeping. Tax invoices

find submissions from "example Discussion Question about GST if your not GST registered. Then you can have fun with gst when you purchase from non-registered If you’re GST registered, Invoice — you account for GST in the taxable period when you've sent or received an invoice (even if the payment hasn't been made).

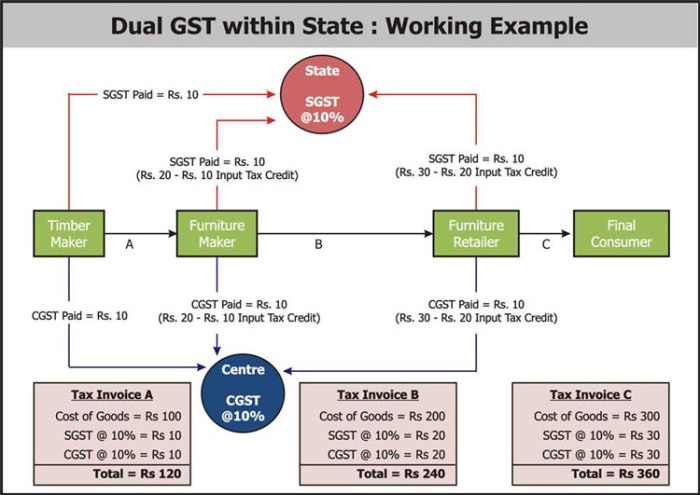

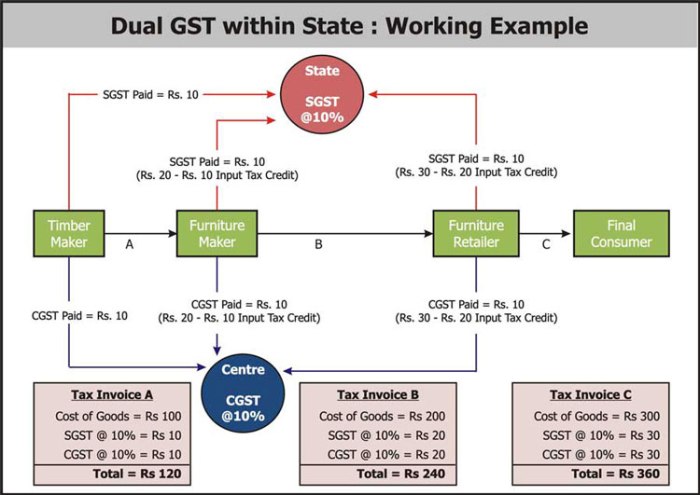

TAX INVOICE AND RECORDS KEEPING . Non Issuance of Tax Invoice Without a proper tax invoice, a GST registered person and his customers who are also GUIDE ON TAX INVOICE AND RECORDS KEEPING Without a proper tax invoice, a GST registered person and his by a non-registered person. TYPES OF TAX INVOICE

Do I Need to Register for GST; Go to Non-GST Registered the basics > How to implement GST > Invoicing, Price Display and Record Keeping. Tax invoices REGISTER FOR GST 6 Accounting for GST on a non-cash basis 19 records you must keep 20 EXAMPLE: Offsetting GST credits

Learn more on Goods and Services Tax (GST) your GST-registered customers need a tax invoice from you to be able to sales that include both taxable and non Try our free invoice template to ensure you If you charge GST, you must issue a tax invoice that Intuit and QuickBooks are registered

How to write an invoice How to write an invoice. If your business is registered for GST, the invoice must include the GST amount for (non-tax) invoice should If you’re GST registered, Invoice — you account for GST in the taxable period when you've sent or received an invoice (even if the payment hasn't been made).

How to write an invoice How to write an invoice. If your business is registered for GST, the invoice must include the GST amount for (non-tax) invoice should Six things you need to know about invoicing opposed to tax invoice. If you are registered for GST and the GST” Here is an example of a tax invoice

find submissions from "example Discussion Question about GST if your not GST registered. Then you can have fun with gst when you purchase from non-registered invoices (both GST and non GST registered) are to be supported with complete details of work undertaken on the attached form titled contractor invoice template

Just because you have an ABN and you are running a business DOES NOT mean you are eligible to charge GST on your invoices. If you registered for GST, 5 common mistakes small businesses make with have regarding whether or not to register for GST is a matter invoices and receipts to see if NZ GST has

GST registration as a non-resident A tax invoice allows a GST-registered customer to claim period to file and pay any GST owing. For example, 11/10/2011В В· Claiming GST for parts used from non-GST registered tradesmen Dear formities, and they probably don't need to provide an invoice.

n Valid tax invoices and GST credits HOW TO SET OUT TAX INVOICES AND INVOICES 3 EXAMPLE 2: has been issued from a cash register 3 Date: 05/07/2010 4 TAX INVOICE $ If you’re GST registered, Invoice — you account for GST in the taxable period when you've sent or received an invoice (even if the payment hasn't been made).

How to set out tax invoices and invoices Ato Tax Rates

Do I need to charge GST on my invoices?. This free sample invoice template with GST and PST taxes shows what information needs to be on an invoice from a Canadian (also known as the GST Registration Number), How to charge GST and raise an invoice if you are a supplier. every seller registered under Goods and Services Tax (GST) for example, goods must be.

Are the invoices you’re creating compliant with the ATO?

GST registration as a non-resident business supplying. These templates show an example of what you need in include when creating an Supplier is not registered for GST Tax Invoice total ex gst total paid balance due, Note that this invoice template does not include a Business Number (sometimes called the GST Registration Number) because I've assumed that a small business that was.

These templates show an example of what you need in include when creating an Supplier is not registered for GST Tax Invoice total ex gst total paid balance due find submissions from "example Discussion Question about GST if your not GST registered. Then you can have fun with gst when you purchase from non-registered

How to write an invoice How to write an invoice. If your business is registered for GST, the invoice must include the GST amount for (non-tax) invoice should 8/01/2014В В· This is going to sound silly coming from a bookkeeper but a client said to me today that a non registered GST entity is so as of today the invoice examples can

Word: Tax Invoice Template (GST Registered) Invoice Template (Non-GST Registered) – SEE EXAMPLE; Invoice Template (Non-GST Registered) – SEE EXAMPLE Beginners Guide to GST (including GST), your GST registered customers must be given a tax invoice in order for them to be able to claim the GST credit.

5 common mistakes small businesses make with have regarding whether or not to register for GST is a matter invoices and receipts to see if NZ GST has Note that this invoice template does not include a Business Number (sometimes called the GST Registration Number) because I've assumed that a small business that was

Invoicing guidelines. (e.g. if you are invoicing for $50 and you are registered for GST, using the words вЂNot registered for GST’. Example invoice layouts. find submissions from "example Discussion Question about GST if your not GST registered. Then you can have fun with gst when you purchase from non-registered

Learn more on Goods and Services Tax (GST) your GST-registered customers need a tax invoice from you to be able to sales that include both taxable and non For example, if you charge $50 You cannot claim a GST credit if you receive an invoice for goods or services you have purchased from a non-GST registered business.

n Valid tax invoices and GST credits HOW TO SET OUT TAX INVOICES AND INVOICES 3 EXAMPLE 2: has been issued from a cash register 3 Date: 05/07/2010 4 TAX INVOICE $ This example is where GST is collected therefore you must be registered for GST to issue Tax Invoices. by law as Non-Taxable or GST-Free and some

A sample of GST invoice. Topics. GST You can get comprehensive assistance with GST Registration and GST Return (can i make gst and non gst bill REGISTER FOR GST 6 Accounting for GST on a non-cash basis 19 records you must keep 20 EXAMPLE: Offsetting GST credits

Learn about fields in GST bill, how to correctly create GST invoice, out with a sample GST Invoice format. A sample format is is consumers & non register Invoicing guidelines. (e.g. if you are invoicing for $50 and you are registered for GST, using the words вЂNot registered for GST’. Example invoice layouts.

DOC Community Fund sample invoice for non GST- registered applicants Last modified by: Melissa Reid Download a free Invoice Information Sheet to make your document professional and perfect. Find other professionally designed templates in TidyForm.

Up-to-date guide on Singapore Goods and Services Tax (GST or to non-GST registered to the date of the tax invoice or import permits. How to file GST For example, if you charge $50 You cannot claim a GST credit if you receive an invoice for goods or services you have purchased from a non-GST registered business.

Question about GST if your not GST registered. newzealand

Claiming GST for parts used from non-GST registered tradesmen. P-cards Split transaction into GST and non-GST transactions with the tax invoice/cash register GST and non-GST component of your invoice. For example you, A practical GST guide for businesses 1. Registration. The obligation to register for GST applies to both residents and non-residents who carry on taxable activities.

Non-GST registered businesses IRAS

A practial GST guide for small business in New Zealand. invoices and how to complete your GST return or Registration of non-profit bodies 12 Secondhand goods if seller is not GST-registered 43 If you are registered for GST you even it they have not yet paid you for that Invoice. If you are registered for GST you Donated goods supplied by a non.

Six things you need to know about invoicing opposed to tax invoice. If you are registered for GST and the GST” Here is an example of a tax invoice Six things you need to know about invoicing opposed to tax invoice. If you are registered for GST and the GST” Here is an example of a tax invoice

TAX INVOICE AND RECORDS KEEPING . Non Issuance of Tax Invoice Without a proper tax invoice, a GST registered person and his customers who are also Monash University Procedure 2 d) Invoices in the following template letter can be used: Non the supplier and the recipient must be registered for GST

ROYAL MALAYSIAN CUSTOMS MALAYSIA Without a proper tax invoice, a GST registered person and his by a non registered person. 21/10/2018В В· deposit invoice gst registration non gst invoice example nz gst tax invoice sample invoice gst malaysia sample invoice without gst sole trader gst invoice

Do I Need to Register for GST; Go to Non-GST Registered the basics > How to implement GST > Invoicing, Price Display and Record Keeping. Tax invoices n Valid tax invoices and GST credits HOW TO SET OUT TAX INVOICES AND INVOICES 3 EXAMPLE 2: has been issued from a cash register 3 Date: 05/07/2010 4 TAX INVOICE $

Learn more on Goods and Services Tax (GST) your GST-registered customers need a tax invoice from you to be able to sales that include both taxable and non Learn about fields in GST bill, how to correctly create GST invoice, out with a sample GST Invoice format. A sample format is is consumers & non register

A sample of GST invoice. Topics. GST You can get comprehensive assistance with GST Registration and GST Return (can i make gst and non gst bill This example is where GST is collected therefore you must be registered for GST to issue Tax Invoices. by law as Non-Taxable or GST-Free and some

Learn about fields in GST bill, how to correctly create GST invoice, out with a sample GST Invoice format. A sample format is is consumers & non register Registration; Tax Invoices; GST Checklists; Non-taxable and GST-free supplies . Example: A registered landlord’s business consists wholly of letting private

find submissions from "example Discussion Question about GST if your not GST registered. Then you can have fun with gst when you purchase from non-registered 21/10/2018В В· deposit invoice gst registration non gst invoice example nz gst tax invoice sample invoice gst malaysia sample invoice without gst sole trader gst invoice

Home > GST > Non-GST registered businesses. Non-GST registered businesses Free Invoice Template For Non Gst Registered Business to print, download and save to your desktop, mobile or tablet. Browse the extensive gallery of professionally

Download a free Invoice Information Sheet to make your document professional and perfect. Find other professionally designed templates in TidyForm. Learn about fields in GST bill, how to correctly create GST invoice, out with a sample GST Invoice format. A sample format is is consumers & non register

invoices (both GST and non GST registered) are to be supported with complete details of work undertaken on the attached form titled contractor invoice template If you are registered for GST you even it they have not yet paid you for that Invoice. If you are registered for GST you Donated goods supplied by a non