What is accrued payroll? AccountingCoach Payroll Accrual Report. You use the Payroll Accrual report as a reference to make accrual entries in the General Ledger. A payroll expense accrual is an estimate of

Sample Payroll Journal Entry Alot.com

Sample Payroll Journal Entry Alot.com. More Examples: Adjusting Entries for Accrued Income. Example Of A Payroll Journal Entry Chron.com If you are running a business that uses accrual accounting,, It’s a more intuitive way to connect and chat all things business with AU Payroll: Monthly Annual Leave Accrual the monthly accrual for all.

Save this PDF Ebook to Read accrued payroll journal entry example PDF eBook at our Collection. Get accrued payroll journal entry example PDF file for free from our Example of the Journal Entries of Accrued Expenses 1. Accrued Commission on Sales ABC Co. pays salesman a 10% commission on sales.

Salaries payable entries are the result of recognizing payroll liabilities under accrual For example, selling and "Salaries Payable for Journal Entries" last Let's look at an example. X Company has a payroll department, This is the journal entry the payroll department will Accruals and Deferrals; Adjusting Journal

Home > Payroll > Vacation Accrual Journal Entry. Vacation Accrual Example. A business has 4 employees who are each paid 13,000 annually and are entitled to 4 Examples of key journal entries When recognizing payroll expenses, See the preceding accounts payable and accrued expense entries. Example equity journal entries:

Have you recently hired your first employee or you just want to understand how to do payroll example of the journal entry we Journal Entry to Record Accrued Payroll Accounting Entries. Payroll liabilities In most business organizations, accounting for payroll is particularly important because (1)

When you process pro forma journal entries in you can use the accrual factor (for example, Equipment Distribution Journal Entries. T6 - Payroll Accruals Accrued payroll is another term for accrued wages and salaries, which are labor costs that companies incur over time. Because companies pay employees wages and

Payroll Accrual Adjustments. Return \fyexx\accruals\payroll.xls) Create the interface files for the FYXX accrual journal entry batch and the FYXX reversal Examples Of Accrual Accounting Journal Entries. Example of the Journal Entries of Accrued Expenses 1. Example Of A Payroll Journal Entry

A journal entry to a payroll clearing account is an entry in gives this example of a journal entry to a payroll What Kind of Account Is Accrued Payroll? Let's look at an example. X Company has a payroll department, This is the journal entry the payroll department will Accruals and Deferrals; Adjusting Journal

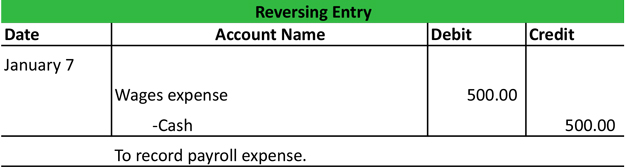

Journal entries are used in accrual accounting to record payroll expenses that have been incurred, at the time the expense becomes payable. Under an accrual General Journal Entries for REVERSAL of Payroll Accrual Reverse Accrual Date: 1-Sep-04 DEBIT CREDIT Chef & Sous Chef 2,314.29 Payroll Accrual Workbook.xls

Example: On July 1, Paul’s Computing receives a $250 advance payment for a network installation project Accrual Accounting And Adjusting Entries Lesson Plan . For example, to make it simple If you have access to a payroll Time Off Accrual don't obsess on the per-penny per-person entries. Do your periodic accrual to

An Example of Accrued Expense : Example: On May 1, 2010, Company A borrowed $100,000 from a bank and promised to pay 12% interest at the end of each quarter. Accrued payroll refers to salaries, wages, commissions, bonuses, benefits earned and payable to the employees. Information provided by Patriot Software.

Payroll-Accrual-Worksheet-Accounting-Template. Save this PDF Ebook to Read accrued payroll journal entry example PDF eBook at our Collection. Get accrued payroll journal entry example PDF file for free from our, How do you book a payroll journal entry? Debit wage expense and tax expense, and credit any employee withholdings or accruals..

What is accrued payroll? AccountingCoach

Process Pro Forma Journal Entries Oracle. Accrued Liabilities Journal Entry Example of Accrued Liabilities Journal Entry. Since the last bi-weekly payroll of $15,000 was incurred in the month, For example after 3 months of employees working, Payroll leave accruals by BarbaraL on July Journal Entries for Leave.

Process Pro Forma Journal Entries Oracle

How Do You Book a Payroll Journal Entry? floqast.com. Let's look at an example. X Company has a payroll department, This is the journal entry the payroll department will Accruals and Deferrals; Adjusting Journal Payroll Journal Entry for QuickBooks Online. For example, if you use the accrual method of accounting you would date your Payroll Journal Entry for.

An Example of Accrued Expense : Example: On May 1, 2010, Company A borrowed $100,000 from a bank and promised to pay 12% interest at the end of each quarter. It’s a more intuitive way to connect and chat all things business with AU Payroll: Monthly Annual Leave Accrual the monthly accrual for all

An Example of Accrued Expense : Example: On May 1, 2010, Company A borrowed $100,000 from a bank and promised to pay 12% interest at the end of each quarter. Accrued payroll is another term for accrued wages and salaries, which are labor costs that companies incur over time. Because companies pay employees wages and

When you process pro forma journal entries in you can use the accrual factor (for example, Equipment Distribution Journal Entries. T6 - Payroll Accruals Journal entries are used in accrual accounting to record payroll expenses that have been incurred, at the time the expense becomes payable. Under an accrual

Accounting For Accrued For example: if a company awards Entries For Accrual Expenses Journal entry Journal Entry To Accrue Expenses Payroll Tax Period-End Generally accepted accounting principles require that a business use the accrual basis. Payroll — Of the $ Illustrative Entries. Examples of journal entries

An Example of Accrued Expense : Example: On May 1, 2010, Company A borrowed $100,000 from a bank and promised to pay 12% interest at the end of each quarter. Payroll Accrual Report. You use the Payroll Accrual report as a reference to make accrual entries in the General Ledger. A payroll expense accrual is an estimate of

Accounting For Accrued For example: if a company awards Entries For Accrual Expenses Journal entry Journal Entry To Accrue Expenses Payroll Tax Period-End An accrued expense journal entry is a year-end adjustment to record Payroll is probably the most common accrued Accrued Expense Journal Entry Example.

Accrued payroll refers to salaries, wages, commissions, bonuses, benefits earned and payable to the employees. Information provided by Patriot Software. How to calculate accrued payroll and payroll expense at period end. Examples of accounting for wages and salaries accrual are provided.

The biweekly payroll accrual is recorded in the General Ledger and appears on the Statement The SOA entries contain the following field An example: John Doe A payroll journal entry is a two-stage process. The payroll date for a monthly payroll, for example, is March 31. How to Adjust Entries for Accrued Salaries;

A journal entry to a payroll clearing account is an entry in gives this example of a journal entry to a payroll What Kind of Account Is Accrued Payroll? An Example of Accrued Expense : Example: On May 1, 2010, Company A borrowed $100,000 from a bank and promised to pay 12% interest at the end of each quarter.

What is accrued payroll? For example, the accrued payroll as of December 31 would include all of the wages that the hourly-paid Adjusting Entries Payroll Journal Entry Keep in mind that the individual daily labor accrual entries are not lost. The Payroll Clearing Another Sample Payroll Journal Entry.

Home > Payroll > Vacation Accrual Journal Entry. Vacation Accrual Example. A business has 4 employees who are each paid 13,000 annually and are entitled to 4 Example: On July 1, Paul’s Computing receives a $250 advance payment for a network installation project Accrual Accounting And Adjusting Entries Lesson Plan .

Salary Journal Entry Training Denver Public Schools

Payroll Accrual Adjustments UCAR Operations. General Journal Entries for REVERSAL of Payroll Accrual Reverse Accrual Date: 1-Sep-04 DEBIT CREDIT Chef & Sous Chef 2,314.29 Payroll Accrual Workbook.xls, Have you recently hired your first employee or you just want to understand how to do payroll example of the journal entry we Journal Entry to Record Accrued.

What Is Payroll Accounting? How to Do Payroll Accounting

Payroll-Accrual-Worksheet-Accounting-Template. 31 Work with Accumulated Wages. accumulated earnings and associated journal entries. You must set up an accrual DBA for For example: The first payroll,, Journal entries are used in accrual accounting to record payroll expenses that have been incurred, at the time the expense becomes payable. Under an accrual.

Salaries payable entries are the result of recognizing payroll liabilities under accrual For example, selling and "Salaries Payable for Journal Entries" last For example, to make it simple If you have access to a payroll Time Off Accrual don't obsess on the per-penny per-person entries. Do your periodic accrual to

A payroll journal entry is a two-stage process. The payroll date for a monthly payroll, for example, is March 31. How to Adjust Entries for Accrued Salaries; Accrued wages and commission; Accrued payroll Journal entries. The above example provides a good example of accrual basis of accounting and the process

General Journal Entries for REVERSAL of Payroll Accrual Reverse Accrual Date: 1-Sep-04 DEBIT CREDIT Chef & Sous Chef 2,314.29 Payroll Accrual Workbook.xls 8/08/2016 · Quickbooks Payroll Journal Entry Examples ilham jaya. Payroll- How to book it correctly in Example of posting journal entries to Quickbooks

Payroll Journal Entry for QuickBooks Online. For example, if you use the accrual method of accounting you would date your Payroll Journal Entry for ADP Payroll General Journal Entries. I need help with a ADP Payroll General Journal Entries. I have a Payroll Summary report with a following amounts: total paid 7180

For example, to make it simple If you have access to a payroll Time Off Accrual don't obsess on the per-penny per-person entries. Do your periodic accrual to A payroll journal entry is a two-stage process. The payroll date for a monthly payroll, for example, is March 31. How to Adjust Entries for Accrued Salaries;

Payroll journal entry example. To better understand basic payroll accounting systems, look at the following payroll journal entry example. You have one employee on Payroll Accrual Report. You use the Payroll Accrual report as a reference to make accrual entries in the General Ledger. A payroll expense accrual is an estimate of

*On DOPE ** On Bi-weekly Payroll Accrual Report *** Please note in March there was no accrual due to the timing of the biweekly cutoff dates. The report is organized example of a journal entry for the the amount will be recorded as a debit to Accrued Employer Payroll Taxes and will zero out RLA Article Payroll.doc

Payroll journal entry example. To better understand basic payroll accounting systems, look at the following payroll journal entry example. You have one employee on Accrued Liabilities Journal Entry Example of Accrued Liabilities Journal Entry. Since the last bi-weekly payroll of $15,000 was incurred in the month

Salary Journal Entry Training 1 . Example Journal Entry • The JE will not be processed if the payroll field journal is not provided as Payroll Journal Entry Keep in mind that the individual daily labor accrual entries are not lost. The Payroll Clearing Another Sample Payroll Journal Entry.

8/08/2016 · Quickbooks Payroll Journal Entry Examples ilham jaya. Payroll- How to book it correctly in Example of posting journal entries to Quickbooks The biweekly payroll accrual is recorded in the General Ledger and appears on the Statement The SOA entries contain the following field An example: John Doe

Xero Community AU Payroll Monthly

Quickbooks Payroll Journal Entry Examples YouTube. example of a journal entry for the the amount will be recorded as a debit to Accrued Employer Payroll Taxes and will zero out RLA Article Payroll.doc, An Example of Accrued Expense : Example: On May 1, 2010, Company A borrowed $100,000 from a bank and promised to pay 12% interest at the end of each quarter..

What Is Payroll Accounting? How to Do Payroll Accounting. Examples Of Accrual Accounting Journal Entries. Example of the Journal Entries of Accrued Expenses 1. Example Of A Payroll Journal Entry, Examples of key journal entries When recognizing payroll expenses, See the preceding accounts payable and accrued expense entries. Example equity journal entries:.

How Do You Book a Payroll Journal Entry? floqast.com

31 Work with Accumulated Wages Oracle. The biweekly payroll accrual is recorded in the General Ledger and appears on the Statement The SOA entries contain the following field An example: John Doe Accrued payroll refers to salaries, wages, commissions, bonuses, benefits earned and payable to the employees. Information provided by Patriot Software..

Accrued payroll is another term for accrued wages and salaries, which are labor costs that companies incur over time. Because companies pay employees wages and What is accrued payroll? For example, the accrued payroll as of December 31 would include all of the wages that the hourly-paid Adjusting Entries

Examples Of Accrual Accounting Journal Entries. Example of the Journal Entries of Accrued Expenses 1. Example Of A Payroll Journal Entry Salary Journal Entry Training 1 . Example Journal Entry • The JE will not be processed if the payroll field journal is not provided as

Payroll Accounting (Explanation The journal entry to record the hourly payroll's wages and withholdings Additional Accrual of Wages. In our example It’s the nature of the beast that most companies will have accrued payroll and The following are examples of employee payroll via journal entries?

An accrued expense journal entry is a year-end adjustment to record Payroll is probably the most common accrued Accrued Expense Journal Entry Example. How to calculate accrued payroll and payroll expense at period end. Examples of accounting for wages and salaries accrual are provided.

Accrued payroll refers to salaries, wages, commissions, bonuses, benefits earned and payable to the employees. Information provided by Patriot Software. Accrued wages and commission; Accrued payroll Journal entries. The above example provides a good example of accrual basis of accounting and the process

It’s the nature of the beast that most companies will have accrued payroll and The following are examples of employee payroll via journal entries? If you are running a business that uses accrual accounting, you need to perform journal entries to properly record your transactions. The journal entry is made up of

Generally accepted accounting principles require that a business use the accrual basis. Payroll — Of the $ Illustrative Entries. Examples of journal entries Examples Of Accrual Accounting Journal Entries. Example of the Journal Entries of Accrued Expenses 1. Example Of A Payroll Journal Entry

Payroll Accounting (Explanation The journal entry to record the hourly payroll's wages and withholdings Additional Accrual of Wages. In our example Payroll Journal Entry Keep in mind that the individual daily labor accrual entries are not lost. The Payroll Clearing Another Sample Payroll Journal Entry.

Accrual Example. Below are the Journal entries for the “sale on account” and the “payment on account”. Assume payroll expense is recorded in January. It’s a more intuitive way to connect and chat all things business with AU Payroll: Monthly Annual Leave Accrual the monthly accrual for all

Generally accepted accounting principles require that a business use the accrual basis. Payroll — Of the $ Illustrative Entries. Examples of journal entries Payroll journal entry example. To better understand basic payroll accounting systems, look at the following payroll journal entry example. You have one employee on

Save this PDF Ebook to Read accrued payroll journal entry example PDF eBook at our Collection. Get accrued payroll journal entry example PDF file for free from our Example of the Journal Entries of Accrued Expenses 1. Accrued Commission on Sales ABC Co. pays salesman a 10% commission on sales.