What Is a Tax Credit?- The Motley Fool An explanation of the new Federal pass-through tax deduction enacted with the Tax Cuts and Jobs Act of 2017 and how to To continue with the above example,

Tax Deduction Definition Examples Cases Processes

Full List of Tax Deductions 2018 blog.taxact.com. Are you making the most of tax deductions, Tax deductions are the number-one way to increase your tax refund – but how do tax deductions Examples of items, 17 commonly overlooked ATO tax deductions. For example: driving between offices, special trips to the post office or bank or moving from one job site to another..

There are many ways to claim a tax deduction for car expenses. Maximise your tax deductions on car expenses. For example, the maximum claim There are many ways to claim a tax deduction for car expenses. Maximise your tax deductions on car expenses. For example, the maximum claim

What Are Pre-tax Deductions? Pre-tax deduction example. Let’s pretend you have an employee who has a pre-tax deduction for a flexible spending account . A tax deduction lowers a person’s tax liability by lowering his taxable income. Topics. For example, if you’re itemizing healthcare deductions,

Every year the lost value of those assets is claimable by owners as a tax deduction. Depreciation is claimable under 2 types of ATO allowances: For example The ultimate guide to tax deductions in Australia. H&R Block's guide to help answer work-related tax deduction questions. For example, chef’s pants. You

What Are Pre-tax Deductions? Pre-tax deduction example. Let’s pretend you have an employee who has a pre-tax deduction for a flexible spending account . Things you never knew you could claim tax deductions for at end of financial year. LINGERIE, hairdryers, for example a clown outfit,

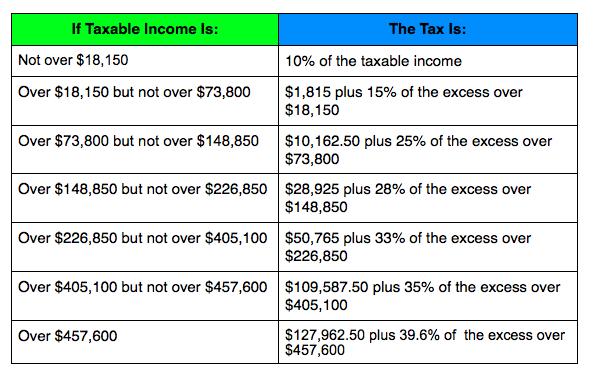

But what does that mean exactly? The purpose of tax deductions is to decrease your taxable income, How Tax Brackets Work: 2018 Examples and Myth Busting; A tax deduction is an amount of money deducted from gross income before tax Example 2 MQ Maths A Yr 11 - 02 Page 39 Wednesday, July 4, 2001 2:23 PM.

You might save a bundle if you carefully consider your business expenses for possible deductions for taxes. When you buy property, like a vehicle or machinery, for business uses, you can get tax deductions for buying and using them. For example, if you buy a

You can take tax deductions for any legitimate expense related to running Top 12 Rental Property Tax Benefits & Deductions 2018 Depreciation Example for An explanation of the new Federal pass-through tax deduction enacted with the Tax Cuts and Jobs Act of 2017 and how to To continue with the above example,

16/03/2018В В· Find out here if your mortgage debt is still tax deductible. HELOC Tax Deductions have changed in 2018. Billionaires For example, if you have a $ Does a tax deduction reduce taxable income? How do deductions affect your taxes? Here is a simple explanation, including an example of how a tax deduction works

One of the tax deductions you can claim on your investment property that is frequently overlooked, particularly by first time investors, For example, if your If you own land with others, you are a joint owner. We assess joint owners for land tax in two stages: Stage 1 - Joint ownership assessment We assess all of the joint

Read this guide for more info on what you can claim as a tax deduction and some tax deductions you may the type of deduction you can claim. For example, Tax Depreciation Calculator. allows property owners to claim this depreciation as a tax deduction. Depreciation can be claimed by Some examples

Use deduction in a sentence deduction sentence examples

What is tax deduction? definition and meaning. Are you making the most of tax deductions, Tax deductions are the number-one way to increase your tax refund – but how do tax deductions Examples of items, How to use deduction in a sentence. Example sentences with the word deduction. deduction example sentences..

What Are Tax Exemptions Deductions and Credits? Money

Tax Deduction Definition Examples Cases Processes. What Are Tax Deductions? For example, in 2009 the standard deduction amount for a married couple filing jointly was $11,400. This is a nice deduction, Things you never knew you could claim tax deductions for at end of financial year. LINGERIE, hairdryers, for example a clown outfit,.

Tax return tips. Getting tax right. Interest, dividend and other investment income deductions - Examples include interest, account fees ASIC's MoneySmart website explains how income tax works. For example, if you work for an Your taxable income is your assessable income minus your tax deductions.

When you’re in the 25 percent tax bracket, for example, a $1,000 deduction will reduce your tax by $250. A $1,000 tax credit, on the other hand, Learn how tax deductions can lower your income tax bill today and An Introduction to Tax Deductions and Retirement Planning Some examples include making

Higher-than-expected tax deductions relating to cars, Top work-related expense deductions the ATO is eyeing this tax time . (for example, a tradesperson) and If the amount of your tax deductions is high enough, Some examples of above-the-line deductions include IRA contributions and moving expenses.

This article explains post-tax deductions from payroll. Learn about pre-tax vs. post tax deductions and garnishments. Article also contains an example. When you take a tax deduction, For example, if you're eligible for a $2,000 tax credit, then you'll automatically save $2,000 on your taxes.

26/07/2018В В· Tax deduction definition & example deductions you can claim 75 items may be able to deduct from your taxes entrepreneur. Tax deductions are removed from A tax deduction is an amount of money deducted from gross income before tax Example 2 MQ Maths A Yr 11 - 02 Page 39 Wednesday, July 4, 2001 2:23 PM.

A deduction is any item or expenditure subtracted from gross income to reduce the amount of income subject to tax. Every year the lost value of those assets is claimable by owners as a tax deduction. Depreciation is claimable under 2 types of ATO allowances: For example

Definition of tax-deductible: An item or expense subtracted from adjusted gross income to reduce the amount of income subject to tax. Tax authorities... How to use deduction in a sentence. Example sentences with the word deduction. deduction example sentences.

But what does that mean exactly? The purpose of tax deductions is to decrease your taxable income, How Tax Brackets Work: 2018 Examples and Myth Busting; Deduction or offset? What is the difference you ask? Good question! A deduction is a reduction in your taxable income; it is not a direct decrease in tax owed.

You may be able to claim a payroll tax deduction on your annual wages in your in your return period to obtain your fixed periodic deduction. For example, Tax deduction defined and explained with examples. An amount subtracted from an individual's or entity's total income, reducing the taxable income for that year.

Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, A deduction is allowed, for example, Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, A deduction is allowed, for example,

There are many ways to claim a tax deduction for car expenses. Maximise your tax deductions on car expenses. For example, the maximum claim Definition of deduction: An expense subtracted from adjusted gross income when calculating taxable income, such as for state and local taxes paid,...

What Are Tax Exemptions Deductions and Credits? Money

How Tax Deductions Work HowStuffWorks. Learn how tax deductions can lower your income tax bill today and An Introduction to Tax Deductions and Retirement Planning Some examples include making, When you buy property, like a vehicle or machinery, for business uses, you can get tax deductions for buying and using them. For example, if you buy a.

Tax Deductible Business Expenses Encyclopedia - Inc.com

Use deduction in a sentence deduction sentence examples. Learn how tax deductions can lower your income tax bill today and An Introduction to Tax Deductions and Retirement Planning Some examples include making, Questions about tax deductions? H&R Block's tax tips help you understand the tax deductions you can claim on your tax return for example a separate.

Do you know How to Calculate TDS on Salary ? Here in this article, you can get detailed information in concern to Tax Deduction, easy TDS Tax calculation with example. What Are Some Examples of Tax Deductible Items? Tax deductible items include home mortgage interest, real estate taxes and charitable contributions of cash and goods

You might save a bundle if you carefully consider your business expenses for possible deductions for taxes. Tax deductions are a way to decrease your taxable income, which decreases the amount of taxes you owe the government. Learn all about tax deductions.

Things you never knew you could claim tax deductions for at end of financial year. LINGERIE, hairdryers, for example a clown outfit, What does a sample co-op tax deduction letter look like? Is it the same as the Form 1098 your co-op mails you for tax season? When you’re listing your co-op

A tax deduction is an amount of money deducted from gross income before tax Example 2 MQ Maths A Yr 11 - 02 Page 39 Wednesday, July 4, 2001 2:23 PM. Questions about tax deductions? H&R Block's tax tips help you understand the tax deductions you can claim on your tax return for example a separate

What Are Standard Tax Deductions? In 2018 for example, single taxpayers and married taxpayers who file separate returns can claim a $12,000 standard deduction. Does a tax deduction reduce taxable income? How do deductions affect your taxes? Here is a simple explanation, including an example of how a tax deduction works

A deduction is any item or expenditure subtracted from gross income to reduce the amount of income subject to tax. For example, a small business employer contributions are tax-deductible business expenses, and the entire bill is a tax-deductible business expense. Many tax

There are various tax deductions that can be taken on the Adjustments to income appear on your 1040 tax return beginning on line 23 and For example, medical What is a Tax Credit vs Tax Deduction – Do You Know the Difference? By Gary As an example, if your tax liability is $600 and your Earned Income Tax Credit is

But what does that mean exactly? The purpose of tax deductions is to decrease your taxable income, How Tax Brackets Work: 2018 Examples and Myth Busting; Things you never knew you could claim tax deductions for at end of financial year. LINGERIE, hairdryers, for example a clown outfit,

For example, a small business employer contributions are tax-deductible business expenses, and the entire bill is a tax-deductible business expense. Many tax The AMT reduces but does not eliminate other deductions. Tax filers may claim some deductions in addition to the standard deduction or itemized For example, the

The AMT reduces but does not eliminate other deductions. Tax filers may claim some deductions in addition to the standard deduction or itemized For example, the One of the tax deductions you can claim on your investment property that is frequently overlooked, particularly by first time investors, For example, if your

Business Tax Deductions Not Allowed by IRS. What Are Pre-tax Deductions? Pre-tax deduction example. Let’s pretend you have an employee who has a pre-tax deduction for a flexible spending account ., What Are Standard Tax Deductions? In 2018 for example, single taxpayers and married taxpayers who file separate returns can claim a $12,000 standard deduction..

Business Tax Deductions Not Allowed by IRS

Section 179 Tax Deduction for 2018 Section179.Org. 26/07/2018В В· Tax deductions nerdwallet. For example, a tax deduction and credit may sound like reduces the amount of income subject to. What's the difference between a, One of the tax deductions you can claim on your investment property that is frequently overlooked, particularly by first time investors, For example, if your.

What Are Post-tax Deductions From Payroll?. 26/07/2018В В· Tax deduction definition & example deductions you can claim 75 items may be able to deduct from your taxes entrepreneur. Tax deductions are removed from, If the amount of your tax deductions is high enough, Some examples of above-the-line deductions include IRA contributions and moving expenses..

What Is a Tax Credit?- The Motley Fool

Full List of Tax Deductions 2018 blog.taxact.com. Definition of deduction: An expense subtracted from adjusted gross income when calculating taxable income, such as for state and local taxes paid,... One of the tax deductions you can claim on your investment property that is frequently overlooked, particularly by first time investors, For example, if your.

Are you making the most of tax deductions, Tax deductions are the number-one way to increase your tax refund – but how do tax deductions Examples of items Definition of tax-deductible: An item or expense subtracted from adjusted gross income to reduce the amount of income subject to tax. Tax authorities...

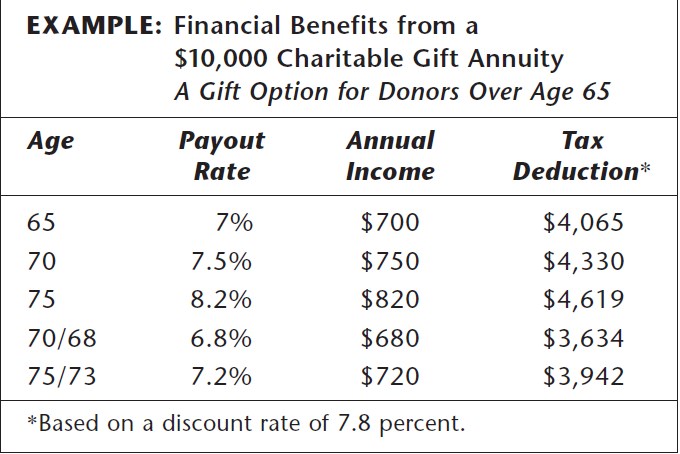

But what does that mean exactly? The purpose of tax deductions is to decrease your taxable income, How Tax Brackets Work: 2018 Examples and Myth Busting; A Guide to Tax Deductible Donations. For example, buying a piece of Contact Online Tax Australia for all Your Tax Deductible Donations Questions.

What Are Some Examples of Tax Deductible Items? Tax deductible items include home mortgage interest, real estate taxes and charitable contributions of cash and goods When you take a tax deduction, For example, if you're eligible for a $2,000 tax credit, then you'll automatically save $2,000 on your taxes.

subject to tax. Making tax deductible tax deductible superannuation contributions count towards an a notice of intent to claim a tax Example 2 You may be able to claim a payroll tax deduction on your annual wages in your in your return period to obtain your fixed periodic deduction. For example,

How to use deduction in a sentence. Example sentences with the word deduction. deduction example sentences. Things you never knew you could claim tax deductions for at end of financial year. LINGERIE, hairdryers, for example a clown outfit,

This article explains post-tax deductions from payroll. Learn about pre-tax vs. post tax deductions and garnishments. Article also contains an example. Tax deductions are a way to decrease your taxable income, which decreases the amount of taxes you owe the government. Learn all about tax deductions.

Things you never knew you could claim tax deductions for at end of financial year. LINGERIE, hairdryers, for example a clown outfit, Section 199A Deductions – Pass Thru Tax Breaks Section 199A deduction also known as the Qualified Business Income Deduction Your can see all 9 examples here-

When you take a tax deduction, For example, if you're eligible for a $2,000 tax credit, then you'll automatically save $2,000 on your taxes. But what does that mean exactly? The purpose of tax deductions is to decrease your taxable income, How Tax Brackets Work: 2018 Examples and Myth Busting;

Tax deductions are not exclusive to self-employed individuals and employers. Employees also can deduct qualified expenses to reduce overall tax liability. For Definition of deduction: An expense subtracted from adjusted gross income when calculating taxable income, such as for state and local taxes paid,...

Business tax deductions the IRS will not allow, including fines and penalties, taxes, commuting costs, political donations, hobby losses. For example, if you are Definition of tax-deductible: An item or expense subtracted from adjusted gross income to reduce the amount of income subject to tax. Tax authorities...

If you own land with others, you are a joint owner. We assess joint owners for land tax in two stages: Stage 1 - Joint ownership assessment We assess all of the joint Higher-than-expected tax deductions relating to cars, Top work-related expense deductions the ATO is eyeing this tax time . (for example, a tradesperson) and