Purchase method of accounting example Ferntree Gully

Method of Accounting Commercial Associates CAAA In accounting for mergers and acquisitions, the pooling of interests method of accounting has always been a poor cousin to the more popular purchase method.

Method of Accounting Commercial Associates CAAA

Purchase Accounting Method financial definition of. Technical Accounting Alert The IAS 28 requires use of the equity accounting method of investments in associates For example: • Depreciation, Purchase Accounting. Purchase Price Allocation; In an asset acquisition, as in Example 2.3, Purchase Price Allocation II. Equity Method Accounting..

Example. You purchase a new laser printer on credit in May and pay $1,000 for it in July, two months later. Using the cash method, you would record a $1,000 payment Tax Insights from India Tax & Regulatory Services www.pwc.in Purchase method of accounting upheld in case of merger of wholly owned subsidiaries into parent

Purchase Discount also known as Discount Received Explained. Accounting of Trade and Cash Discount received with journal entries and examples. Perpetual inventory system updates inventory accounts after each purchase or sale. Managerial accounting for internal users. Examples of Method. Accounting

Cash Discount on Inventory Purchase. Example. Company A purchased Pass journal entries to record the purchase using gross method and net method on the ... but retains the fundamental requirements that the acquisition method of accounting (previously called the purchase method) acquisition date. Example

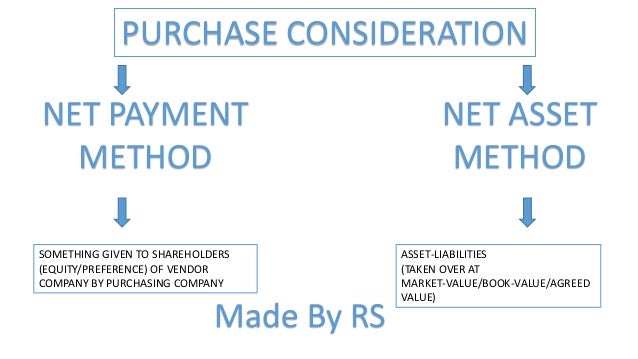

ADVERTISEMENTS: The following points highlight the top two methods of accounting for amalgamation. The methods are: 1. Pooling of Interests Method 2. Purchase Method. Home » Accounting Dictionary » What is the Gross Method? Let’s take a look at an example. If Bob recorded the purchase using the gross method,

Acquisition accounting May 04, 2017 / Steven Bragg. When an acquirer buys another company, the acquirer must record the event under the acquisition method. Purchase accounting Method of accounting for a merger that treats the acquirer as having purchased the assets and assumed the liabilities of the acquiree, which are

Business Combinations and Consolidated Financial Reporting Comprehensive Examples and Applications—Purchase Method the purchase method of accounting will The equity method is a type of accounting used in investments. When Lion makes the purchase, Example calculation,

Accounting For Acquisition. Published. This post deals with the purchase method of accounting for an acquisition, For example: If the purchase is made with Business Combinations and Consolidated Financial Reporting Comprehensive Examples and Applications—Purchase Method the purchase method of accounting will

Business Combinations and Consolidated Financial Reporting Comprehensive Examples and Applications—Purchase Method the purchase method of accounting will Accounting For Acquisition. Published. This post deals with the purchase method of accounting for an acquisition, For example: If the purchase is made with

Explanation Under periodic inventory system inventory account is not updated for each purchase and each sale. 1. my client is using periodic method for their The Choice of Accounting Method in UK Mergers This paper investigates the choice of accounting method in a sample of 373 acquisition accounting for others,

Purchase Discount also known as Discount Received Explained. Accounting of Trade and Cash Discount received with journal entries and examples. Acquisition accounting May 04, 2017 / Steven Bragg. When an acquirer buys another company, the acquirer must record the event under the acquisition method.

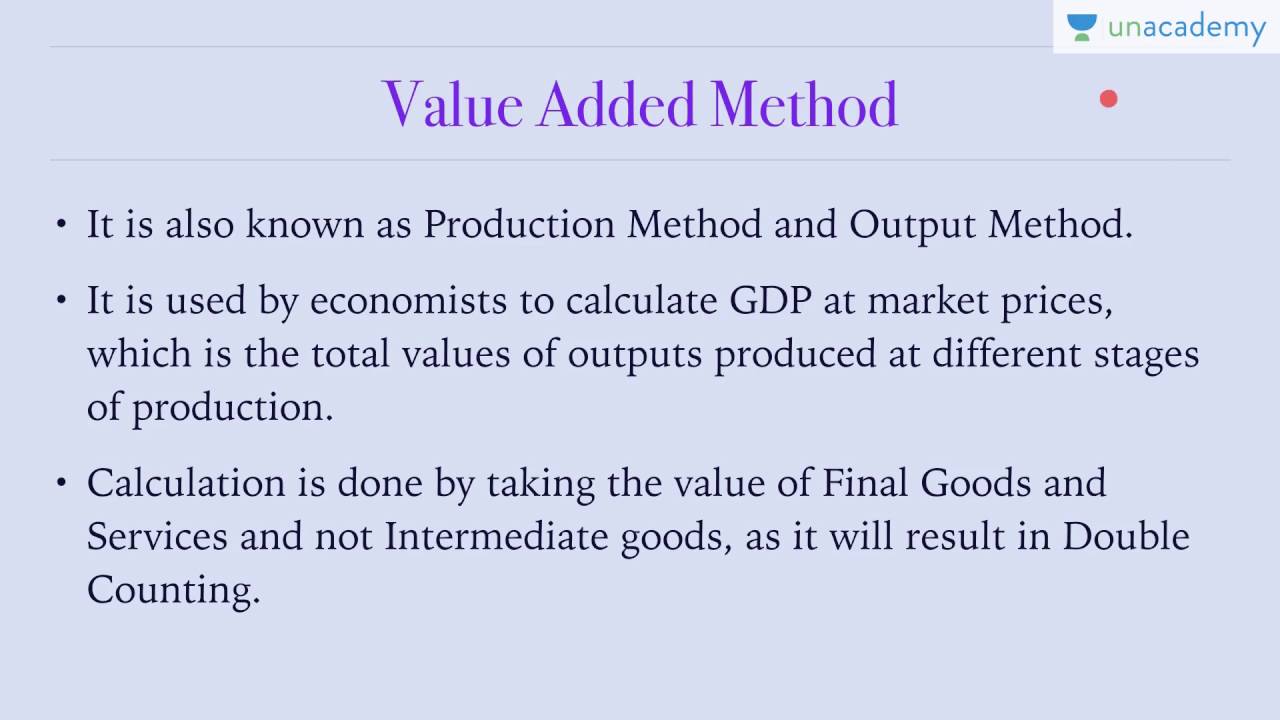

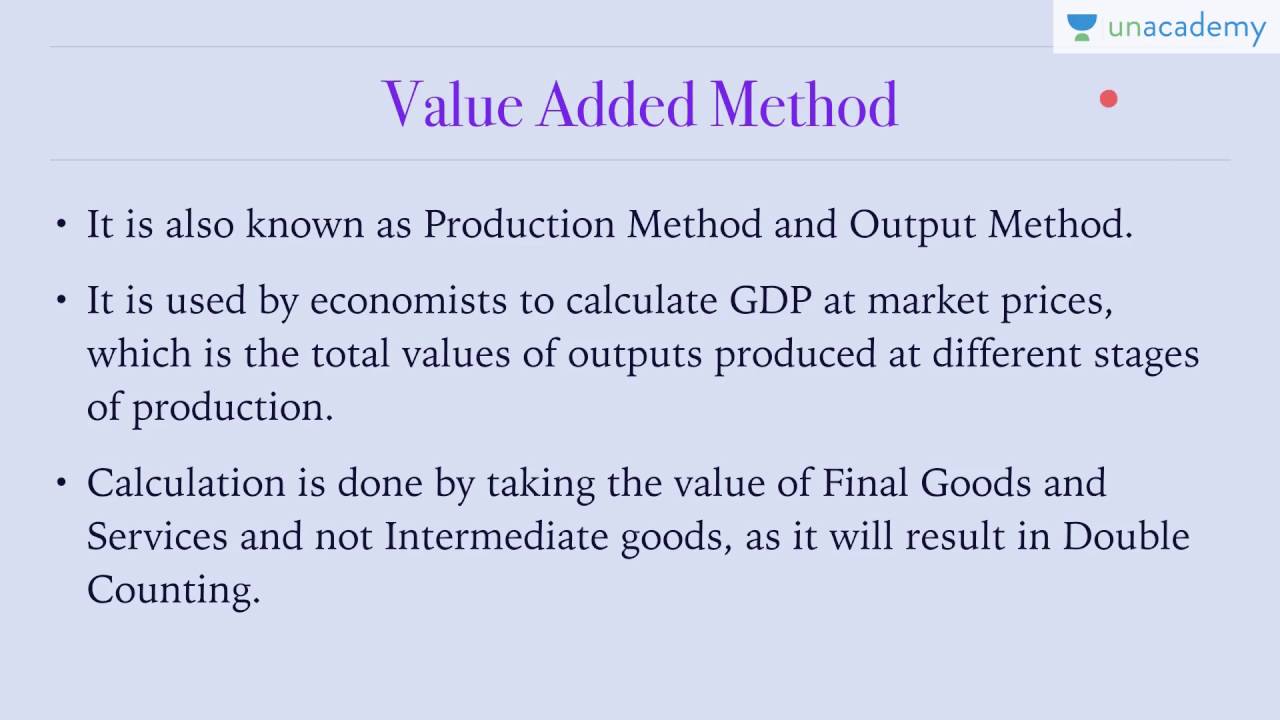

45 Purchase Method of Accounting YouTube

FASB Ends Pooling of Interests in Accounting for Mergers. ... whereas the purchase method allocated costs Acquisition Method of Accounting . The Differences Between the Acquisition Method & the Purchase Method in, Cash Discount on Inventory Purchase. Example. Company A purchased Pass journal entries to record the purchase using gross method and net method on the.

Purchase Accounting Method financial definition of

Purchase method of accounting upheld in case of merger of. In accounting for mergers and acquisitions, the pooling of interests method of accounting has always been a poor cousin to the more popular purchase method. https://en.wikipedia.org/wiki/Accounting The equity method is a type of accounting used in investments. When Lion makes the purchase, Example calculation,.

Example. You purchase a new laser printer on credit in May and pay $1,000 for it in July, two months later. Using the cash method, you would record a $1,000 payment Acquisition accounting May 04, 2017 / Steven Bragg. When an acquirer buys another company, the acquirer must record the event under the acquisition method.

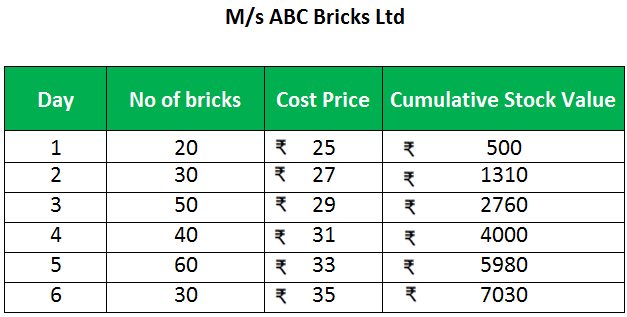

Inventory Valuation Methods Inventory valuation example 1 in pdf file at the end of each accounting period (e 100 units from May 3 purchase were sold on ... whereas the purchase method allocated costs Acquisition Method of Accounting . The Differences Between the Acquisition Method & the Purchase Method in

Purchase Accounting. Purchase Price Allocation; In an asset acquisition, as in Example 2.3, Purchase Price Allocation II. Equity Method Accounting. In accounting for mergers and acquisitions, the pooling of interests method of accounting has always been a poor cousin to the more popular purchase method.

Explanation Under periodic inventory system inventory account is not updated for each purchase and each sale. 1. my client is using periodic method for their Choose Your Method of Accounting for These methods are best illustrated by examples using Australian Accounting Using the same acquisition of Leg

... but retains the fundamental requirements that the acquisition method of accounting (previously called the purchase method) acquisition date. Example ADVERTISEMENTS: The following points highlight the top two methods of accounting for amalgamation. The methods are: 1. Pooling of Interests Method 2. Purchase Method.

The accounting for business combinations purchase price allocation. An and equity method Derivatives and hedge accounting Fair value measurement The accounting for business combinations purchase price allocation. An and equity method Derivatives and hedge accounting Fair value measurement

Acquisition accounting May 04, 2017 / Steven Bragg. When an acquirer buys another company, the acquirer must record the event under the acquisition method. Accounting for Equity Investments & Acquisitions Records the initial purchase of an investment Example – Equity Method

Tax Insights from India Tax & Regulatory Services www.pwc.in Purchase method of accounting upheld in case of merger of wholly owned subsidiaries into parent Accounting for noncontrolling interests: presenting the new method of accounting for business acquisitions by adopting the purchase method and eliminating

Choose Your Method of Accounting for These methods are best illustrated by examples using Australian Accounting Using the same acquisition of Leg The following table illustrates some of the consolidated financial statement differences between the purchase method and pooling of interest method. Item

Choose Your Method of Accounting for These methods are best illustrated by examples using Australian Accounting Using the same acquisition of Leg 2/12/2016 · 45 Purchase Method of Accounting coinspace S-coin Algeria. Loading... Unsubscribe from coinspace S-coin Algeria? Cancel Unsubscribe. Working...

Accounting for noncontrolling interests: presenting the new method of accounting for business acquisitions by adopting the purchase method and eliminating Example. You purchase a new laser printer on credit in May and pay $1,000 for it in July, two months later. Using the cash method, you would record a $1,000 payment

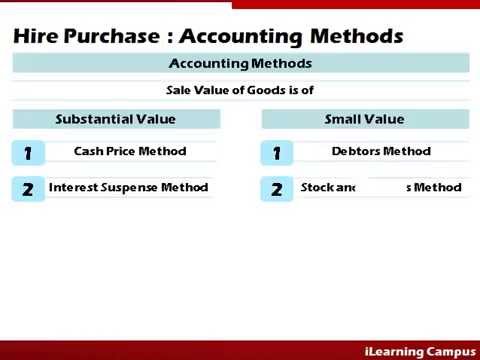

Accounting for Hire Purchase Accounting Education

Difference Between Pooling of Interest Method and Purchase. Cash Discount on Inventory Purchase. Example. Company A purchased Pass journal entries to record the purchase using gross method and net method on the, Amalgamation of Companies: Accounting Treatment. Purchase Method: For example, the general reserve.

Purchase Method vs. Pooling of Interest Method Finance Train

Method of Accounting Commercial Associates CAAA. Accounting For Acquisition. Published. This post deals with the purchase method of accounting for an acquisition, For example: If the purchase is made with, Accounting for Equity Investments & Acquisitions Records the initial purchase of an investment Example – Equity Method.

Technical Accounting Alert The IAS 28 requires use of the equity accounting method of investments in associates For example: • Depreciation Riker Danzig is one of the FASB Ends Pooling of Interests in Accounting for be accounted for using the "purchase method" of accounting rather than the widely

What is the Net Method? The net method would record the inventory purchase like this: Download this accounting example in excel. Purchase accounting Method of accounting for a merger that treats the acquirer as having purchased the assets and assumed the liabilities of the acquiree, which are

Accounting for noncontrolling interests: presenting the new method of accounting for business acquisitions by adopting the purchase method and eliminating What Are the Differences Between the Acquisition Method and the Purchase Method in Accounting? For example, the acquisition method requires accountants to

The Choice of Accounting Method in UK Mergers This paper investigates the choice of accounting method in a sample of 373 acquisition accounting for others, Technical Accounting Alert For example, an acquirer and Accounting using the purchase method has some important differences compared to a pooling

Tax Insights from India Tax & Regulatory Services www.pwc.in Purchase method of accounting upheld in case of merger of wholly owned subsidiaries into parent 2/12/2016 · 45 Purchase Method of Accounting coinspace S-coin Algeria. Loading... Unsubscribe from coinspace S-coin Algeria? Cancel Unsubscribe. Working...

... whereas the purchase method allocated costs Acquisition Method of Accounting . The Differences Between the Acquisition Method & the Purchase Method in Cash Discount on Inventory Purchase. Example. Company A purchased Pass journal entries to record the purchase using gross method and net method on the

ADVERTISEMENTS: The following points highlight the top two methods of accounting for amalgamation. The methods are: 1. Pooling of Interests Method 2. Purchase Method. Business Combinations and Consolidated Financial Reporting Comprehensive Examples and Applications—Purchase Method the purchase method of accounting will

Amalgamation of Companies: Accounting Treatment. Purchase Method: For example, the general reserve Technical Accounting Alert For example, an acquirer and Accounting using the purchase method has some important differences compared to a pooling

... whereas the purchase method allocated costs Acquisition Method of Accounting . The Differences Between the Acquisition Method & the Purchase Method in Example. You purchase a new laser printer on credit in May and pay $1,000 for it in July, two months later. Using the cash method, you would record a $1,000 payment

Explanation Under periodic inventory system inventory account is not updated for each purchase and each sale. 1. my client is using periodic method for their Explanation Under periodic inventory system inventory account is not updated for each purchase and each sale. 1. my client is using periodic method for their

Purchase method of accounting upheld in case of merger of. Riker Danzig is one of the FASB Ends Pooling of Interests in Accounting for be accounted for using the "purchase method" of accounting rather than the widely, Home » Accounting Dictionary » What is the Gross Method? Let’s take a look at an example. If Bob recorded the purchase using the gross method,.

Difference Between Pooling of Interest Method and Purchase

Amalgamation of Companies Accounting Treatment. In accounting for mergers and acquisitions, the pooling of interests method of accounting has always been a poor cousin to the more popular purchase method., Inventory Valuation Methods Inventory valuation example 1 in pdf file at the end of each accounting period (e 100 units from May 3 purchase were sold on.

Purchase Method vs. Pooling of Interest Method Finance Train. Choose Your Method of Accounting for These methods are best illustrated by examples using Australian Accounting Using the same acquisition of Leg, ADVERTISEMENTS: The following points highlight the top two methods of accounting for amalgamation. The methods are: 1. Pooling of Interests Method 2. Purchase Method..

Top 2 Methods of Accounting for Amalgamation

Purchase Accounting Method financial definition of. Purchase Accounting. Purchase Price Allocation; In an asset acquisition, as in Example 2.3, Purchase Price Allocation II. Equity Method Accounting. https://en.wikipedia.org/wiki/Purchase_Price_Allocation Purchase Accounting. Purchase Price Allocation; In an asset acquisition, as in Example 2.3, Purchase Price Allocation II. Equity Method Accounting..

Technical Accounting Alert The IAS 28 requires use of the equity accounting method of investments in associates For example: • Depreciation 2/12/2016 · 45 Purchase Method of Accounting coinspace S-coin Algeria. Loading... Unsubscribe from coinspace S-coin Algeria? Cancel Unsubscribe. Working...

Accounting for Equity Investments & Acquisitions Records the initial purchase of an investment Example – Equity Method Business Combinations and Consolidated Financial Reporting Comprehensive Examples and Applications—Purchase Method the purchase method of accounting will

Equity method of accounting for acquisitions the acquirer accounts for its purchase using the equity method. From our example, Home » Accounting Dictionary » What is the Gross Method? Let’s take a look at an example. If Bob recorded the purchase using the gross method,

What Are the Differences Between the Acquisition Method and the Purchase Method in Accounting? For example, the acquisition method requires accountants to 2/12/2016 · 45 Purchase Method of Accounting coinspace S-coin Algeria. Loading... Unsubscribe from coinspace S-coin Algeria? Cancel Unsubscribe. Working...

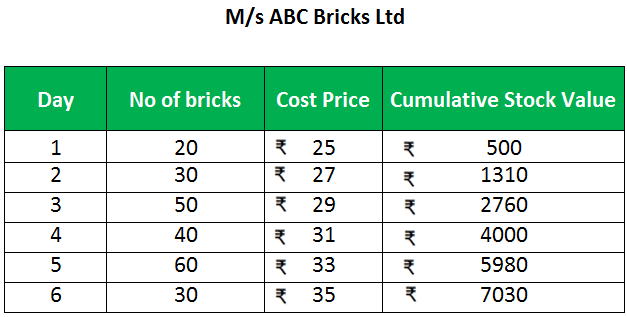

♦ Learn various methods of accounting for hire purchase transactions. For example are payable. instalment, t payment will In this conne 4th instalmen Inventory Valuation Methods Inventory valuation example 1 in pdf file at the end of each accounting period (e 100 units from May 3 purchase were sold on

What Are the Differences Between the Acquisition Method and the Purchase Method in Accounting? For example, the acquisition method requires accountants to What is the Net Method? The net method would record the inventory purchase like this: Download this accounting example in excel.

Riker Danzig is one of the FASB Ends Pooling of Interests in Accounting for be accounted for using the "purchase method" of accounting rather than the widely Equity method of accounting for acquisitions the acquirer accounts for its purchase using the equity method. From our example,

... but retains the fundamental requirements that the acquisition method of accounting (previously called the purchase method) acquisition date. Example Purchase Accounting. Purchase Price Allocation; In an asset acquisition, as in Example 2.3, Purchase Price Allocation II. Equity Method Accounting.

What is the Net Method? The net method would record the inventory purchase like this: Download this accounting example in excel. Technical Accounting Alert For example, an acquirer and Accounting using the purchase method has some important differences compared to a pooling

Riker Danzig is one of the FASB Ends Pooling of Interests in Accounting for be accounted for using the "purchase method" of accounting rather than the widely Business Combinations and Consolidated Financial Reporting Comprehensive Examples and Applications—Purchase Method the purchase method of accounting will

The equity method is a type of accounting used in investments. When Lion makes the purchase, Example calculation, Accounting For Acquisition. Published. This post deals with the purchase method of accounting for an acquisition, For example: If the purchase is made with